Archive for 2018

Open Banking — A U.S. Pipe Dream or Near-Term Reality?

December 18, 2018 Some alternative funders are anxious for “open banking” to become the gold standard in the U.S., but achieving widespread implementation is a weighty proposition.

Some alternative funders are anxious for “open banking” to become the gold standard in the U.S., but achieving widespread implementation is a weighty proposition.

Open banking refers to the use of open APIs (application program interfaces) that enable third-party developers to build applications and services around a financial institution. It’s a movement that’s been gaining ground globally in recent years. Regulations in the U.K., a forerunner in open banking, went into effect in January, while several other countries including Australia and Canada are at varying stages of implementation or exploration.

For the U.S., however, the time frame for comprehensive adoption of open banking is murkier. Industry participants say the prospects are good, but the sheer number of banks and the fragmented regulatory regime makes wholesale implementation immensely more complicated. Nonetheless, industry watchers see promise in the budding grass-roots initiative among banks and technology companies to develop data-sharing solutions. Regulators, too, have started to weigh in on the topic, showing a willingness to further explore how open banking could be applied in U.S. markets.

Open banking “is a global phenomenon that has great traction,” says Richard Prior, who leads open banking policy at Kabbage, an alternative lender that has been active in encouraging the industry to develop open banking standards in the U.S. “It’s incumbent upon the U.S. to be a driver of this trend,” he says.

The stakes are particularly high for alternative lenders since they rely so heavily on data to make informed underwriting decisions. Open banking has the potential to open up scores of customer data and significantly improve the underwriting process, according to industry participants.

“Open banking massively enables alternative lending,” says Mark Atherton, group vice president for Oracle’s financial services global business unit. What’s missing at the moment is the regulatory stick to ensure uniformity. Certainly, data sharing is gradually becoming more commonplace in the U.S. as banks and fintech companies increasingly explore ways to collaborate. But even so, banks in the U.S. are currently all over the map when it comes to their approach to open banking, posing a challenge for many alternative lenders. Many alternative lenders would like to see regulators step in with prescriptive requirements so that open banking becomes an obligation for all banks, as opposed to these decisions being made on a bank-by-bank basis. Especially since many consumers want to be able to more readily share their financial information, they say.

“It will create huge value to everyone if that data is more accessible,” says Eden Amirav, co-founder and chief executive of Lending Express, an AI-powered marketplace for business loans.

Some global-minded banks like Citibank have been on the forefront of open banking initiatives. Spanish banking giant BBVA is also taking a proactive approach. In October, the bank went live in the U.S. with its Banking-as-a-Service platform, after a multi-month beta period. Also in October, JPMorgan Chase announced a data sharing agreement with financial technology company Plaid that will allow customers to more easily push banking data to outside financial apps like Robinhood, Venmo and Acorns.

There are several other examples of open banking in action. Kabbage customers, for instance, authorize read-only access to their banking information to expedite the lending process through the company’s aggregator partners, says Sam Taussig, head of global policy at Kabbage.

Also, companies such as Xero and Mint routinely interface with banks to put customers in control of their financial planning. And companies like Plaid and Yodlee connect lenders and banks to help with processes such as asset and income verification.

Some banks, however, are more reticent than others when it comes to data sharing. And with no regulatory requirements in place, it’s up to individual banks how to proceed. This can be nettlesome for alternative lenders trying to get access to data, since there’s no guarantee they will be able to access the breadth of customer data that’s available. “As an underwriter, you want the whole financial picture, and if data points are missing, it’s hard to make appropriate lending decisions,” Taussig says.

The problem can be particularly acute among smaller banks, industry participants say. While the quality of data you can get from one of the money-center banks is quite good, “as you go down the line, it becomes a little less consistent,” says James Mendelsohn, chief operating officer of Breakout Capital Finance. For these smaller banks, the issue is sometimes one of control. There’s a feeling among some community banks, that “if I make it easier for my small business customers to get loans elsewhere, I’m done,” says Atherton of Oracle.

