Marketplace Lending

Company Founded By LendIt’s Co-founders Has Acquired LendingRobot

August 10, 2017 NSR Invest has acquired LendingRobot to become the largest robo-advisor in the alternative lending space, according to an announcement made by both companies.

NSR Invest has acquired LendingRobot to become the largest robo-advisor in the alternative lending space, according to an announcement made by both companies.

Of note is that three of NSR Invest’s co-founders, Peter Renton, Bo Brustkern, and Jason Jones, are also co-founders of the LendIt Conference.

The acquisition is a reminder that the conference founders are also significant players in the alternative lending space itself. According to the announcement, the new combined parent company, Lend Core, LLC, serves over 8,000 clients and manages over $150 million in assets.

For those not familiar with LendingRobot, deBanked started reporting on the company more than two years ago as a tool for investors to automate their investment picks on marketplace lending platforms like Lending Club and Prosper. I eventually became an individual paying customer of the service, using it to automate the purchase of nearly $30,000 worth of tiny $25 and $50 notes that fit within the parameters I had set. LendingRobot’s classic service can also automate investments on the Funding Circle platform, though I have never signed up with Funding Circle or invested in their loans.

When I last met with Emmanuel Marot, LendingRobot’s CEO, in person, he was launching a new hedge fund dubbed the LendingRobot Series that would be managed with robo-advisor technology. The hedge fund was included in NSR Invest’s acquisition.

NSR Invest CEO and LendIt co-founder Bo Brustkern will lead the combined entity as CEO. In a prepared statement he said, “We have long respected the work of the LendingRobot team and recognize that our companies are pursuing a common goal. That is, to provide a unifying investment solution for the millions of investors worldwide who seek the attractive, uncorrelated, diversified returns that alternative lending can provide. With this combination of our firms, we are bringing enhanced capabilities to our combined client bases today, and big plans for the future. A shining example of the kind of innovation that we will emphasize is the Lending Robot Series Fund, which provides customization, liquidity and diversification to investors through a novel, elegant, low-cost fund structure.”

Meanwhile, Marot will continue on only as a special advisor to the company. In a prepared statement, he said, “NSR and LendingRobot have taken different tracts to provide similar services. Now is the perfect time to combine our complementary strengths. The combination of LendingRobot’s advanced technology and NSR’s extensive knowledge of this industry puts us in the best position to provide superior investment advice in the alternative lending space for both individual and institutional investors.”

On Bloomberg: Watch Lending Club CEO Scott Sanborn Talk Q2

August 9, 2017On Bloomberg, Lending Club CEO Scott Sanborn said that banks were a critical piece of their platform. In Q2, 44% of all originations were funded by banks. Watch below:

Video not loading? Click here

Fintech Remains Loyal to Prosper & Suber

July 10, 2017

When deBanked reached out to fintech market participants for comment on Ron Suber’s sudden departure as Prosper’s president, the responses were the same — ‘anything for Ron.’ Dubbed the Godfather of fintech, Suber might deserve superhero status given the recapitalization that he and the Vermuts led half a decade ago to save Prosper Marketplace. That type of rescue inspires the kind of loyalty that investors and other fintech participants are displaying not only for Suber but also the Prosper brand.

“Ron is an incredible business partner. His word is always good. He doesn’t overpromise, and he always follows through. We were honored to work with a guy like that,” said Matt O’Malley, co-founder and president of Looking Glass Investments, which has been investing on the Prosper platform since 2008.

Perhaps he has never seen him overpromise but in recent weeks he and many other investors on the Prosper platform did observe an overstatement of returns. O’Malley calls it a forgivable mistake.

“In my view, it is our responsibility to track our returns. Prosper provides an extremely robust data set. We have the ability to calculate our returns daily,” said O’Malley, pointing to a nascent fintech market that is still evolving. “This asset class is new. If you compare it to investing in stocks and bonds, it’s in its infancy. When preparing returns, it’s very challenging to determine what they are,” he said.

Looking Glass has been investing in individual loans on the Prosper platform since before Suber’s time and has watched as the former Wells Fargo executive has transformed the peer-to-peer lender to welcome institutional investors.

“He didn’t have to let us stay on the platform. They could have chosen to replace the little guy. But that isn’t how he does business. He knew the investment banks and [other] banks would get involved, however he knew there was enough room for everyone,” said O’Malley.

That day is here, evidenced by Prosper’s previously announced deal with a consortium of institutional investors to purchase $5 billion worth of loans via the Prosper platform over the next couple of years.

