Related Headlines

| 10/04/2022 | NextPoint restructures old LoanMe debt |

| 02/22/2021 | LoanMe,Liberty Tax to take on Enova, Intuit |

| 02/26/2020 | LoanMe rebrands |

| 09/24/2018 | Meet LoanMe in San Diego on Oct 4th |

Related Videos

LoanMe Acquisition, Big League Advance, & more - Ep. 35 | The End of LoanMe |

Keeping it Real With LoanMe | |

Stories

New Info On The End of LoanMe

January 16, 2023 It was originally communicated as “market conditions.” That’s what NextPoint Financial, LoanMe’s parent company, announced in June 2022 as the reason that it was winding down LoanMe’s business. The news shocked the world because LoanMe had just been acquired by NextPoint for a price of more than $100M.

It was originally communicated as “market conditions.” That’s what NextPoint Financial, LoanMe’s parent company, announced in June 2022 as the reason that it was winding down LoanMe’s business. The news shocked the world because LoanMe had just been acquired by NextPoint for a price of more than $100M.

Now, after many delays, NextPoint has finally filed its 2021 financial statements, and with that more information about what happened with LoanMe.

Around the time it was being acquired (In Q1 2021), LoanMe transferred the majority of its loan portfolio to sub-servicers to “secure expected financial and operational efficiencies,” the report states, but “transition challenges negatively impacted loan performance and servicing costs.” The problems were allegedly so bad that in March 2022 they had to move the loan portfolio to yet another sub-servicer.

“LoanMe’s management’s attention was diverted from loan production to sub-servicer oversight,” the report states. This, when combined with lower than expected originations due to a competitive lending environment made for a challenging situation.

On May 9, 2022 LoanMe filed a lawsuit against loan servicer Amerifirst Home Improvement Finance LLC in Delaware Superior Court over alleged failures to live up to its loan servicing contract. Amerifirst filed counterclaims against LoanMe on November 3rd. The case is pending.

The tide of events had already overcome the company, however. On June 21, NextPoint announced that LoanMe would cease loan originations but would continue to service outstanding loans. LoanMe’s report attributes this final decision to an “elevated rate of charge-offs” and “a significant shortfall of cash being generated versus the amount required to fund the operations.”

Three months later, NextPoint decided to unwind LoanMe from its business altogether.

LoanMe originated both consumer and business loans. Its business loans ranged from 2-10 years. Business loan customers had an average FICO score of 692.

NextPoint Financial Formally Announces End of LoanMe Business

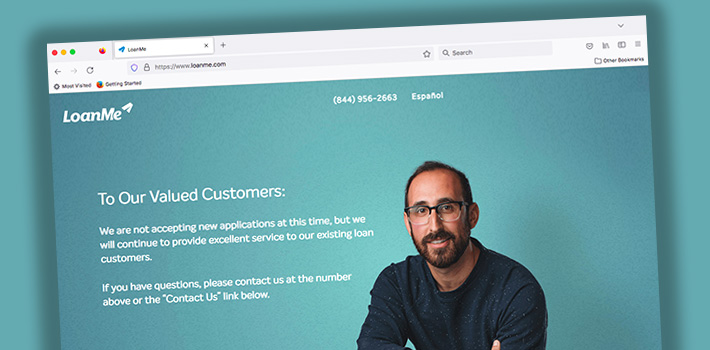

June 23, 2022 Less than a week after word spread that LoanMe had stopped originating business loans, NextPoint Financial, LoanMe’s parent company, confirmed it in a formal announcement.

Less than a week after word spread that LoanMe had stopped originating business loans, NextPoint Financial, LoanMe’s parent company, confirmed it in a formal announcement.

“Given current market conditions, the Company announces that LoanMe, Inc. (“LoanMe”), a subsidiary of the Company, will cease loan originations,” the statement read. “As a result, LoanMe has reduced its workforce and will continue to service outstanding loans that were previously originated. The Company decided to make these strategic changes to the business of LoanMe to better reflect the areas of focus and growth at NextPoint and to take into account existing market dynamics.”

