Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: lascott on May 19, 2015, 11:00:00 PM

Post by: lascott on May 19, 2015, 11:00:00 PM

With interest rates the way the are and likely direction why wouldn't you just use conservative LC notes as the "bonds"/safe side of your asset allocation?

I recently moved some money out of a Fidelity ROTH IRA to a "LC" ROTH IRA and am buying mainly A and B and selective C notes. Heck even 5% or 6% is better than bonds (term used loosely as there many kinds).

What if when you get to 59.5 you then take out 4%-5% ... doesn't that just keep in principle intact. Or just pull out the max per month once you hit 59.5 (ie. extract all payments received).

With LC going public it gave me more confident to do this. I take advantage of professional independent credit models to aid in being more selective of the LC notes as well (P2P-Picks and LendingRobot).

How much should you invest in Marketplace Lending?

http://www.LendingRobot.com/HowMuchToInvest

P2P Lending: Why You Need a New Uncorrelated Asset Class

http://www.lendingmemo.com/p2p-lending-uncorrelated-asset-class/

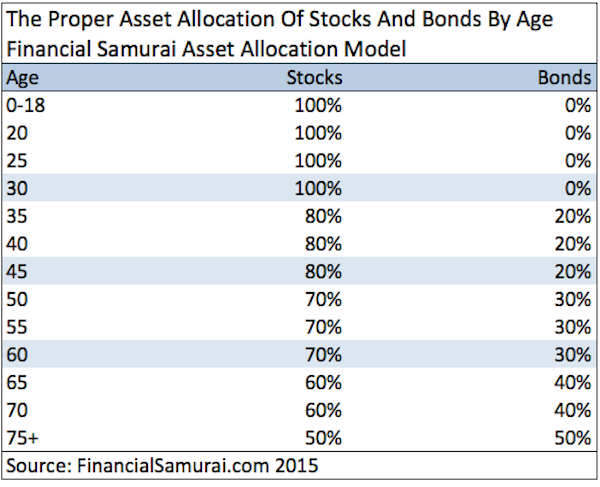

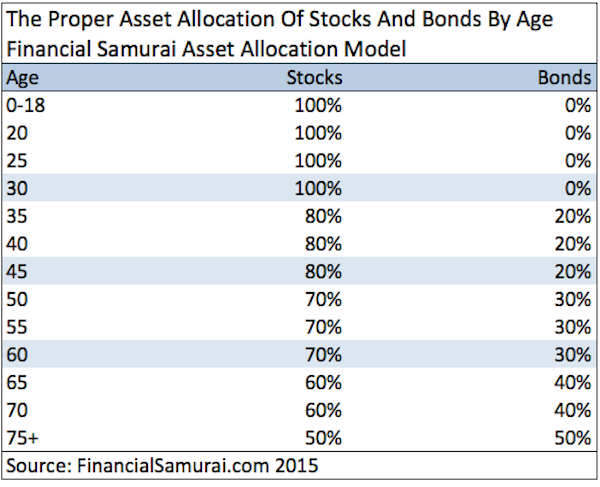

Just one very generalized visual example...

Steady income...

http://www.lendingrobot.com/#/resources/charts

I recently moved some money out of a Fidelity ROTH IRA to a "LC" ROTH IRA and am buying mainly A and B and selective C notes. Heck even 5% or 6% is better than bonds (term used loosely as there many kinds).

What if when you get to 59.5 you then take out 4%-5% ... doesn't that just keep in principle intact. Or just pull out the max per month once you hit 59.5 (ie. extract all payments received).

With LC going public it gave me more confident to do this. I take advantage of professional independent credit models to aid in being more selective of the LC notes as well (P2P-Picks and LendingRobot).

How much should you invest in Marketplace Lending?

http://www.LendingRobot.com/HowMuchToInvest

P2P Lending: Why You Need a New Uncorrelated Asset Class

http://www.lendingmemo.com/p2p-lending-uncorrelated-asset-class/

Just one very generalized visual example...