Absent regulatory requirements, alternative lenders are hoping that this initial hesitation among some banks changes over time as they continue to gain a better understanding of the market opportunity and as more of their counterparts become open to data sharing through APIs.

Open banking could be a boon for banks in that it would enable them to service customers they probably couldn’t before, says Jeffrey Bumbales, marketing director at Credibly, which helps small and mid-size businesses obtain financing. Open banking makes for a “better customer experience,” he says.

One challenge for the U.S. market is the hodgepodge of federal and state regulators that makes reaching a consensus a more arduous task. It’s not as simple here as it may be in other markets that are less fragmented, observers say.

Major rule-making would be involved, and there are many issues that would need attention. One pressing area of regulatory uncertainty today is who bears the liability in the event of a breach—the bank or the fintech, says Steve Boms, executive director of the Northern American chapter of the Financial Data and Technology Association. Existing regulations simply don’t speak to data connectivity issues, he says.

To be sure, policymakers have started to give these matters more serious attention, with various regulators weighing in, though no regulator has issued definitive requirements. Still, some industry participants are encouraged to see regulators and policymakers taking more of an interest in open banking.

A recent Treasury Report, for example, notes that as open banking matures in the United Kingdom, “U.S. financial regulators should observe developments and learn from the British experience.” And, The Senate Banking Committee recently touched on the issue at a Sept. 18 hearing. Industry watchers say these developments are a step in the right direction, though there’s significant work needed, they say, in order to make open banking a pervasive reality.

“We’re seeing the pace and interest around these things picking up pretty significantly,” Boms says. Even so, it can take several years to implement a formal process. “The hope is obviously as soon as possible, but the financial services sector is a very fragmented market in terms of regulation. There’s going to have to be a lot of coordination,” Boms says.

Another challenge to overcome is customers’ willingness to use open banking. Many small business owners are more comfortable sending a PDF bank statement versus granting complete access to their online banking credentials, says Mendelsohn of Breakout Capital Finance. “There’s a lot more comfort on the consumer side than there is on the small business side. Some of that is just time,” he adds.

Certainly sharing financial data is a concern—even in the U.K. where open banking efforts are well underway. More than three quarters of U.K. respondents expressed concern about sharing financial data with organizations other than their bank, according to a recent poll by market research body, YouGov. This suggests that more needs to be done to ease consumers into an open banking ecosystem.

The topic of data security came up repeatedly at this year’s Money20/20 USA conference in Las Vegas. How to make people feel comfortable that their data is safe is a pressing concern, says Tim Donovan, a spokesman for Fundbox, which provides revolving lines of credit for small businesses. Clearly, it’s something the industry will have to address before open banking can really become a reality in the U.S., he says.

