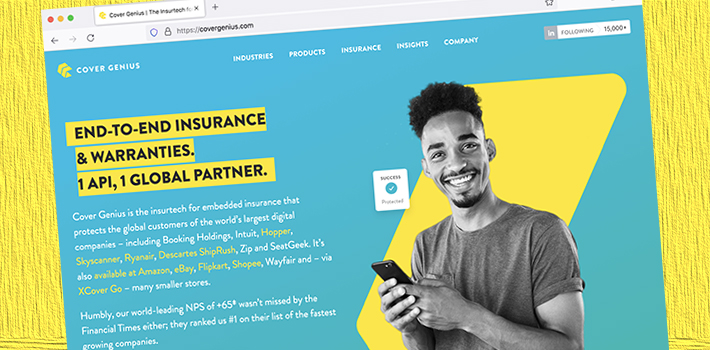

Finance Isn’t the Only Thing Being Embedded, This ‘Embedded Insurance Technology’ Company is Genius

Ever notice the check box to protect a flight? That’s Cover Genius! The New York-headquartered insurtech company is embedding insurance by providing protection directly to the user of a platform. This can be done at sign-up, checkout, or wherever the offer seems relevant to the user. Alex Sklar, VP of Strategic Partnerships, describes the process in numerous examples such as adding rental protection at the moment you’re paying a security deposit, adding car insurance at the time you’re buying your car, or adding any type of commercial insurance lines at the moments when you’re scaling up your business.

Ever notice the check box to protect a flight? That’s Cover Genius! The New York-headquartered insurtech company is embedding insurance by providing protection directly to the user of a platform. This can be done at sign-up, checkout, or wherever the offer seems relevant to the user. Alex Sklar, VP of Strategic Partnerships, describes the process in numerous examples such as adding rental protection at the moment you’re paying a security deposit, adding car insurance at the time you’re buying your car, or adding any type of commercial insurance lines at the moments when you’re scaling up your business.

“And so, the new way of doing things when we think about embedded insurance, is customers get customized protection directly from their favorite apps, platforms and brands, at the same time that the major life events or transaction is happening,” said Sklar.

Their direct customers range from many well-known digital companies in the BNPL market as well as retail, travel, and bank partners. They work in a B2B2C and B2B2B fashion, internationally, not just in the U.S.

“So, we’re protecting the end use customers of our partners,” said Sklar. “You know, some of those partners are the Buy Now Pay Later, Zip, into Intuit QuickBooks, eBay Wayfair, Ryanair for booking holdings. So really, for us, we take an insurance agnostic approach. And it’s really a question of being able to pair that protection at the right moment when it’s relevant.”

With many events or natural disasters that could potentially put businesses out of business, Cover Genius ensures customers that they are protected. And for retail customers they offer product protection and product warranty.

“That’s where that being able to have that protection at that moment removes the trepidation from the customer making the purchase knowing that the product will be protected,” said Sklar. “So, there’s all different types of ways that we actually work with our partners to protect their end customers.”

“That’s where that being able to have that protection at that moment removes the trepidation from the customer making the purchase knowing that the product will be protected,” said Sklar. “So, there’s all different types of ways that we actually work with our partners to protect their end customers.”

Like any company, there’s always challenges to be faced, especially when introducing new ways to do things. And in the insurance industry there are rules and regulations to be complied with even when attempting to deliver it in a more efficient way.

“I think that there’s also, just in general, anytime you’re taking on a large legacy industry, you’re always going to have a little bit of challenges you know, of showing people that there are new ways to do things,” said Sklar. “But I think the size and breadth of the partners we work with show that we’re able to overcome these challenges.”

Finding more ways for their end users to add protection to purchases, Cover Genius recently launched a collaboration with Zip to allow customers to protect their purchase at checkout. They will also provide transaction monitoring that monitors the transactions recently made for the items post-purchase.

“So overall, the future will give Zip Pay and Zip Money customers the ability to add protection to their Zip purchases, either during checkout or after checkout on select purchases, making it an affordable and timely alternative,” said Sklar.

Last modified: October 3, 2022