Small Business

Covid EIDL Charge-Offs Explode, Increase By $52 Billion in FY 2023

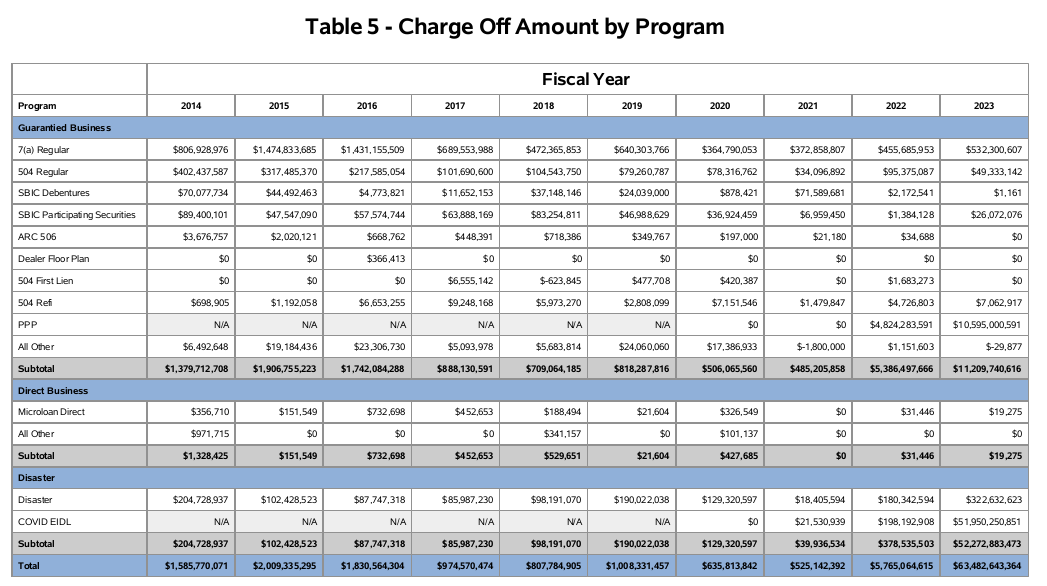

February 4, 2024The SBA charged off an extraordinary amount of Covid-era EIDL loans in its FY 2023, hitting $52 billion! That was up from the $220 million charged-off collectively in FY 2021 and 2022. $52 billion equates to 17.2% of the unpaid principal balance, an astonishing percentage considering that most of these loans still have approximately 28 years left on their term. Many borrowers did not even have to start making payments until 2023, thanks to an initial 30-month deferment program followed by an additional 6 month deferment assistance option. The SBA’s FY ended on September 30, 2023 so this does not reflect any loans charged off for the last 3 months of the year.

Per the SBA, “Loans are charged off if SBA determines no additional principal and interest from the borrower will be recovered via the agency.”

The remaining unpaid principal balance on Covid-era EIDL loans is $302 billion. Given that the unpaid principal balance was $358 billion last year, the reduction is almost entirely due to charge-offs rather than borrowers paying down the principal.

PPP loan charge-offs were also up, hitting $10.6 billion in FY 2023, up from $4.8 billion in FY 2022.

The SBA published this data as part of its regular FY reporting on February 2.

Top Industry Execs Attend Small Business Finance Leaders Summit in Washington DC

January 29, 2024 Fifty top C-level executives attended the Small Business Finance Leaders Summit in Washington DC last week to discuss the economy, small business finance, policy issues, regulatory impacts, and industry best practices. Co-hosted by two major trade organizations, the Small Business Finance Association (SBFA) and the Innovative Lending Platform Association (ILPA), it was invite-only and open to members of both.

Fifty top C-level executives attended the Small Business Finance Leaders Summit in Washington DC last week to discuss the economy, small business finance, policy issues, regulatory impacts, and industry best practices. Co-hosted by two major trade organizations, the Small Business Finance Association (SBFA) and the Innovative Lending Platform Association (ILPA), it was invite-only and open to members of both.

Speakers included US Senator Roger Marshall, Tom Sullivan from the US Chamber of Commerce, Holly Wade from the National Federation of Independent Business, Aaron Klein from Brookings, Will Tumulty from Rapid Finance, Justin Bakes from Forward Financing, Kirk Chartier from OnDeck, and Steve Allocca from Funding Circle, among others.