Steady income...

http://www.lendingrobot.com/#/resources/charts

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: Lovinglifestyle on May 19, 2015, 11:00:00 PM

Post by: Lovinglifestyle on May 19, 2015, 11:00:00 PM

Considering that if 85% continue to pay and 15% don't (C line), I wanted to look at what % of principal is recovered/lost by grade at time of default again, but I can't find the bar graph now. Think it was from PeerCube. Anyway, does the ~5% gain projection account for the loans that fail to continue to pay? It takes a few A notes to pay for one that doesn't. Would you stick to 36 month loans for this plan? I'm getting a lot more risk-averse lately. I'd like a return OF my money.

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: TravelingPennies on May 19, 2015, 11:00:00 PM

Post by: TravelingPennies on May 19, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: Rob L on May 19, 2015, 11:00:00 PM

Post by: Rob L on May 19, 2015, 11:00:00 PM

You won't find this on any of the charts.

Maybe it's just me, but I would invest substantially more in LC were it not for the small but real possibility that LC might go bankrupt.

Recessions come and go. Maybe I'll lose a double digit percentage of my account. Okay, I'll deal with it.

But potentially losing 100% in an LC bankruptcy, as unlikely as that may seem, very substantially limits my investment.

Very frustrating, but until LC somehow fixes this (BRV or whatever) I've got to play small ball.

Why should it be so difficult for the unquestioned leader in P2P (LC) to lack the investor protection (BRV) that Prosper provides to its investors?

Maybe it's just me, but I would invest substantially more in LC were it not for the small but real possibility that LC might go bankrupt.

Recessions come and go. Maybe I'll lose a double digit percentage of my account. Okay, I'll deal with it.

But potentially losing 100% in an LC bankruptcy, as unlikely as that may seem, very substantially limits my investment.

Very frustrating, but until LC somehow fixes this (BRV or whatever) I've got to play small ball.

Why should it be so difficult for the unquestioned leader in P2P (LC) to lack the investor protection (BRV) that Prosper provides to its investors?

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: TravelingPennies on May 19, 2015, 11:00:00 PM

Post by: TravelingPennies on May 19, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: Fee on May 19, 2015, 11:00:00 PM

Post by: Fee on May 19, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: AnilG on May 19, 2015, 11:00:00 PM

Post by: AnilG on May 19, 2015, 11:00:00 PM

With losses in P2P lending, the challenge is you never recover "double digit percentage" losses incurred. There is finite life for a loan and once it is charged off, you not only have lost your principal but also any possibility of future returns from the sunk money in the loan. With stock, at least you don't realize losses until you are ready to realize them or company goes bankrupt or you can wait out for stock to recover or double-down. Troubled P2P notes are like stock options that expire worthless.

Have you seen the terms and conditions of Prosper BRV? I will be interested in finding out what happens in bankruptcy scenario with BRV. Do the lenders have first right to the originated loans or just an unsecured claim within BRV.

from: Rob L on May 20, 2015, 07:53:30 PM

Have you seen the terms and conditions of Prosper BRV? I will be interested in finding out what happens in bankruptcy scenario with BRV. Do the lenders have first right to the originated loans or just an unsecured claim within BRV.

from: Rob L on May 20, 2015, 07:53:30 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: TravelingPennies on May 19, 2015, 11:00:00 PM

Post by: TravelingPennies on May 19, 2015, 11:00:00 PM

Again, we have another pretty good discussed thread on BRV. Please, can it continue there? http://www.lendacademy.com/forum/index.php?topic=2701.0

I meant this thread for Asset Alloc of (Stocks and P2P ) vs (Stocks and bonds). The risk is understood in LC P2P. There is a 0.00xx% chance LC will go bankrupt.

I meant this thread for Asset Alloc of (Stocks and P2P ) vs (Stocks and bonds). The risk is understood in LC P2P. There is a 0.00xx% chance LC will go bankrupt.

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: Fred on May 20, 2015, 11:00:00 PM

Post by: Fred on May 20, 2015, 11:00:00 PM

I don't understand why any rational (profit-maximizing) investor would choose other grades besides E, when LC shows E as having the highest ANAR.