FT Partners was the lead advisor on that deal.

“When they needed capital they could have chosen anybody to help. We were excited to be the chosen one to help them on the deal. It was one of fintech’s largest deals and certainly the largest of its kind,” said Steve McLaughlin, founder of FT Partners.

McLaughlin went on to explain the unique circumstances surrounding the transaction, including a lack of diversification tied to Prosper’s capital sources, which he added was a learning experience not only for the peer-to-peer lender but for all of fintech.

“They were focused on getting capital from hedge funds in a steady stream. When the capital markets had a blip, lots of that capital backed away. It was an unprecedented thing to go out and get a $5 billion forward agreement from a series of investors. “There was nothing cookie cutter about it,” said McLaughlin.

Since then the rest of fintech seems to be catching on.

“FT Partners is getting a lot of attention and a lot of calls for all of the other activity we are doing in the space as well. We raised capital for Prosper and a bunch of other companies, including Earnest, GreenSky, Upstart, Kabbage and others. We get a lot of calls, and we’re doing a lot of deals in the space. It’s a lot of fun,” McLaughlin said.

Much of the success of the multi-billion dollar Prosper deal was thanks to Suber.

“A lot of people are very familiar with Ron and the Prosper story and view Prosper as a high-end institution that while having some issues on financing had a very big and long-term future. Lots of Ron’s connections from before came into play in the round,” said McLaughlin.

Now that Suber is out of the picture in an official capacity, investors have every right to be disappointed. But as McLaughlin pointed out, Suber remains a big shareholder in Prosper and the peer-to-peer lender’s greatest supporter, two things that the FT Partners founder does not expect to change.

“This is not a major blow for Prosper. They maintain Ron as a friend of the firm and as an advisor. He has great friends and colleagues at Prosper. He is not going to work for anybody else. He won’t be doing anything with any other lending companies, I don’t think. He may be able to do more good from the outside than the inside at Prosper. I think Ron will always be part of the Prosper family,” McLaughlin said.

Why Now?

If things were going so well for Suber ushering Prosper into its chapter that included expanding the role of institutions on the platform then why is he leaving now? While Suber himself was not available to answer that question, the answer seems to be that it is personal. The fintech community knows Suber for his role in advancing this new asset class but what people might not know is that he is also a husband and a father.

“I think he just feels like this is more of a personal shift,” McLaughlin said.

O’Malley’s impression was similar. Upon joining the fintech startup, Suber made it a point to get to know the Looking Glass team.

“Ron invited us to breakfast. We did this three times. I remember meeting him and thinking this guy is exactly what we need – extra bright, charismatic and he talked lovingly about his children and his wife. He even joked that marriage is like yoga – it’s harder than it looks,” O’Malley said. “My guess is they are going to spend some time together as a family. And he is going to come back bigger and better than ever.”

Meanwhile Both O’Malley and McLaughlin were familiar with Prosper before Suber came on board, and both will remain engaged with Prosper even after Suber’s departure.

“They’re terrific and we have a great relationship. If they do something, we’re definitely the banker for it,” said McLaughlin.

O’Malley’s commitment is steadfast “We will remain loyal,” he said.

Catching Up With Marketplace Lending – A Timeline

June 13, 20174/11 Regions Bank recruited Kabbage’s chief technology officer, Amala Duggirala, to become its chief information officer

4/12 Federal Reserve Published their 2016 Small Business Credit Survey

4/13

- Marathon Partners, a minority shareholder of OnDeck, publicly called on the company to make changes

- Fifth Third Bank partnered with Accion to support lending to underserved small businesses

4/17 Affirm surpassed the mark of making more than 1 million loans since inception

4/20 YieldStreet surpassed $100M in loans funded since inception

4/21 Glenn Goldman stepped down as Credibly’s CEO

4/25

- SmartBiz Loans announced partnership with Sacramento-based Five Star Bank

- CommonBond begins offering loans to undergrads directly

4/26 State regulators sued OCC over fintech charter proposal

4/28

- IOU Financial announced that they loaned $107.6M to small businesses in Q1

- China Rapid Finance announced their IPO

5/2

- Funding Circle closed their online forum

- Elevate’s Debt facility with Victory Park Capital increased from $150M to $250M

5/3

- Prosper Marketplace disclosed that it miscalculated returns shown to retail investors

- Square announced that they loaned $251M to small businesses in Q1

- Nav raised $13M from investors that include Goldman Sachs and Steve Cohen’s Point72 Ventures

5/4

- Vermont governor signed into law new licensing requirements for anyone soliciting loans to Vermont borrowers.

