| The Top Small Business Funders By Revenue Read more |

|

Underwriting 101 - Veteran Funders Share Tools of the Trade For brokers, funding partnerships are critical to success. But making the most of these connections can be elusive. Read more |

|

|

|

Why is P2P Lending Unraveling in China? |

| Renton said that this implosion is largely the result of lax Chinese regulation for a number of years. But the Chinese government is now making up for it. In November 2017, China’s central bank said that no new licenses would be issued to online lending platforms. And with Chinese P2P platforms failing daily this summer, the central government has proposed new measures, according to Xinhua, the official government news agency Read more |

As Ripple’s XRP Drops, Legal Trouble Builds |

| Ripple’s cryptocurrency, XRP, has dropped by about 90 percent from a high of $3.84 per token in January of this year to $0.29 Read more |

|

|

|

Survey Indicates That Senior Loan Officers Have Eased Standards |

| Domestic banks eased standards or terms on commercial and industrial (C&I) loans over the past three months, according to a July 2018 Federal Reserve survey that gathered information from senior loan officers at banks. The survey received responses from 72 U.S. banks. Read more |

Survey Reveals U.S. Small Business Owner Outlook |

| Confidence among small business owners in the U.S. is up, according to a quarterly online survey produced by CNBC and SurveyMonkey. Read more |

|

|

|

OCC’s Fintech Charter is a Mistake |

| Via PayThink: If facilitating fintech innovation and protecting consumers is the goal, preempting state licensing and consumer laws with a federal charter is not the answer. The OCC’s charter creates a new class of institutions that benefits large, established fintech firms and harms the very innovation and choice that U.S. Treasury Secretary Steven Mnuchin and the Comptroller of the Currency Joseph Otting say it would provide. Read more |

Kabbage's Forbes Interview |

| Excerpt: There are few issues that really kill a business. An entrepreneur needs to both be able to look around the corner as to what might kill it in the future and have the fortitude to make difficult decisions. Businesses are constantly faced with life or death scenarios—the ones that make it through those issues are the ones that become great. Read more |

|

|

|

Fed's Probe Commercial Mortgage Fraud |

| Via American Banker Read more |

States Take Action on Online Bitcoin Lending |

| Via Manatt Read more |

|

|

|

California Supreme Court Rules Interest Rates on Consumer Loans Can be Unenforceable Even if Not in Violation of Usury Limits |

| On August 13, 2018, the California Supreme Court ruled that a consumer loan not otherwise subject to the state usury cap can have an interest rate so high that the loan agreement is Read more |

Join The Industry on October 4th in San Diego |

| Don't miss out on this incredible opportunity to network with your peers! deBanked CONNECT San Diego tickets are still available! Read more |

|

|

|

Get Certified in MCA Basics |

| Make sure you know how MCAs really work before you sell them Read more |

Booming Walmart, Cisco results show US economy’s strength is real and broad-based |

| Via CNBC: The economy is hot! Read more |

|

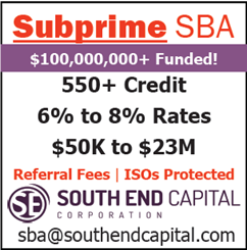

| Thanks to Our Email Newsletter Sponsors |

|

|

|

Found this email in your junk folder? Make sure to specifically whitelist both sean@debanked.news and funded@debanked.deals :-) |

SUBSCRIBE HERE |