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: TravelingPennies on May 20, 2015, 11:00:00 PM

Post by: TravelingPennies on May 20, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: TravelingPennies on May 20, 2015, 11:00:00 PM

Post by: TravelingPennies on May 20, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: TravelingPennies on May 20, 2015, 11:00:00 PM

Post by: TravelingPennies on May 20, 2015, 11:00:00 PM

Should I assume from your question that you have already decided that instead of having different type of bonds in your portfolio, you want to replace bond or "safe" portion of your portfolio with LC A/B/C loans? Is that so? I will be interested in learning why do you think LC A/B/C loans are substitute for bond in your portfolio.

from: lascott on May 21, 2015, 12:07:43 AM

from: lascott on May 21, 2015, 12:07:43 AM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: TravelingPennies on May 20, 2015, 11:00:00 PM

Post by: TravelingPennies on May 20, 2015, 11:00:00 PM

About 10%-20% of loans of all grades were fully prepaid early. I am not sure how the chart below take this into consideration since those loans were no longer "making payments."

from: lascott on May 20, 2015, 01:57:37 PM

from: lascott on May 20, 2015, 01:57:37 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: kya on May 20, 2015, 11:00:00 PM

Post by: kya on May 20, 2015, 11:00:00 PM

for me lc notes will never replace a bond portfollio....for one simple reason stated above when someone defaults on a lc loan for the most part we the investor lose all our principal.... i have suffered one or two bond defaults in the past 15 years and because the were sr secured bonds went on to recover over 80% of my principal... i view my p2p accounts as just another asset class which will never be more than 5% of the total pie...i will say its kinda fun

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: TravelingPennies on May 20, 2015, 11:00:00 PM

Post by: TravelingPennies on May 20, 2015, 11:00:00 PM

Personally, my bond portfolio consist of 45% in Investment grade Government and Corporate bond, 20% in High Yield Corporate bond, 15% in Emerging Market bond, and 15% in Inflation protected I-series bond and about 5% in P2P. I just can't see any reasons to reduce allocation in one of the other bond categories to increase allocation to P2P.

It will interesting to hear from people like lascott about their reasons for preferring P2P over other bond categories.

from: kya on May 21, 2015, 08:36:44 AM

It will interesting to hear from people like lascott about their reasons for preferring P2P over other bond categories.

from: kya on May 21, 2015, 08:36:44 AM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: rawraw on May 20, 2015, 11:00:00 PM

Post by: rawraw on May 20, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: AnilG on May 20, 2015, 11:00:00 PM

Post by: AnilG on May 20, 2015, 11:00:00 PM

The High Yield Corporate Bond ETF - HYG and JNK are yielding 8 and 10% right now. If yield is only criteria than these trump P2P because of additional liquidity and history. One benefit of LC and Prosper P2P is exposure to consumer lending that is difficult to get by other means.

from: rawraw on May 21, 2015, 06:29:12 PM

from: rawraw on May 21, 2015, 06:29:12 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: TravelingPennies on May 20, 2015, 11:00:00 PM

Post by: TravelingPennies on May 20, 2015, 11:00:00 PM

If you are going to buy conservatively, I will suggest you select notes based on borrower credit profile rather than "artificially assigned" credit grade. It is much more difficult to "fudge" (though possible) borrower credit profile instead of credit grade. Over time, the P2P borrower credit profile has deteriorated for the same credit grade.

Quote"> from: lascott on May 20, 2015, 01:57:37 PM

Quote"> from: lascott on May 20, 2015, 01:57:37 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: jheizer on May 20, 2015, 11:00:00 PM

Post by: jheizer on May 20, 2015, 11:00:00 PM

For reference I am 31 so I am on the riskier/less fixed income side of things already. Previously I held equal parts mixed US Gov, long term corp, and Municipal. On two different times the 10yr dropped into the 1.8x I sold off the gov and then the corp. At that point I figured they'd almost never be worth more. The funds from the first sale opened the LC account and the other went into stocks on a dip.