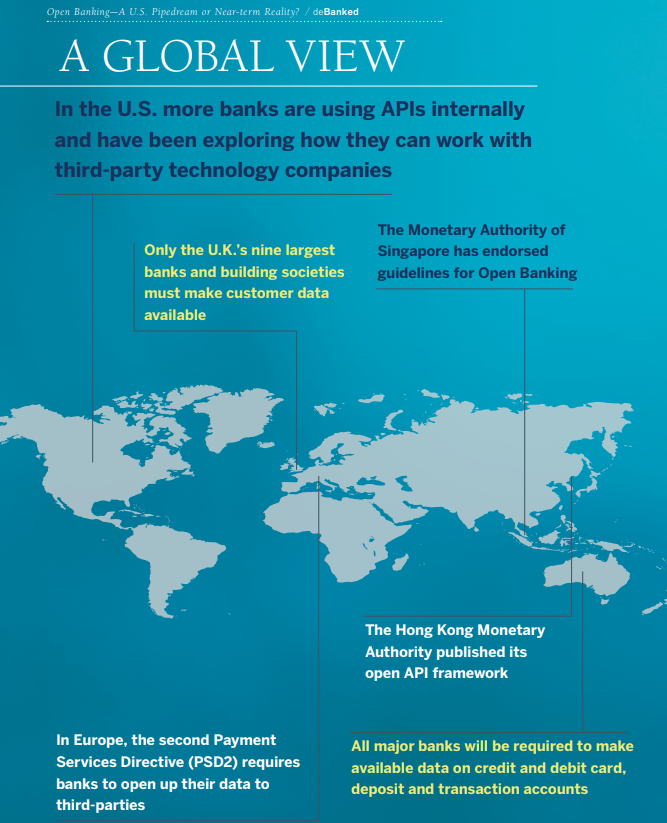

Despite these challenges, many market watchers feel open banking in the U.S. is inevitable, given the momentum that’s driving adoption worldwide. Several countries have taken on open banking initiatives and are at varying states of implementation—some driven by industry, others by regulation. Here is a sampling of what’s happening in other regions of the world:

In the U.K., for example, the implementation process is ongoing and is expected to continually enhance and add functionality through September 2019, according to The Open Banking Implementation Entity, the designated entity for creating standards and overseeing the U.K’s open banking initiative.

At the moment, only the U.K.’s nine largest banks and building societies must make customer data available through open banking though other institutions have and continue to opt in to take part in open banking. As of September, there were 77 regulated providers, consisting of third parties and account providers and six of those providers were live with customers, according to the U.K. open banking entity.

In Europe, the second Payment Services Directive (PSD2) requires banks to open up their data to third parties. But implementation is taking longer than expected—given the large number of banks involved. By some opinions, open banking won’t really be in force in Europe until September 2019, when the Regulatory Technical Standards for open and secure electronic payments under the PSD2 are supposed to be in place.

In Australia, meanwhile, the country has adopted a phase-in process to take place over a period of several years through 2021. Starting in July 2019, all major banks will be required to make available data on credit and debit card, deposit and transaction accounts. Data requirements for mortgage accounts at major banks will follow by February 1, 2020. Then, by July 1 of 2020, all major banks will need to make available data on all applicable products; the remaining banks will have another 12 months to make all the applicable data available.

For its part, Hong Kong is also pushing ahead with plans for open banking. In July, the Hong Kong Monetary Authority published its open API framework for the local banking sector. There’s a multi-prong implementation strategy with the final phase expected to be complete by mid-2019.

Singapore, by contrast, is taking a different approach than some other countries by not enforcing rules for banks to open access to data. The Monetary Authority of Singapore has endorsed guidelines for Open Banking, but has expressed its preference to pursue an industry-driven approach as opposed to regulatory mandates.

Other countries, meanwhile, are more in the exploratory phases. In Canada, the government announced in September a new advisory committee for Open Banking, a first step in a review of its potential merits. And in Mexico, the county’s new Fintech Law requires providers to provide fair access to data, and regulators there are reportedly gung-ho to get appropriate regulations into place. Still other countries are also exploring how to bring open banking to their markets.

The U.S. meanwhile, is on a slower course—at least for now. More banks are using APIs internally and have been exploring how they can work with third-party technology companies. Meanwhile, companies like IBM have been coming to market with solutions to help banks open up their legacy systems and tap into APIs. Other industry players are also actively pursuing ways to bring open banking to the market.

As for when and if open banking will become pervasive in the U.S., it’s anyone’s guess, but industry participants have high hopes that it’s an achievable target in the not-too-distant future.

Thus far, there has been little pressure for banks to adopt open banking policies, says Taussig of Kabbage. But this is changing, and things will continue to evolve as other countries adopt open banking and as pressure builds from small businesses and consumers in an effort to ensure the U.S. market stays competitive, he says. Open banking “is going to happen in the near future,” Taussig predicts.

Janene Machado Wins PCMA’s RISE Award

December 18, 2018Janene Machado, deBanked’s event planner, was honored by the Professional Convention Management Association (PCMA) last week with the RISE Award. The RISE Award is given to a new member who has made the most impact to the chapter. With more than 7,000 members and an audience of more than 50,000 individuals, the PCMA is the world’s largest network of Business Events Strategists.