The circumstances with LoanMe have apparently contributed to NextPoint’s failure to file its year-end 2021 and Q1 2022 financials, which are claimed to be forthcoming. NextPoint is publicly traded on the Toronto Stock Exchange. The sunsetting of LoanMe is oddly timed given that NextPoint only just acquired LoanMe last year and because LoanMe was one of its two primary business operations. NextPoint was a SPAC that also acquired Liberty Tax at the same time.

Although NextPoint cites “current market conditions,” a recent lawsuit filed by LoanMe against a loan servicer suggests that there may have been other issues at play as well.

LoanMe Has Stopped Originating Business Loans

June 15, 2022 At least two public-facing employees of LoanMe have stated that the company has stopped originating business loans. Both believe that this is permanent.

At least two public-facing employees of LoanMe have stated that the company has stopped originating business loans. Both believe that this is permanent.

The news may seem rather abrupt given that NextPoint Financial, a new publicly traded SPAC, just completed its acquisition of LoanMe less than a year ago. NextPoint apparently had second thoughts because in March it announced that it may have overpaid for LoanMe after reviewing its financial calculations. It stated that it would commence a review of the matter and report back. No determination to that end, if one were made, was subsequently announced.

NextPoint has since delayed filings of its year-end 2021 and Q1 2022 statements on the basis that it had not yet been able to finalize the books for LoanMe and another newly acquired subsidiary named Community Tax LLC. In doing so, it did not suggest that anything was awry.

Separately, however, LoanMe sued a loan servicing company in Delaware Superior Court on May 9th under seal for allegedly breaching a contract. The case was unsealed on June 10th. Three days later, two LoanMe employees say that they received notice that the company was shuttering.

The Senior National Accounts Manager wrote on social media, “yes, LoanMe is permanently closing. The powers that be at our parent holding company, NextPoint Financial, decided it was time to pull the plug.”

LoanMe Now Officially Part of NextPoint

August 11, 2021 The Canadian SPAC deal to merge LoanMe with Liberty Tax was finally completed last month after being announced in February.

The Canadian SPAC deal to merge LoanMe with Liberty Tax was finally completed last month after being announced in February.

The combined entity, NextPoint Financial, trades on the Toronto Stock Exchange under the ticker NPF.

“In just over a year from establishing this SPAC, we have closed two acquisitions that immediately create a financial services company with scale and opportunities for synergistic growth,” said Andy Neuberger, Chairman of NextPoint Financial. “With a management team and board comprised of proven executives and operators across the financial services, digital and retail sectors, we have very quickly created an organization that is set to impact how financial services are delivered to North America consumers and small businesses.”

The deal is especially significant in the small business finance space since it will place LoanMe’s small business loan and merchant cash advance products into 2,700 Liberty Tax storefronts throughout North America.

LoanMe, Liberty Tax Merger to Take on Intuit, Enova

February 22, 2021NextPoint Financial will combine LoanMe’s business, consumer, and mortgage lending with Liberty Tax’s tax preparation business, according to merger announced on Monday. Liberty’s “2,700+ locations in the US and Canada” will become consumer and SMB loan shops.

The new firm will also offer Merchant Cash Advances; LoanMe launched MCA funding in January and expects to fund $15 million in MCAs in 2021. Based on the acquisition prospectus, NextPoint will be a tax readiness firm, with the added suite of financial products as a value and growth builder.

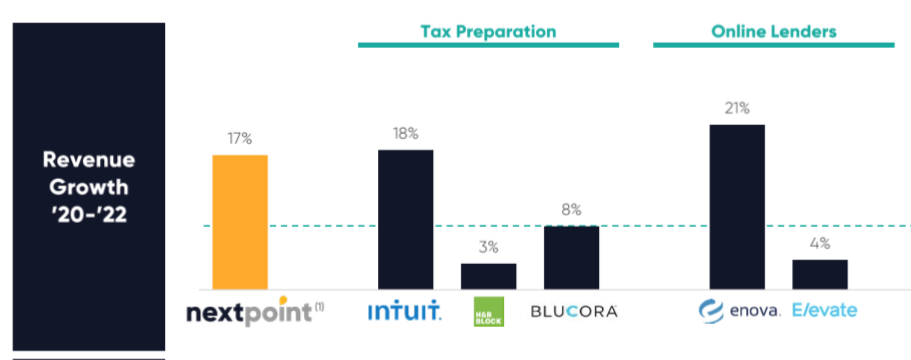

Ramping up consumer, installment, and MCA lending, paired with the third-largest tax-prep business in the U.S, NextPoint expects to compete directly with Intuit, H&R Block, Enova, and Elevate.