“As our industry matures, it’s important to provide industry leaders with an opportunity to connect and engage with high-level thought leaders,” said Steve Denis, Executive Director of the SBFA. “We believe our C-level Summit complements the Broker Fair and other industry conferences like Money 20/20 or Nexus. We hope to expand our Summit in June to bring in some new industry voices and will continue to focus on high-end content that is meaningful and strategic for our members and other top industry leaders.”

The organizations are planning another Summit in early June to build upon the success.

When Funding Gets Personal

November 16, 2023 “We’re excited to have the opportunity to fund within the community, and then go visit, help them grow their business and everything like that…” said Benjamin Lieff, Chief Revenue Officer of Capital Gurus.

“We’re excited to have the opportunity to fund within the community, and then go visit, help them grow their business and everything like that…” said Benjamin Lieff, Chief Revenue Officer of Capital Gurus.

For an industry that has a reputation for being online, funding relationships can become quite personal. Lieff, for example, previously helped a couple with securing a lease to open a barcade in North Hollywood, California and then also did whatever he could to get them through to their grand opening including work to get their liquor license. Now, they’re actually friends.

“Not only was I able to go visit during the construction process and them opening this location but whenever I’m back in Los Angeles, I always go spend some time with him and his wife,” said Lieff. “I went to the opening party and anybody who talks to me, and they’re looking for that type of business, I always lead them there and they’re actually really blowing up. And I’m really happy to see them. I’m constantly cheering them on.”

For Funding Circle US, having an office in the big city of Denver means that some of their borrowers are coincidentally located right in their neighborhood. It’s fairly common for them to be customers of these businesses as well and they’ve actually used some for in-office catering.

“One of our favorites in Denver is called Whittier cafe. And it’s Denver’s only African espresso bar,” said Kristal Bergfield, General Manager of Strategic Partnerships at Funding Circle. The store has even been featured on Funding Circle’s TikTok.

As for Claude Darmony, President at WeFund in the Fort Lauderdale area, he knew one business quite well before the funding started.

“He was just a mechanic shop, I gave him the funds to start building gas stations next to it,” said Darmony. “It was a good friend of mine.”

While still having to go through the normal underwiting process, Darmony got to attend the grand opening after the deal went through. “It was nice,” he said.

What’s In Your Cup?

August 8, 2023 “I like cold brew coffee with an extra 3 shots of espresso and 2 packets of stevia to get the day started,” said Brin Richardson, Sales Development Team Lead at Banana Exchange.

“I like cold brew coffee with an extra 3 shots of espresso and 2 packets of stevia to get the day started,” said Brin Richardson, Sales Development Team Lead at Banana Exchange.

Everyone has their own unique routine that helps them power through the workday. For some, it might be caffeine.

“I think coffee, for me personally, it definitely gives me the energy I need in the morning,” said Nicolette DiAntonio, Head of ISO Relations at Lexington Capital Holdings. “First thing when I wake up I put the pot of coffee on at home. I get to work I make my second cup…”

From there it’s another 1-2 cups throughout the day for her, which she said is still less than what the company CEO drinks. “It boosts my energy, my productivity and everything like that,” she said.

“I’m like an every hour on the hour type of guy,” said Frankie DiAntonio, the CEO at Lexington Capital Holdings. “Typically, like 6,7,8,9 o’clock and then I’m going for the rest of the day. And then I might have one more in the afternoon to get me through the rest.”

That’s about 5 cups a day for him on average. “Moral of the story, we love it over here,” Frankie said. “Lexington runs on coffee.”

Brandon Schadek, Director of Sales at Leads to Business said he’s definitely more productive when he has caffeine in him. “I just tend to be more alert and more on top of things but when I don’t have it, I feel like I’m lacking that extra energy.”

Unsurprisingly, coffee is his beverage of choice for that. “First thing in the morning, I have a Keurig and I use French Roast from Starbucks,” said Schadek. “That’s what I use for the coffee and then I definitely have I would say about two teaspoons of creamer, it’s caramel macchiato. […] And I have that every day to start my day.”

But caffeine isn’t for everyone. Ryan Metcalf, Head of Public Affairs for Funding Circle US, told deBanked that he really enjoys drinking Diet Coke, though not for the caffeine content of it.

“I love the taste of it. I like the coldness of it,” Metcalf said. Although Diet Coke has more caffeine than regular Coke, he feels that too much caffeine on a whole can actually impede one’s productivity rather than increase it. As such, he limits himself to two Diet Cokes per day and only enjoys them between the hours of noon and five pm.

