Kevin Travers was a Reporter at deBanked.

Articles by Kevin Travers

Banks, Non-Banks, Fintech and More Came Through for Lendio on PPP, But it Wasn’t Easy

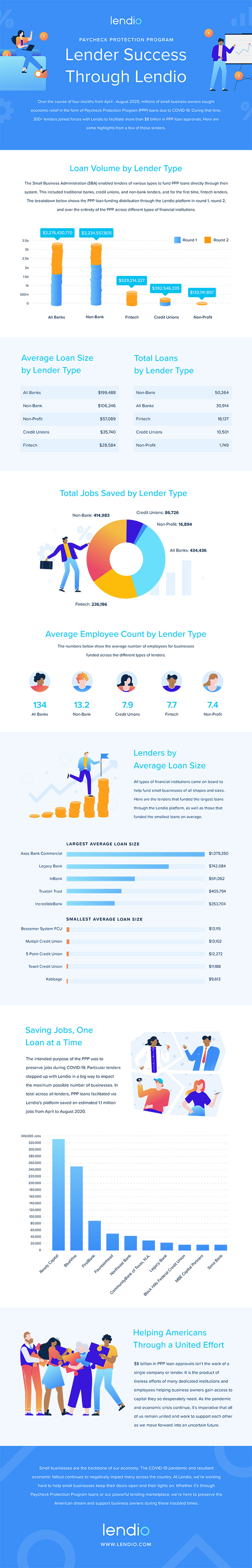

August 27, 2020 Last week, Lendio, a facilitator of small business loans, released a report analyzing the $8 billion of PPP loans that were approved through its lending platform. A coalition of more than 300 lenders was able to give aid, saving an estimated 1.1 million jobs, Lendio indicates.

Last week, Lendio, a facilitator of small business loans, released a report analyzing the $8 billion of PPP loans that were approved through its lending platform. A coalition of more than 300 lenders was able to give aid, saving an estimated 1.1 million jobs, Lendio indicates.

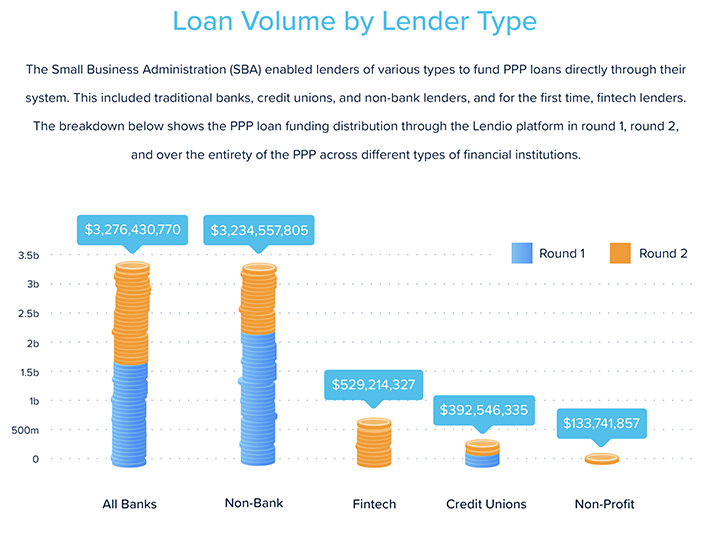

Through Lendio’s service, traditional banks approved the most funding at $3.3 billion- or about 44% of the PPP dollars on the platform. Though non-bank lenders secured the highest number of approvals at 50,264 transactions in lesser dollar amounts.

Fintech lenders funded 6% of the total loan volume through the platform.

Lendio was well situated to facilitate lending from institutions to those that needed help through funds provided by the SBA. Brock Blake, CEO, and co-founder of Lendio, said the company’s success in delivering on PPP was no accident— they had to remove all stops and almost bet on the success of the PPP program.

“Our mission at Lendio is normally ‘Fueling the American Dream’: helping the American business owner accomplish their dream,” Blake said. “We tweaked our mission during this timeframe to ‘Saving the American Dream.'”

Blake said while other companies were closing their doors and sending off employees on furlough, Lendio took on 250 new hires- and buckled down for thousands of hours of engineering work to overhaul their system. Not just loan sales, but legal processes, onboarding, training, and backend tech work had to be updated in just days.