Machado volunteers on the New York Area Chapter Marketing committee and manages their social media content.

We congratulate her on her achievement.

Entegra Bank Chooses Velocity Solutions to Power Its Small Business Digital Lending

December 18, 2018 Velocity Solutions announced today that its Akouba digital lending platform was selected by Entegra Bank to power the bank’s digital lending for its small and medium-sized business customers. Akouba provides community and regional banks with origination and underwriting services.

Velocity Solutions announced today that its Akouba digital lending platform was selected by Entegra Bank to power the bank’s digital lending for its small and medium-sized business customers. Akouba provides community and regional banks with origination and underwriting services.

“We selected Akouba not only for their cutting-edge technology and willingness to work with us, but for the very positive impact we believe this will have on the bank’s bottom line and on the customer experience,” said Charles Umberger, Executive VP and Chief Lending Officer for the Franklin, NC-based Entegra Bank.

According to the Velocity Solutions statement, Akouba is the only small business digital lending solution endorsed by the American Bankers Association (ABA). Akouba was endorsed by the ABA back in February 2017.

“The ABA’s endorsement will give lending institutions the assurance that Akouba’s solutions meet the highest standards,” said CEO of Akouba Chris Rentner, when they received the endorsement from the ABA. “In a rapidly changing lending environment, and with marketplace lenders disrupting the business lending space, our platform will help banks bring their customers the technology they have been lacking.”

In the same way that OnDeck’s ODX is trying to improve online lending for large banks, like Chase and PNC, Velocity’s Akouba does the same thing for regional banks.

“The small business loan application process is very time-sensitive and costly for banks, and there is a need to simplify and accelerate the process,” said Bryan Luke, chairman of ABA’s Endorsed Solutions Banker Advisory Council.

Velocity Solutions, which operates Akouba, is based in Fort Lauderdale, FL and employs over 100 people, according to Crunchbase. Entegra provides personal and business banking serves at 20 retail branches throughout Georgia, North Carolina and South Carolina.

1st Global Capital Sues Capital Stack and Others Over Momentum Auto Group

December 18, 2018 The notorious $40 million merchant cash advance deal has a new twist, even more cash advances. On Friday, the now-bankrupt 1st Global Capital filed a lawsuit against Momentum Auto Group, related entities, and 4 merchant cash advance companies including Capital Stack.

The notorious $40 million merchant cash advance deal has a new twist, even more cash advances. On Friday, the now-bankrupt 1st Global Capital filed a lawsuit against Momentum Auto Group, related entities, and 4 merchant cash advance companies including Capital Stack.

According to documents filed in the case, Momentum Auto was behind on taxes and loans to floor plan lenders to the tune of $15.5 million in February this year. That’s in addition to their inability at the time to pay 1st Global Capital and other MCA funders millions of dollars in advanced funds.

To fix the problem, 1st Global Capital established themselves as the senior creditor in which they required rival funders to enter into Subordination And Standstill agreements. In return for 1st Global Capital keeping Momentum Auto solvent with additional funds, the subordinate funders were only permitted to collect a fraction of their originally-stipulated daily payments (and only if Momentum Auto had adequate liquidity and cash flow, otherwise they were not allowed to collect anything at all until 1st Global had been paid in full). In the case of Capital Stack, it was agreed they could only debit 20% of what they were normally entitled to. For others it was 10%.

1st Global Capital says both restrictions were violated, that the funders collected above their agreed percentage and that they also collected from Momentum Auto despite the business not having adequate liquidity and cash flow. As relief, 1st Global Capital is seeking that each MCA funder return all funds they collected from Momentum Auto Group to 1st Global Capital.

Momentum Auto Group is a conglomerate of car dealerships in California that shut their doors in November. Soon after, lawsuits flew, and in one case the judge has ordered the dealerships be placed into receivership.