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: Fred on May 21, 2015, 11:00:00 PM

Post by: Fred on May 21, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: TravelingPennies on May 21, 2015, 11:00:00 PM

Post by: TravelingPennies on May 21, 2015, 11:00:00 PM

How did you come up with E grade offering the best risk-adjusted return? How are you measuring the risk? If we take average interest rate for each grade as a measure of risk, C offers the best risk-adjusted return.

from: Fred on May 22, 2015, 01:01:26 AM

from: Fred on May 22, 2015, 01:01:26 AM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: TravelingPennies on May 21, 2015, 11:00:00 PM

Post by: TravelingPennies on May 21, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: TravelingPennies on May 21, 2015, 11:00:00 PM

Post by: TravelingPennies on May 21, 2015, 11:00:00 PM

In general, I define risk as the probability to deviate for expected outcomes. For LC, I define risk as performance over the entire credit cycle, not just the rosy part. This includes the chance it may perform differently than expected in stressed times. I'm sure many define it this way as well -- and it is why a rational actor wouldn't just use that chart and go in 100% IMO

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: lascott on May 21, 2015, 11:00:00 PM

Post by: lascott on May 21, 2015, 11:00:00 PM

I am on the road enjoying the fruits of labor with wife and friends. So I am not fully focused on this and finances as we are headed to breakfast in a few minutes.

I really appreciate the conversation and everyone's input and varying thoughts on this.

I'll post some asset allocation info below to add to my position/perspective. It shows I still have bonds. Just starting one of few (future) 72t/SEPP plans and I am putting 1 years (maybe 2 by year end) worth of those annual distributions into a "bond" safe bucket in case the market changes so I don't have to take money out when it drops.

I've been financially conservative for most of my life. I'm in my late 40s. I enjoy automated investing that is simple so I don't have to fret about it as much and can enjoy life (so dollar cost averaging, automated tools in P2P, as examples). I use low feed index funds mainly. I've used www.financialengines.com for over 15 years to keep a risk adjusted and balanced portfolio for both my wife and my investments across various institutes (401k, trad and roth iras in Fidelity and Vanguard)

from: AnilG on May 21, 2015, 10:21:10 PM

I really appreciate the conversation and everyone's input and varying thoughts on this.

I'll post some asset allocation info below to add to my position/perspective. It shows I still have bonds. Just starting one of few (future) 72t/SEPP plans and I am putting 1 years (maybe 2 by year end) worth of those annual distributions into a "bond" safe bucket in case the market changes so I don't have to take money out when it drops.

I've been financially conservative for most of my life. I'm in my late 40s. I enjoy automated investing that is simple so I don't have to fret about it as much and can enjoy life (so dollar cost averaging, automated tools in P2P, as examples). I use low feed index funds mainly. I've used www.financialengines.com for over 15 years to keep a risk adjusted and balanced portfolio for both my wife and my investments across various institutes (401k, trad and roth iras in Fidelity and Vanguard)

from: AnilG on May 21, 2015, 10:21:10 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: TravelingPennies on May 21, 2015, 11:00:00 PM

Post by: TravelingPennies on May 21, 2015, 11:00:00 PM

Are you assuming all credit grades have same risk? Just looking at highest ANAR without considering the risk variation between the grades, it seems you are not deciding based on risk-adjusted return instead just using maximum return.

from: Fred on May 22, 2015, 03:23:25 AM

from: Fred on May 22, 2015, 03:23:25 AM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: TravelingPennies on May 22, 2015, 11:00:00 PM

Post by: TravelingPennies on May 22, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: TravelingPennies on May 22, 2015, 11:00:00 PM

Post by: TravelingPennies on May 22, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: Unfolder on May 23, 2015, 11:00:00 PM

Post by: Unfolder on May 23, 2015, 11:00:00 PM

I've just started allocating in seven equal portions for each A-G grade, all 60 month notes. That may be underthinking it but w/e it covers all bases and misses none

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: Rob L on June 03, 2015, 11:00:00 PM

Post by: Rob L on June 03, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: sean3.eth on June 03, 2015, 11:00:00 PM

Post by: sean3.eth on June 03, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: sean3.eth on June 03, 2015, 11:00:00 PM

Post by: sean3.eth on June 03, 2015, 11:00:00 PM

The thought of opening a Lending Club IRA is just unimaginable to me. Given my age, that's a 28-year long position on Lending Club itself. It's almost the same as putting my retirement savings in Lending Club stock for the next 28 years and hoping for the best.

If you are aiming to diversify your retirement portfolio, putting it all (or a substantial amount) in the full faith and credit of what is essentially still a new tech startup for the next 3 decades is utter madness.