- Lending Club announced that they loaned $1.96B in Q1

5/5 Thomas Curry steps down as OCC head, replaced by Acting Head Keith Noreika

5/8

- OnDeck announced it was substantially reducing its workforce as part of its plan to achieve profitability. The stock price proceeded to hit record lows.

- Dv01 announced reporting partnership with SoFi

- With no IPO on the horizon, SoFi revealed that they began letting their employees sell some of their stock

5/9

- In the United States District Court, The Southern District of New York ruled that a purchase of future receivables was not a loan largely because it was not absolutely payable. Colonial Funding Network, Inc. as servicing provider for TVT Capital, LLC v. Epazz, Inc. CynergyCorporation, and Shaun Passley a/k/a Shaun A. Passley

- The value of 1 Bitcoin surpassed $1,700.

5/10

- CFPB announces that it will begin work on small business loan data collection pursuant to Section 1071 of Dodd-Frank.

- CFPB publishes a white paper on small business lending

- SoFi revealed that they will apply for an industrial bank charter

5/12 NY’s banking regulator sued the OCC over its proposed fintech charters

5/15

Prosper announced that they lent $585M in Q1 and had a net loss of $23.9M

5/16

- Media outlets reported that SoFi is expanding into wealth management

- Lending Club named PayPal’s former head of Global Credit Steve Allocca as President

- OnDeck’s share price hit a new all-time low

See previous timelines:

2/17/17 – 4/5/17

12/16/16 – 2/16/17

9/27/16 – 12/16/16

Upstart’s Average Borrower

June 12, 2017Online lender Upstart considers more than 10,000 variables such as an applicant’s education, academic performance, and employment background, according to their website, a proprietary system they say is used to detect “future prime” borrowers. But according to a recent Kroll Rating Agency report, their borrower base looks prime even by traditional standards in that their average borrower is 28 years old, earns $95,000 a year and has a FICO score of 690. Upstart lends money (through Cross River Bank) to individuals for a variety of purposes including student loan refinancing and debt consolidation.

In the Kroll report, Upstart asserts its belief that its use of additional data points will outperform traditional credit models, but concedes that their system has not been tested through economic cycles.

Upstart has raised $88.35 million in equity to-date. The Kroll Report was prepared in anticipation of a $163 million securitization transaction that is expected to close this month. They expect to be making $100 million of loans per month by the end of the year.

Marketplace Lending: The Next 10 Years

June 7, 2017 The marketplace for consumer and small-business loans has come a long way over the last 10 years. Since the early days of peer-to-peer lending, there has been a great proliferation of new types of intermediaries creating new layers of distribution for the risk involved with the lending process. Now marketplace lending has reached an inflection point that will create a much different scenario with fewer players and more partnerships.

The marketplace for consumer and small-business loans has come a long way over the last 10 years. Since the early days of peer-to-peer lending, there has been a great proliferation of new types of intermediaries creating new layers of distribution for the risk involved with the lending process. Now marketplace lending has reached an inflection point that will create a much different scenario with fewer players and more partnerships.

“Marketplace lending has created a much richer ecosystem for risk distribution,” said Shane Hadden, a marketplace lending consultant at BlackLine Advisory Group. “There are many more participants on the investor side, new origination strategies and more intermediaries. We are seeing new types of risk being distributed to the best holders of that risk. This is a very good development for consumers and small business borrowers.”

Now that investors agree that marketplace lending risk is attractive, this segment is poised to mature. Hadden has turned his attention toward the next stage of marketplace lending.

“Marketplace lending has been about intermediation with new types of technology-driven companies being placed between the risk and the ultimate loan holder. That’s going to collapse back over time,” said Hadden.

Indeed marketplace lending to date has been the practice of lenders going around the banks to reach bank customers. This has created a market where lenders are competing against banks for originating credit risk that they then distribute, which in turn has created an appetite from investors for this type of risk.

Now that investors agree this is the type of risk they desire, they’re examining the process to determine the most cost efficient way to take on this risk. As they look down the marketplace lending supply chain, they’re faced with multiple layers that ultimately lead to the consumer.

“The next phase is that investment firms will partner directly with credit originators, the ones that have the data. They will partner with banks, for example, directly. Or with data driven online aggregators like Credit Karma Whoever is the ultimate holder of the loan partners with the company that has the best primary relationships with the borrower, cutting out the middle man,” said Hadden.