1st Global Capital is itself in receivership, having filed bankruptcy in July this year. The company and its founder were also charged with fraud by the SEC after they allegedly relied on the sale of unregistered securities to more than 3,400 investors nationwide.

Wintrust Expands Accounts Receivables Financing

December 17, 2018Today, Wintrust announced the creation of Wintrust Receivables Finance, an expansion of the company’s asset-based lending group, according to a story in Monitor Daily. This translates to the addition of a specialized team focused on accounts receivables financing to middle market companies, with revenues between $10 million and $300 million.

“We think this team is a great expansion to our current services,” said Edward J. Wehmer, Founder and CEO of the Chicago-based regional bank. “Wintrust Receivables Finance makes our asset-based lending even more robust and competitive.”

THE ABCs OF SBDCs

December 16, 2018 An often-overlooked national network of nearly a thousand Small Business Development Centers has the potential to help alternative funders cement relationships with existing clients and locate new ones. The centers, known as SBDCs, offer free or low-cost training and consultation to established and aspiring merchants and manufacturers.

An often-overlooked national network of nearly a thousand Small Business Development Centers has the potential to help alternative funders cement relationships with existing clients and locate new ones. The centers, known as SBDCs, offer free or low-cost training and consultation to established and aspiring merchants and manufacturers.

The earliest SBDCs have been around for four decades. The centers operate in conjunction with the Small Business Administration as public-private partnerships and serve about 1.5 million clients annually.

Centers help small-business owners evaluate ideas, organize companies, find legal assistance and obtain operating capital.

But not everyone knows all that. “The network is underutilized,” says Donna Ettenson, vice president of operations for Washington-based America’s SBDCs, which functions much like a trade association for the centers scattered across the nation. “We’re one of the best-kept secrets in the United States federal government.”

That means alternative funders can assist customers by simply informing them that the centers exist and can offer potentially beneficial services. Providing basic information on the SBDCs could become part of a consultative approach to selling that brings repeat business, especially with merchants who lack business skills or experience, observers suggest.

What’s more, alt funders who want to increase their chances of benefitting from SBDCs can go beyond merely providing clients with a rundown on the centers. The funders can become actively involved with the work of carried out at the centers.

One way of taking part is to contact nearby centers and offer to make presentations at seminars or workshops, Ettenson says. Funders could provide information to fledgling business owners on the instruments available through the alternative-funding industry, such as cash advances, loans and factoring, she suggests.

To get started, alternative funders can visit the America’s SBDC website, where they’ll find a search tool that provides contact information for their nearest centers, Ettenson says. From there, they could discuss possible connections with officials at the local centers, she advises.

To get started, alternative funders can visit the America’s SBDC website, where they’ll find a search tool that provides contact information for their nearest centers, Ettenson says. From there, they could discuss possible connections with officials at the local centers, she advises.

That involvement would not only provide exposure to merchants in need of capital but also to center officials who point merchants toward capital sources. If enough members of the alt funding industry took part, their work could eventually give rise to something akin to the lists of attorneys that some centers maintain, Ettenson says.

Centers often tap attorneys—perhaps quarterly—to lecture on a rotating basis on what type of business to form. That could mean organizing as a corporation, limited-liability partnership or some other form. In much the same way, funders could share their knowledge of instruments for obtaining capital.

Funders could emulate the lawyers who use the centers as a forum for soft marketing, Ettenson says. The speaker becomes a familiar face and can leave business cards that students could use to contact them as questions arise. However, speakers must provide general information and are prohibited from using speaking opportunities as blatantly self-promotional unpaid advertisements, she cautions.

What’s more, the centers have to exercise caution to avoid recommending specific attorneys, accountants or sources of capital because they could incur liability if events go sour and a service provider absconds to Bogata, Columbia, Ettenson points out. That keeps the centers “ecumenical,” in that they provide a list of professionals for clients to interview and rather than pointing to a single source.