If you are aiming to diversify your retirement portfolio, putting it all (or a substantial amount) in the full faith and credit of what is essentially still a new tech startup for the next 3 decades is utter madness.

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: Fee on June 03, 2015, 11:00:00 PM

Post by: Fee on June 03, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: lascott on June 03, 2015, 11:00:00 PM

Post by: lascott on June 03, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: bobeubanks on June 03, 2015, 11:00:00 PM

Post by: bobeubanks on June 03, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: AnilG on June 04, 2015, 11:00:00 PM

Post by: AnilG on June 04, 2015, 11:00:00 PM

I agree with SeanMCA, you are buying a long position on LC by keeping LC notes in IRA and you have to pay premium to close your position.

If you want to avoid taking a big bath in secondary market, it will take a long time to liquidate through charge offs and fully paid route. There is a big opportunity cost attached to this route. You incur real losses right away when you want to sell in secondary market in a hurry.

For example, lets think of an optimistic scenario where you have a $10,000 IRA invested in 3 year LC notes that you want to move out of LC. I don't know exactly how much fee the LC IRA custodian charges for each withdrawal/transfer out of IRA to another IRA but lets be generous and assume custodian allows you one transfer at no fee every year. And, you plan to transfer $3,000, $3,000, and $4,000 at the end of Year 1, 2 and 3 as notes are paid back. Your opportunity cost is 7% a year (another investment opportunity that generates 7% a year).

Opportunity cost first year = 0.07 * 10,000 = $700

Second year = 0.07 * 7,000 = $490

Third year = 0.07 * 4,000 = $280

Total opportunity cost = $1,470 or 14.7% of original $10,000 over 3 years or about 5% annually assuming no gains/losses in LC IRA.

It was just a hypothetical example with lots of simplification but the point is keeping "illiquid" assets in an IRA comes with big opportunity costs. So, unless you are confident that you want to keep this asset in your IRA for life/until you retire, you are going to loose quite a bit in opportunity cost when it comes time to do transfer that IRA.

I learnt this lesson hard way from Real Estate partnerships. It is easy to get into such "illiquid" partnerships but it is difficult to sell your partnership stake without taking big bath.

from: bobeubanks on June 04, 2015, 11:55:11 PM

If you want to avoid taking a big bath in secondary market, it will take a long time to liquidate through charge offs and fully paid route. There is a big opportunity cost attached to this route. You incur real losses right away when you want to sell in secondary market in a hurry.

For example, lets think of an optimistic scenario where you have a $10,000 IRA invested in 3 year LC notes that you want to move out of LC. I don't know exactly how much fee the LC IRA custodian charges for each withdrawal/transfer out of IRA to another IRA but lets be generous and assume custodian allows you one transfer at no fee every year. And, you plan to transfer $3,000, $3,000, and $4,000 at the end of Year 1, 2 and 3 as notes are paid back. Your opportunity cost is 7% a year (another investment opportunity that generates 7% a year).

Opportunity cost first year = 0.07 * 10,000 = $700

Second year = 0.07 * 7,000 = $490

Third year = 0.07 * 4,000 = $280

Total opportunity cost = $1,470 or 14.7% of original $10,000 over 3 years or about 5% annually assuming no gains/losses in LC IRA.

It was just a hypothetical example with lots of simplification but the point is keeping "illiquid" assets in an IRA comes with big opportunity costs. So, unless you are confident that you want to keep this asset in your IRA for life/until you retire, you are going to loose quite a bit in opportunity cost when it comes time to do transfer that IRA.

I learnt this lesson hard way from Real Estate partnerships. It is easy to get into such "illiquid" partnerships but it is difficult to sell your partnership stake without taking big bath.

from: bobeubanks on June 04, 2015, 11:55:11 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: mchu168 on June 04, 2015, 11:00:00 PM

Post by: mchu168 on June 04, 2015, 11:00:00 PM

I recommend people get help from a good financial/tax planner for advice on these questions. The advice here is frankly pretty bad.