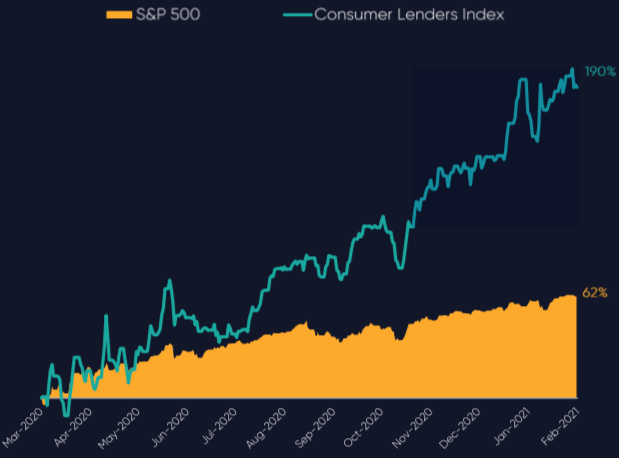

Fintech firms are setting themselves apart from the competition as one-stop shops for everything a business needs, including MCA products. Why branch into financial services now? NextPoint found that this year alt lenders have outperformed the S&P500 three times over.

“We are a one-stop financial services destination empowering hardworking and credit-challenged consumers and small businesses,” the investor presentation reads. “To get to the next point in their financial futures.”

Intuit offers a variety of financial products, like business loans through Quickbooks Capital, alongside their popular, 60%+ market share of tax prep software. H&R began offering small $1,000 lines of credit this year, but not much more.

The team leading the new company, NextPoint Financial, will feature execs like Brent Turner as CEO, Mike Piper CFO, both keeping their previous Liberty Tax positions. Jonathan Williams, former president and founding shareholder of LoanMe, will become president of lending.

LoanMe Has Been Acquired Along With Liberty Tax By Canadian Listed SPAC

February 22, 2021 LoanMe has been acquired. The announcement was made by Nextpoint, a SPAC listed on the Toronto Stock Exchange that simultaneously acquired Liberty Tax.

LoanMe has been acquired. The announcement was made by Nextpoint, a SPAC listed on the Toronto Stock Exchange that simultaneously acquired Liberty Tax.

The combined company will be called NextPoint Financial.

NextPoint will acquire LoanMe at an enterprise value of approximately US$102 million, US$18 million of which is payable in cash, approximately US$49 million of which is payable in NextPoint common stock equivalents and with the balance of which reflects the assumption of existing corporate net debt at LoanMe.

“We are a one-stop financial services destination empowering hardworking and credit-challenged consumers and small businesses to get to the NextPoint in the financial futures,” the company said of its newly formed self.

The company says that LoanMe had originated $2 billion since inception, 340,000+ borrowers since inception, and has a $200 million loan portfolio. Liberty Tax, meanwhile, processes 185,000+ SME tax returns, 1 million+ US consumer tax returns, and 400k+ Canadian tax returns.

Combined, the company projects $317M in revenue in 2021.

“NextPoint has obtained a commitment for a new US$200 million revolving credit facility, advances under which may be used for NextPoint’s general corporate purposes, including to fund the Liberty Tax and LoanMe cash purchase prices, and to fund potential future acquisitions,” the company said in a public release.

LoanMe is a Sponsor of deBanked CONNECT – San Diego

September 24, 2018LoanMe is a sponsor of deBanked CONNECT San Diego. The half-day event for funders, lenders, brokers and industry professionals is being held at the Andaz on October 4th!

