Actually Paying the EIDL Not So Easy?

“It’s like the DMV, everything’s very complicated,” said Eddie Klein, Managing Partner at YM Ventures. “The whole process was complicated to begin with…”

“It’s like the DMV, everything’s very complicated,” said Eddie Klein, Managing Partner at YM Ventures. “The whole process was complicated to begin with…”

Just recently, the first round of EIDL borrowers were required to start making payments after receiving a 30-month deferment and already challenges are starting to present themselves. The availability of these funds came at a desperate time for merchants that needed the capital and few were probably asking about the servicing or repayment process.

“You really got to look at them from a perspective that they got very cheap money at a time where everyone desperately needed it, so very cheap money and dealing with a little bit of headache or taking expensive money and not dealing with a little bit of headache,” said Klein. “I would definitely always take the cheaper money.”

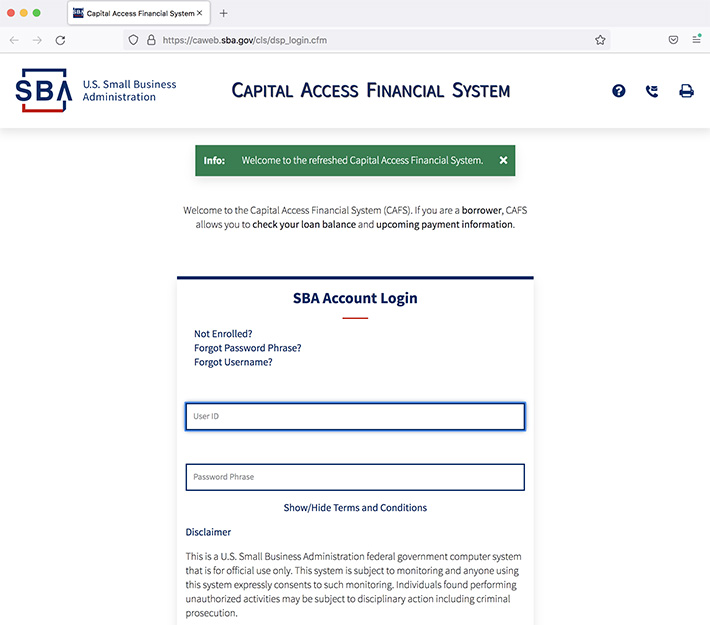

And so too did millions of American business owners go with the cheaper EIDL funds. But now that it’s time to pay, borrowers are learning that their balances and statements exist on one website, CAFS (caweb.sba.gov), and the system to make payments exists on another, (pay.gov). The first refers you to the latter but it’s not exactly a smooth transition. For one, each website has its own separate username and password system.

“If you’re going to ask these business owners for money back, which is fine, it’s the government’s right to do that, you got to make it simple,” said Trey Markel, VP Sales & Marketing at Centrex Software. “You got to have some videos, you got to have some tutorials, you got to make sure you’re guiding people down the right path and unfortunately, that’s just not happening.”

It can also be quite difficult to contact the SBA directly when dealing with system problems, according to Markel who provided an example. One of Markel’s clients has been trying to make interest payments on two EIDL loans but the system will only apply payments to one.

It can also be quite difficult to contact the SBA directly when dealing with system problems, according to Markel who provided an example. One of Markel’s clients has been trying to make interest payments on two EIDL loans but the system will only apply payments to one.

“He’s making principal and interest payments, technically to one, because that’s how it’s being calculated,” said Markel. “And the other one, the interest has been accruing the entire time, with no payments associated to it.”

The SBA, for its part, said it provides instructions to merchants to make payments.

“SBA sends a direct email to borrowers to remind them that their deferment period is ending, and they are entering repayment, including instructions to create CAFS account to check loan balance, payment amount and due date,” said Christalyn Solomon, Public Affairs Specialist at the SBA. “If they create a CAFS account, as instructed, they will also receive a monthly statement.”

And for borrowers experiencing short-term financial challenges, the SBA is now offering a Hardship Accommodation Plan allowing those who are eligible to request an extension for another six months.

“The Hardship Accommodation plan has been well received by borrowers experiencing difficulties in repaying their loans,” said Solomon. “SBA wanted to provide relief to existing COVID EIDL borrowers experiencing short-term financial challenges. The six-month payment reduction plan, called the Hardship Accommodation Plan will assist those who are still working to repay this COVID economic aid loan that provided them with much needed emergency working capital during the pandemic.”

Last modified: December 15, 2022