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: TravelingPennies on June 04, 2015, 11:00:00 PM

Post by: TravelingPennies on June 04, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: TravelingPennies on June 04, 2015, 11:00:00 PM

Post by: TravelingPennies on June 04, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: kya on June 04, 2015, 11:00:00 PM

Post by: kya on June 04, 2015, 11:00:00 PM

i think the smartest way to treat p2p accounts is to keep it to no more than 5% of your total investment portfollio.... i am under this % and have stopped adding to both my lc and prosper accounts...currently i am reinvesting the payments received but will stop even doing that in a couple of years and then start drawing the accounts down for income ( i am 59 and retired)

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: TravelingPennies on June 04, 2015, 11:00:00 PM

Post by: TravelingPennies on June 04, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: TravelingPennies on June 04, 2015, 11:00:00 PM

Post by: TravelingPennies on June 04, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: TravelingPennies on June 04, 2015, 11:00:00 PM

Post by: TravelingPennies on June 04, 2015, 11:00:00 PM

my two cents would be "in addition to a bond portfollio" have a small postion in p2p lending.... you can go out right now and buy a very liquid municipal bond closed end fund paying 6% fed tax free at a 8% discount to net asset value....sit back and collect monthly without messing around with p2p loans

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: TravelingPennies on June 04, 2015, 11:00:00 PM

Post by: TravelingPennies on June 04, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: rawraw on June 04, 2015, 11:00:00 PM

Post by: rawraw on June 04, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: TravelingPennies on June 04, 2015, 11:00:00 PM

Post by: TravelingPennies on June 04, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: rawraw on June 04, 2015, 11:00:00 PM

Post by: rawraw on June 04, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: AnilG on June 04, 2015, 11:00:00 PM

Post by: AnilG on June 04, 2015, 11:00:00 PM

There is a basic implicit assumption in the historical returns by grade that you showed in attached image. The assumption is that returns are based on you continually re-investing the payments/principal paid back you receive. Those returns are not applicable to a liquidating IRA scenario because you can't reinvest if you want to liquidate.

In my model, I decided to ignore the returns existing loans in liquidating IRA are producing for simplification. Zero return assumption help avoids complication from guessing the average interest rate, the loan average age and impact of amortization and reduction in outstanding principal on the monthly interest that you receive. In addition, you will need to figure out how much you will be able to withdraw from IRA every year instead of 3K, 3K, 4K assumption I made. For example, if your all $10,000 in your IRA portfolio was invested in notes with average interest rate of 10% at the start of first year of liquidation process, the first month you will receive $83 in interest and your outstanding principal balance will decline to $9760. So every month you will get smaller and smaller interest. In 2nd and 3rd year you will receive negligible interest and most payments will consist of principal. If you decided a non-zero return then you will need to account all the above changes.

I use simplified models to think through the scenario and potential impact. They are not a comprehensive analysis of a situation inclusive of all type of conditions that may be encountered or expected by someone. The way I build a model is to start with a very simple model and then start introducing complexity by adding new conditions. You are welcome to modify the example I proposed for impact on opportunity cost with your concerns/conditions and come up with a newer, more accurate, realistic opportunity cost estimates that meets your expectations of "not flawed".

Quote"> from: lascott on June 05, 2015, 10:53:47 AM

In my model, I decided to ignore the returns existing loans in liquidating IRA are producing for simplification. Zero return assumption help avoids complication from guessing the average interest rate, the loan average age and impact of amortization and reduction in outstanding principal on the monthly interest that you receive. In addition, you will need to figure out how much you will be able to withdraw from IRA every year instead of 3K, 3K, 4K assumption I made. For example, if your all $10,000 in your IRA portfolio was invested in notes with average interest rate of 10% at the start of first year of liquidation process, the first month you will receive $83 in interest and your outstanding principal balance will decline to $9760. So every month you will get smaller and smaller interest. In 2nd and 3rd year you will receive negligible interest and most payments will consist of principal. If you decided a non-zero return then you will need to account all the above changes.

I use simplified models to think through the scenario and potential impact. They are not a comprehensive analysis of a situation inclusive of all type of conditions that may be encountered or expected by someone. The way I build a model is to start with a very simple model and then start introducing complexity by adding new conditions. You are welcome to modify the example I proposed for impact on opportunity cost with your concerns/conditions and come up with a newer, more accurate, realistic opportunity cost estimates that meets your expectations of "not flawed".