“The king of all Diet Cokes is a fountain Diet Coke from McDonald’s,” Metcalf said. “There is nothing better.”

Loan Scammers Play With Email Dots

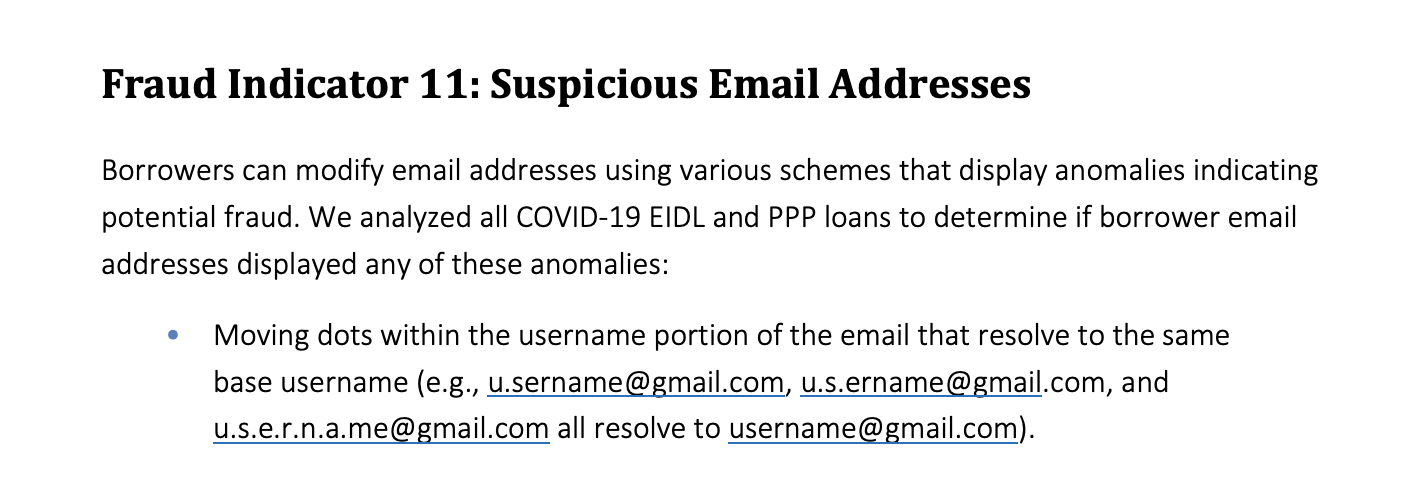

June 28, 2023 Did you know if you send an email to myname@gmail.com or my.name@gmail.com or myna.me@gmail.com, they would all go to the same place? Scammers do. In a recent bombshell report published by the SBA and OIG, $200 billion in PPP/EIDL fraud was accomplished through a number of common techniques, one of which appears to be through the manipulation of email addresses.

Did you know if you send an email to myname@gmail.com or my.name@gmail.com or myna.me@gmail.com, they would all go to the same place? Scammers do. In a recent bombshell report published by the SBA and OIG, $200 billion in PPP/EIDL fraud was accomplished through a number of common techniques, one of which appears to be through the manipulation of email addresses.

Some mail servers, including Gmail’s for example, ignore the dots, a feature likely built in because periods are commonly used as concatenation operators to join two strings in programming. Reader’s Digest recently called this “The Gmail Trick That’s Been Around for 15 Years—But Few People Know About It.”

“Any combination of your e-mail address and those little dots is sent to the exact same inbox. You own all dotted versions of your address,” RD wrote.

The implications of this, however, are that scammers can potentially bypass systems that rely on e-mail addresses as a primary form of verification or identity. Both scammer@gmail.com and scam.mer@gmail.com could have separate accounts in one system even though it’s the same email address. This method is useful to scammers because they do not have to register additional gmail accounts, which could potentially trigger additional unnecessary verifications or reviews from Google for suspicious activity. Instead, they can rely on the single account.

Furthermore, the SBA report said that aliases or email forwarding or disposable email addresses are also used in fraud and are a fraud indicator.

“Using an alias technique to add an extension to an existing email address through use of a dash (-) or plus (+) that resolve to the same email (e.g., username-123@gmail.com or username+bob@gmail.com both resolve to username@gmail.com)” was something that the SBA analyzed in its fraud investigation. “Using a disposable email service to remain anonymous by receiving emails at a temporary address that may self-destruct after a certain time elapses” is another technique that was examined.