This all came on fast, but so did the quarantine. Beginning in April, more than 100,000 business owners applied for economic relief under the PPP using Lendio’s online marketplace.

The demand for capital was outrageous.

“It was more demand in one weekend than the SBA had seen in the last 14 years combined,” Blake said. “We were helping these business owners that were watching their entire lifes’ work flushed down the drain in a matter of weeks, and they were desperate for capital.”

Lendio was finding that many institutions could simply not handle the volume, Blake said, and he knew if banks were only able to process loan requests for their current customers, there would be an exploding demand for loan processing. The company took on 100 new partners who needed help during this time.

“Our systems were tested to their limits, like 1000 times more pressure than we ever saw before,” Blake said. “Some partners of ours got so much demand they couldn’t handle it and turned off their spigot. So we scrambled to find lenders that would take on new customers.”

Though it was ten times more challenging than anything Blake has done in his career, it was ten times more satisfying. Lendio doubled the number of loans it has issued since 2011, and quintupled the dollar amount the platform facilitated in just four short months. Where are they going to go from here?

For one, Lendio is one company out of many that are hoping for another round of PPP funding. Blake said he is getting customer feedback all the time asking for help, dealing with quarantine regulation that is harming business, like restaurants that have nowhere to seat patrons.

Outside of PPP, Blake said that many of the 110,000 businesses they served are now applying for other loans, or using Lendio’s bookkeeping and loan forgiveness applications. Lendio is happy to help business owners and banks through this tough time by launching digital applications.

“Before, lenders across the country were requiring business owners to come into branches [with] paper applications,” Blake said. “Now, there’s not one business owner in America that wants to walk into a bank branch. The demand for lenders to go digital is as high as it’s ever been.”

ODX Introduces New Contact-Free Banking Platform

August 26, 2020 ODX, a banking originations platform, announced the launch of a new service this week—a Digital Account Opening (DAO) experience. With billions of dollars in successfully facilitated loans, the subsidiary of OnDeck made a move beyond origination; to offer banking account solutions.

ODX, a banking originations platform, announced the launch of a new service this week—a Digital Account Opening (DAO) experience. With billions of dollars in successfully facilitated loans, the subsidiary of OnDeck made a move beyond origination; to offer banking account solutions.

Announced Tuesday, the new platform marks another addition to the ODX digital suite that enables financial institutions to reach customers digitally. DAO helps both customers and banks set up checking and savings accounts, filling the need for contactless banking in today’s market.

Brian Geary, the President of ODX, said the DAO’s release is a culmination of over a decade of customer experience merging with the company’s robust technology platform.

“We’re basically hosting the application experience, either web-enabled or mobile-enabled, as well as the workflow platform that is automating and streamlining,” Geary said. “So things like anti-fraud, compliance checks, ID verification, and in the lending case, credit decisioning, all happens on our platform.”

The new platform goes hand-in-hand with the already in place Know Your Customer (KYC) and Anti-Money Laundering (AML) programs proprietary to ODX.

This addition comes at a time when the niche of digital banking has become a necessity. Geary said in the past six months the long laid plans of financial institutions to transition their experience into digital solutions were accelerated by COVID-19. Now institutions and consumers alike are widely adopting contactless commerce.

“When branches closed or were limited in some of their face-to-face interactions, it accelerated that move to digital as well,” Geary said. “So from the customer side there was changing preferences and adoption of digital channels, and from the bank side, they are accelerating investment into digital.”

QuickBooks Capital Has Already Funded $683M in Cumulative Business Loans

August 26, 2020 QuickBooks Capital has funded $683 million in cumulative small business loans since Intuit launched the program in late 2017. This excludes the $1.2 billion in PPP loans the company facilitated, according to the latest quarterly earnings report.

QuickBooks Capital has funded $683 million in cumulative small business loans since Intuit launched the program in late 2017. This excludes the $1.2 billion in PPP loans the company facilitated, according to the latest quarterly earnings report.

Showing optimism, Intuit recorded revenue of $1.8B in Q4 and $7.7B for the fiscal year, up 13 percent.

Among Intuit’s leading products is TurboTax, which experienced its strongest customer growth in four years. Growth was also strong with QuickBooks online payments, QuickBooks Online payroll and TSheets.

Intuit announced that it was acquiring Credit Karma for $7.1B in cash back in February.