Quote"> from: lascott on June 05, 2015, 10:53:47 AM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: lascott on June 04, 2015, 11:00:00 PM

Post by: lascott on June 04, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: TravelingPennies on June 04, 2015, 11:00:00 PM

Post by: TravelingPennies on June 04, 2015, 11:00:00 PM

By chance I ran across this old article (2012) about using P2P in retirement and it was on a "learnbonds" website.

How to Use P2P Lending to Fund Your Retirement

November 12, 2012 By Peter Renton

http://learnbonds.com/how-to-use-p2p-lending-to-fund-your-retirement/12857/

How to Use P2P Lending to Fund Your Retirement

November 12, 2012 By Peter Renton

http://learnbonds.com/how-to-use-p2p-lending-to-fund-your-retirement/12857/

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: Fred93 on June 04, 2015, 11:00:00 PM

Post by: Fred93 on June 04, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: jheizer on June 04, 2015, 11:00:00 PM

Post by: jheizer on June 04, 2015, 11:00:00 PM

I'm currently split 50/50 regular municipal bond fund and LC (of my "fixed income" holdings). Whether this is a great plan or not I am still not so sure but I came to the same general conclusion as Fred93 above. P2P = economy/job market risk while muni = interest rate risk. I try to lower both as best I can buy only buying the "best" P2P loans and only adding to my muni holdings when he 10 year spikes a bit. Not great, but the best plan I have.

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: kya on June 04, 2015, 11:00:00 PM

Post by: kya on June 04, 2015, 11:00:00 PM

the nice feature of any cef wheather it be a equity or bond fund is they never have to sell their holdings to meet redemptions like an open ended fund...so when the mass'es hit the exit all at once they can hang on to the bond or equity and are not forced out at the bottom..... i have enjoyed p2p lending for over three years now and have done "ok" ....7.6% before taxes but this return will not last once i start to just liquidate the accounts and if the economy wilts good luck to everybody here... just like a market rout you will not be able to sell a good note for .80 cents on the dollar

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: TravelingPennies on June 04, 2015, 11:00:00 PM

Post by: TravelingPennies on June 04, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: mchu168 on June 04, 2015, 11:00:00 PM

Post by: mchu168 on June 04, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: TravelingPennies on June 04, 2015, 11:00:00 PM

Post by: TravelingPennies on June 04, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: TravelingPennies on June 04, 2015, 11:00:00 PM

Post by: TravelingPennies on June 04, 2015, 11:00:00 PM

If you are going after current income, also consider looking into MLPs (Master Limited Partnerships), REITS, Preferred Stocks (ETFs/Funds), and Dividend paying Stocks. And, if you want to be further adventurous and meet the minimum threshold for investment, look into alternative fixed income funds that invest in tax liens and other debt securities. Fixed Income is a very diverse field with lot of opportunities for investors looking for income. It is also very complex so you have to be very careful (ex: CDO, MBS in 2008).

Quote"> from: lascott on June 05, 2015, 01:58:45 PM

Quote"> from: lascott on June 05, 2015, 01:58:45 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: TravelingPennies on June 05, 2015, 11:00:00 PM

Post by: TravelingPennies on June 05, 2015, 11:00:00 PM

Those who may not be familiar of Cliff Asness [1]. He is a well known hedge fund manager, co-founder of AQR Capital [2]. He also publishes his opinions at Cliff's Perspective [3]. I think mchu168 is referring to his article "My Top 10 Pet Peeves" [4] published in Financial Analyst Journal. There was a good discussion on his bond fund versus individual bonds at Bogleheads forum [5].

Quote

Quote

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: TravelingPennies on June 05, 2015, 11:00:00 PM

Post by: TravelingPennies on June 05, 2015, 11:00:00 PM

Perhaps I read it too quickly, but that doesn't address interest rate risk as much as maturity vs non-maturity, which I don't care about.

I don't care if you have a municipal bond or a portfolio of laddered municipal bonds, to get high yields currently you either need to be 1) investing in lower end credit muni bonds (revenue, private purpose, Detroit, Puerto Rico, etc), 2) leveraged, 3) going out long, or 4) buying non-rated muni bonds that may be priced higher, although from what I've seen this market as well has been bid up.