Is your system checking for dots in gmail addresses? If they weren’t before, they should now!

Small Businesses Felt the Shift in Q1 as Well

May 10, 2023At the end of last year, small businesses were feeling a renewed sense of optimism about what 2023 might bring. Then the mood soured a little, according to a new study conducted by IOU Financial. “Most businesses did not perform as well during the first quarter of 2023 as they had the previous quarter,” it found. Only 28% of respondents said that their business performed in line with their expectations for the quarter and thirty-seven percent said that their business actually performed worse or much worse. Despite this, only 12% predict that their business will perform worse or much worse in Q2 vs. Q1. In fact, 67% predict that their business will perform somewhat better or much better than Q1.

Interest rates and a possible recession remain the top concerns for business owners. Overall, IOU summed up its findings as a “rocky start to 2023, but optimism for small business growth remains strong.”

SBA Lifts SBLC Moratorium

April 11, 2023

It’s official. The SBA is lifting the moratorium on licenses for Small Business Lending Companies (SBLCs), ending the 40-year pause that began in 1982. The SBA is also adding a new type of lending entity called a Community Advantage SBLC while also removing the requirement for a Loan Authorization in the 7(a) and 504 Loan Programs.

The 37-page rule, which is slated to be published in the federal register on April 12th, included the SBA’s analysis of all the comments it had received, including the criticisms. Some argued, for example, that opening up the doors would allow the unscrupulous world of fintech to participate in the market. The SBA was unmoved by this, countering that existing participants already rely on fintech.

“SBA has for many years provided oversite to non-depository entities participating in the SBA business loan programs,” the SBA said. “This includes SBLCs, non-federally regulated lenders (NFRLs), 504 Certified Development Companies (CDCs), and Microloan Intermediaries. In fact, most all lending institutions incorporate the use of financial technology in their delivery of loans and other financial products.”

One such fintech that has been eager to become a participant, issued a prepared statement on the decision earlier today.

“Funding Circle applauds the Biden Administration for ending the SBA’s 40 year moratorium on licensing additional state and SBA licensed and regulated non-depository lenders thus ending its lender oligopoly in favor of competition and innovation,” said Funding Circle. “This is an opportunity for the more than 8,000 community banks and credit unions that don’t offer 7(a) loans to partner with Fintech lenders to offer affordable loans quickly in underserved communities. Congress should now focus on ensuring SBA has the resources necessary to license more than three new lenders in its SBLC program in order to increase competition and distribution of government guaranteed loans in underserved communities.”

The SBA also published new rules on April 10th that will amend various regulations governing the 7(a) and 504 loan programs.

Federal Regulator Enacts New 888-Page Law Covering Small Business Finance

March 30, 2023 This is NOT an April Fool’s joke. On Thursday, the CFPB released the final rules that govern how small business finance companies will have to collect and report data to the federal government. Such rules had been anticipated since the Dodd-Frank Act, passed in 2010, mandated that they be put in place. Thirteen long years later, the only part that may come as unexpected is the sheer magnitude of the language, 888 pages of fine print.

This is NOT an April Fool’s joke. On Thursday, the CFPB released the final rules that govern how small business finance companies will have to collect and report data to the federal government. Such rules had been anticipated since the Dodd-Frank Act, passed in 2010, mandated that they be put in place. Thirteen long years later, the only part that may come as unexpected is the sheer magnitude of the language, 888 pages of fine print.

Transactions within the scope of the rule include loans, lines of credit, credit cards, merchant cash advances, and credit products used for agricultural purposes.

According to the CFPB’s executive summary, compliance appears to start next year.

- A financial institution must begin collecting data and otherwise complying with the final rule on October 1, 2024 if it originated at least 2,500 covered originations in both 2022 and 2023.

- A financial institution must begin collecting data and otherwise complying with the final rule on April 1, 2025 if it: Originated at least 500 covered originations in both 2022 and 2023; Did not originate 2,500 or more covered originations in both 2022 and 2023; and Originated at least 100 covered originations in 2024.

- A financial institution must begin collecting data and otherwise complying with the final rule on January 1, 2026 if it originated at least 100 covered originations in both 2024 and 2025.

Call your lawyer.