The linchpin holding this model all together is technology including machine learning, which is driving more efficient distribution. “Technology is what has made marketplace lending so rich and competitive. But technology firms must now compete within the market they’ve created. And typically technology – once it exists can be commoditized,” said Hadden, adding that technology will eliminate intermediaries, not create new ones.

Meanwhile, growth for the software providers will be through partnerships. “In the short run technology companies will participate as new financial intermediaries, but that will eventually correct itself and we will be in a situation where there are fewer intermediaries. When the smoke clears, all of the technology will be in the hands of two parties — the primary originators and the ultimate lenders,” said Hadden.

So the big question is ‘who will survive?’ According to Hadden, it will be the players that transition into a natural competitive position as either the lender or the risk originator. “These are the two big specialties. Either you have capital and algorithms and are good at investing or you have relationships and data and you are good at originating loans. These firms need to go in one direction or the other,” said Hadden.

While the patchwork of the new marketplace lending space has yet to be completed, one thing seems abundantly clear. “It will look different from what it looks like today,” said Hadden.

Sneak Peek of Our May/June 2017 Magazine Issue

June 5, 2017

Move over New York, California and Florida because Texas has become a strong incubator for alternative small business finance. In this newest deBanked magazine issue, we went to Dallas-Fort Worth, Austin and Corpus Christi to find out how and why non-bank financing products are flourishing. We were impressed by what we found and inspired just enough to dub Texas The ‘Loan‘ Star State.

And we went bigger than Texas (if that can be believed) by exploring how alternative lenders are spreading their wings beyond the states into other countries like the UK, Australia and Canada. But does it make sense to go abroad before you’ve cornered the market domestically? Industry captains share their thoughts.

There’s more of course, like how new tweaks to automated processes are actually making manual underwriting exercises easier. That itself has re-opened a debate that won’t seem to go away, humans vs computers in underwriting. In 2017, the humans aren’t out of the game yet and some think they never will be, but there are new tools available to increase speed and efficiency.

There’s legal decisions you’ll want to read and details about a new small business lending regulator you’ll want to know about. It’s all in the May/June 2017 issue that subscribers will be receiving in the mail soon and if you’re not subscribed, you should sign up FREE right now!

Old Woes Continue to Hang Over Lending Club

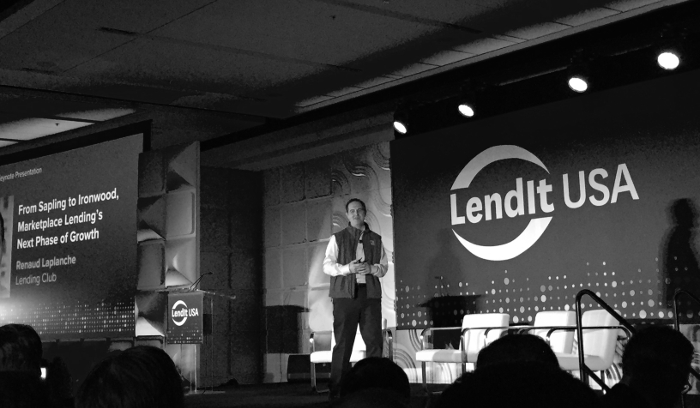

May 26, 2017 Former Lending Club CEO Renaud Laplanche at LendIt in 2016

Former Lending Club CEO Renaud Laplanche at LendIt in 2016A class action lawsuit filed against Lending Club last year isn’t going away. On Thursday, United States District Judge William Alsup denied parts of Lending Club’s motion to dismiss, meaning that the securities fraud case will continue to move forward.

The complaint touched on several issues related to former CEO Renaud Laplanche’s departure, including a conflict of interest he had with a related company named Cirrix, misreported loan volume figures, and manipulated loan data.

In one area of the decision, the judge held that allegations relating to internal controls were adequately pled in that the registration statement represented that disclosure controls and procedures were effective at a reasonable level, when in fact the company represented eighteen months later that internal controls actually suffered from various material weaknesses.

“Reasonable investors would have found it important to know of CEO Laplanche’s prior efforts to drive his company’s performance with artificially initiated loans, and even more importantly, that LendingClub’s internal controls could not effectively curb the artifice,” the judge wrote.

The case # is 3:16-cv-02627-WHA in the Northern District of California. The lead plaintiff is the Water and Power Employees’ Retirement, Disability and Death Plan of the City of Los Angeles.

Lending Club’s stock was down 62% from its IPO price as of Thursday’s close but was up almost 9% on the year, according to the deBanked Tracker.