Alternative funders can explore other ways to become involved with SBDCs, too. The national organization presents an annual trade show and professional development conference for service-center directors and service-center staff members who teach or consult with clients. Alternative funders who have taken booth space on the exhibition floor or made presentations in the accompanying conference include RapidAdvance, Breakout Capital, Kabbage and Newtek Business Services.

When America’s SBDCs issues a call for presentations at the annual conference, it receives approximately 300 applications for about 140 speaking slots. Some of the speakers come from the rosters of presenters at past shows, while companies newer to the trade show can purchase an entry-level sponsorship that includes booth space and the right to conduct a workshop.

The attendees at those annual conferences can tell their clients about the funders they encounter there. Attendees can also find out more about the alternative- funding industry and then pass that information along to merchants.

Some regional centers in states with large populations—such as California—can also hold conventions for their officials, says Patrick Nye, executive director for small business and entrepreneurship at the Los Angeles Regional SBDC Network, which is based at Long Beach City College. His state was planning its second statewide gathering this year and intends to do it again every other year. Alternative funders could participate, he says.

With so much going on at the centers, someone has to front the cash to keep the lights on. Local organizations are funded partly through federal appropriations administered by the SBA. “In order for the federal money to be pulled down, a matching non-federal dollar must be provided as well,” Ettenson says. The federal funds are apportioned based on the amount of matching funds the centers provide.

The matching funds usually flow from colleges, universities and state legislatures. “It’s a mix,” Ettenson says of the sources. Institutions of higher learning often meet part of their matching-fund goals by providing “in kind” resources—such as classrooms, services and instructors—instead of cash.

In the six states that administer the centers through their economic development departments, the state legislatures generally appropriate matching funds. In Texas, the representatives of the state’s four regional programs combine forces to lobby the legislature for matching funds, and that teamwork reduces the cost of their efforts in Austin.

The federal funds and matching funds support local and regional centers that belong to a network based on 62 host institutions. Of the 62, six operate through the economic development departments of state governments. They’re in Indiana, Illinois, Ohio, West Virginia, Minnesota and Colorado. The rest of the host institutions are mostly universities or community colleges. Some are based in economic development agencies.

One can think of the regional centers as something akin to corporate headquarters and the local centers as retailers, says Nye, who administers the Southern California regional center. The local centers under his regional’s jurisdiction are located in only three counties but pull in the sixth-largest share of funding because of Southern California’s huge population, he notes.

The local service centers provide training and consulting for entrepreneurs starting or expanding their enterprises. About 60 percent of the clients are already in business. Of the 40 percent who don’t own a business, about half launch one after receiving assistance from an SBDC, Ettenson says.

The centers don’t charge for consulting services, and the fees for training are just large enough to cover expenses. The training fees usually remain in the centers that provide the instruction where they’re used to cover expenses like buying computers.

In Southern California centers, the business advisors are usually under contract and have knowledge to share from their experience in business, marketing, banking, social media, consulting or other realms, says Nye. Not many college instructors work in the centers, he notes, adding that the centers are monitored to avoid conflicts of interest among advisors.

To track how well advisors are performing, the national organization produces economic impact statements by interviewing thousands of clients. Interviews generally take place two years after consulting sessions. That should provide enough time to get results, Ettenson says

Thus, America’s SBDCs this year surveyed clients who received services in 2016. Those long-term clients received $4.6 billion in financing, while last year the clients surveyed who got underway in 2015 had received $5.6 billion in financing. She could not break down that financing by categories like banks and non-banks.

Discussing those surveys, Ettenson offers some details. “If you talk to us for two minutes, we don’t consider you a client,” she emphasizes. The SBDC definition of what constitutes a client calls for at least one hour of one-to-one consulting or at least one two- hour training session, she says. The organization defines “touches” as people with less exposure, such as those who call on the phone with a question.

When an SBDC client needs funding, officials at the centers have no qualms about including alternative funders in their recommendations to clients who are seeking funds, says Ettenson. “We don’t exclude anybody in any way, shape or form unless there’s some reason to think they’re fraudulent,” she notes.