#1 adds credit risk people are assuming away in the comparison with P2P bonds, while 2 and 3 do not help the IRR. #4 would reduce the IRR but a lot of those bonds are approaching call dates anyway, so I don't know how stable that yield would be.

I didn't read closely what type of fund of munis was suggested earlier, nor am I very familiar. But to downplay the impact redemptions have on some fund structures is silly to me. http://news.morningstar.com/articlenet/article.aspx?id=227989 Perhaps the muni fund mentioned earlier has a lockup where people just can't redeem willy nilly -- I'm more interested in interest rate risk. The bond vs fund debate only intersects IRR in terms of mass redemptions of the fund from people fleeing, which is only tangential towards my concern

I don't care if you have a municipal bond or a portfolio of laddered municipal bonds, to get high yields currently you either need to be 1) investing in lower end credit muni bonds (revenue, private purpose, Detroit, Puerto Rico, etc), 2) leveraged, 3) going out long, or 4) buying non-rated muni bonds that may be priced higher, although from what I've seen this market as well has been bid up.

#1 adds credit risk people are assuming away in the comparison with P2P bonds, while 2 and 3 do not help the IRR. #4 would reduce the IRR but a lot of those bonds are approaching call dates anyway, so I don't know how stable that yield would be.

I didn't read closely what type of fund of munis was suggested earlier, nor am I very familiar. But to downplay the impact redemptions have on some fund structures is silly to me. http://news.morningstar.com/articlenet/article.aspx?id=227989 Perhaps the muni fund mentioned earlier has a lockup where people just can't redeem willy nilly -- I'm more interested in interest rate risk. The bond vs fund debate only intersects IRR in terms of mass redemptions of the fund from people fleeing, which is only tangential towards my concern

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: sean3.eth on June 05, 2015, 11:00:00 PM

Post by: sean3.eth on June 05, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: TravelingPennies on June 10, 2015, 11:00:00 PM

Post by: TravelingPennies on June 10, 2015, 11:00:00 PM

Recent article that discusses the liquidity implications of bond funds and interest rates (indirectly): http://www.theguardian.com/business/2015/jun/01/the-liquidity-timebomb-fiscal-policies-have-created-a-dangerous-paradox

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: edward on June 10, 2015, 11:00:00 PM

Post by: edward on June 10, 2015, 11:00:00 PM

Using lascott's website mentioned above where he did the 3-year calculation, I came up $15,000 principal, earning 8%, will yield $100/month with only a $1,000 decrease in value after 30 years. Just a quick way to think about a quasi lifetime income concept using P2P. I know this is assuming a lot of factors, but just thought I'd share it. It was an interesting calculation to me.

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: lascott on June 10, 2015, 11:00:00 PM

Post by: lascott on June 10, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: mchu168 on June 10, 2015, 11:00:00 PM

Post by: mchu168 on June 10, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: kya on June 10, 2015, 11:00:00 PM

Post by: kya on June 10, 2015, 11:00:00 PM

Title: Just use A/B/C LC notes for Asset Alloc (Stocks and P2P vs Stocks and bonds)

Post by: TravelingPennies on June 10, 2015, 11:00:00 PM

Post by: TravelingPennies on June 10, 2015, 11:00:00 PM

Ran across these old articles related approximately to P2P vs Bonds

Bonds Vs. Peer Lending: Differences In Risks

Jan. 9, 2014 2:46 PM ET

http://seekingalpha.com/article/1937421-bonds-vs-peer-lending-differences-in-risks

Should You Invest In Lending Club: A Statistical Analysis

Sep. 6, 2013 7:58 AM ET

http://seekingalpha.com/article/1677392-should-you-invest-in-lending-club-a-statistical-analysis

Bonds Vs. Peer Lending: Differences In Risks

Jan. 9, 2014 2:46 PM ET

http://seekingalpha.com/article/1937421-bonds-vs-peer-lending-differences-in-risks

Should You Invest In Lending Club: A Statistical Analysis

Sep. 6, 2013 7:58 AM ET

http://seekingalpha.com/article/1677392-should-you-invest-in-lending-club-a-statistical-analysis