Check out photos from deBanked’s past CONNECT event in Miami

Who’s Got Swag?

January 10, 2023 There’s a rush of excitement at Broker Fair and deBanked Connect. Behind the scenes there is also a fun creative process that sponsors get to prepare for right before every event. SWAG! It can be challenging to think of anything other than pens and Post-its to jazz up one’s table with memorable tchotchkes so here is some unforgettable swag from over the years:

There’s a rush of excitement at Broker Fair and deBanked Connect. Behind the scenes there is also a fun creative process that sponsors get to prepare for right before every event. SWAG! It can be challenging to think of anything other than pens and Post-its to jazz up one’s table with memorable tchotchkes so here is some unforgettable swag from over the years:

Broker Fair 2019 in the Roosevelt Hotel, as some might recall, had a live basketball hoop by Rapid Finance. LoanMe brought out squeezable stress relievers and what better way to relieve it than squeezing a money wad. Silver sponsor Cooper Asset had special bags that came in handy when collecting all that swag.

At deBanked Connect San Diego 2019, PIRS Capital gave out mouse pads, great for guests to use at work with a constant reminder of where they got it from. Bitty Advance had reusable water containers, smart to stay hydrated while bouncing from sessions to the sponsor showcase room. BFS Capital had a bowl of candy on their table and who doesn’t love a sweet treat after endless meet and greets.

At deBanked Connect Miami 2019, SOS Capital was looking out for everyone by having a bowl of mints out for grab. And if one can’t calculate large numbers without a calculator handy, RTR Recovery had guests covered with that.

After having a virtual Broker Fair in 2020, Lendini stepped it up a notch with a hand-rolled cigar station at the pre-show party in 2021. If one didn’t have a pen and notepad to take down information, Velocity Capital Group made sure to have plenty available. Velocity also had a mini massage station to loosen everyone up after a tense year in quarantine.

Although Covid took some time away from events, the deBanked Connect Miami 2022 sponsors were more ready than ever to show off their swag. FundFi played it safe with hand sanitizers and the LCF Group knew everyone would need a ChapStick throughout the event after talking all day. FinTap got creative with their very own Staples easy-button that said ‘funded.’ Legend Funding had mini piggy banks, ROC Funding Group had cigar cutters, and Lendini had flasks and raffled off a Gucci duffle bag.

Broker Fair 2022 swag was a blend of the practical with the innovative. THOR Capital had shot glasses and if one needed a coaster for that Lifetime Funding had your back. Now that everyone has moved on to wireless headphones, Dedicated Financial GBC brought back wired headphones, which are perfect for flying. Beyonce said it best, “I got hot sauce in my bag swag,” and everyone could too because IOU Financial had mini hot sauce bottles. Following the tradition of raffling their most-wanted Gucci duffle, Lendini also had mini tool kits and Magic 8 Balls that fortuned all good news surrounding the event.

At deBanked events, sponsors always come through with original swag ideas. With Miami 2023 right around the corner, we are excited to see what will be there this year.

Effective June 17, 2022, LoanMe will be permanently closing. Now What ????... so we have received the email and it’s official effective june 17, 2022,loanme will be permanently closing. let’s face it the rates were ... |

Phoenix Funding : Term Loans... looking for other lenders besides loanme to fund term loans i have about 12 complete files/applications for term loans and all applicants have over 6... |

See Post... loanme deal...lol. you have to understand your lender list and where you can afford some maneuverability and where you can't. , , , i didn't say it was the right thing, i just said that you couldin order to skittle around breaking the iso ag... |

See Post... loanme deal...lol. you have to understand your lender list and where you can afford some maneuverability and where you can't. , , ie -i know i am sacrificing a higher payout in comms with fundation but i am going to get a lower rate which happens to be what that deal specifically needs to close. this kind of falls back on whoever is allocating the deals, they should know where to place deals to maximize the approval + allow for the biggest commission as a result. successful retail shops are organized and notate these things to be able to ferry subs over quickly with the right guidelines. also he... |

See Post... loanme., and if the client's personal credit is excellent, go with personal loans.... |