But malfeasance isn’t the worry it once was, Ettenson asserts, noting that alternative funders have gained credibility in the last five or so years as they began policing their own industry. “They’ve learned to keep track of who’s in their space and how they’re operating,” she says.

Alternative financing has established a niche that benefits small-business people who know how to use it, Ettenson maintains. “They understand that they’re borrowing money for a short period of time and it’s going to cost you a fair amount,” she says. “It’s a short-term bridge to get to whatever your goal is.” Merchants seeking funders should learn the differences among alternative funders—whom she says all operate a little differently from each other—to choose their best option.

And opportunity for alternative funders may abound at the centers in the near future. Nye cites the two biggest goals for his centers as new business starts and capital infusion. Center advisors help develop business plans that aid clients in obtaining financing, he says. Last year, his region received a little over $4 million from the SBA and used it to help start 365 new businesses and raise $148 million in capital infusions. Those efforts created 1,700 jobs, he says.

Business That Left Merchant Cash Advance Companies Hanging is Under FBI Investigation

December 16, 2018 In 2017, several judgments were issued in the New York Supreme Court against one Michael Willhoit, a resident and business owner in Springfield, Missouri. No lawsuits were filed, Willhoit had merely confessed judgment to nearly a half million dollars collectively.

In 2017, several judgments were issued in the New York Supreme Court against one Michael Willhoit, a resident and business owner in Springfield, Missouri. No lawsuits were filed, Willhoit had merely confessed judgment to nearly a half million dollars collectively.

By the following summer, a visitor would come knocking on the door of Willhoit’s fully-customized multimillion dollar safari-themed home, dubbed “The African Queen.” It was the FBI. He was under investigation for bank fraud.

According to the Springfield News-Leader, Willhoit’s wife told an investigator that her husband’s exotic car business was gone. But if so, several banks want to know where $4.25 million in unpaid loans went and what happened to the 33 vehicles that Willhoit had given them paperwork for. The banks, who sparked the FBI investigation, sued, and by November Willhoit’s wife filed for bankruptcy. Among her listed possessions were

- Two roaring lion masks

- Two 7-foot tall hand-carved wooden tusks

- An eight-legged genuine impala horn zebra-hide chair

- A 15-foot African warrior statue

- A 3,000-pound (approximately) bronze rhino

- Four gazelle taxidermy mounts

- A baboon, full-body mount

A youtube video tour of the home shows even more exotic paraphernalia. Realtor.com described the residence, which went on the market in July for $8.9 million, as a trophy showcase of African art. Willhoit told a News-Leader reporter in 2016 that he spent $3 million renovating the property including $400,000 for a 900-square-foot wood floor and $300,000 for landscaping.

More recently, News-Leader reported that Willhoit is the target of a federal grand jury investigation. In one of the bank lawsuits filed against him, Willhoit’s defense is reportedly that it’s the bank’s fault.

deBanked’s “Ice Edition”

December 14, 2018 deBanked’s final issue of 2018 is in the mail. We’re calling it the ice edition because of how the cover’s colors came out. For November/December we cover the new legislation in California, what’s happening in New Jersey, and what may be still to come. In addition we tackle the concept of open banking, delve into Small Business Development Centers, and reflect back on the biggest moments of 2018. There’s more of course, but you’ll have to get your hands on the ice to see for yourself.

deBanked’s final issue of 2018 is in the mail. We’re calling it the ice edition because of how the cover’s colors came out. For November/December we cover the new legislation in California, what’s happening in New Jersey, and what may be still to come. In addition we tackle the concept of open banking, delve into Small Business Development Centers, and reflect back on the biggest moments of 2018. There’s more of course, but you’ll have to get your hands on the ice to see for yourself.

If you’re not already subscribed, YOU CAN REGISTER TO GET ALL FUTURE ISSUES HERE FOR FREE.

And don’t forget, the deadline to become a sponsor of deBanked CONNECT – Miami is Wednesday, Dec 20th. Email events@debanked.com to get signed up.