Articles by Ed McKinley

Mad Over Madden

March 15, 2018 In a dispute that reflects the nation’s rigid political polarization, a piece of legislation pending before Congress either corrects a judicial error or condones “predatory lending.” It depends upon whom one asks. Either way, the proposed law could affect the alternative small-business funding industry indirectly in the short run and directly in the long term by addressing the interest rates non-banks charge when they take over bank loans.

In a dispute that reflects the nation’s rigid political polarization, a piece of legislation pending before Congress either corrects a judicial error or condones “predatory lending.” It depends upon whom one asks. Either way, the proposed law could affect the alternative small-business funding industry indirectly in the short run and directly in the long term by addressing the interest rates non-banks charge when they take over bank loans.

The easiest way to understand the controversy may be to trace it back to a ruling in 2015 by the United States Court of Appeals for the Second Circuit in New York. The case of Madden v. Midland Funding LLC started as claim by a consumer who was challenging the collection of a debt by a debt buyer, says Catherine Brennan, a partner in the law firm Hudson Cook LLP.

“Debt buyers like Midland are sued on a regular basis,” Brennan notes. “That’s a common occurrence.” What’s uncommon is that the appellate court affirmed the idea that the loan debt that Midland sought to collect from Madden became usurious when Midland bought it. The court ruled that because Midland wasn’t a bank it was not entitled to charge the interest the bank was allowed to charge, she maintains.

Under the ruling, non-banks that buy loans can’t necessarily continue to collect the interest rates banks charged because non-banks are generally subject to the limits of the borrower’s state, according to the Republican Policy Committee, an advisory group established by members of the House of Representatives in 1949. Banks can charge the highest rate allowed in the state where they are chartered, which could be much higher than allowed in the borrower’s state.

“So it undermines the concept that you determine the validity of a loan at the time the loan is made,” Brennan says of the decision in the Madden case. The “valid-when-made” doctrine – a long-established principle of usury law – states that if a loan is not usurious when made it does not become usurious when taken over by a third party, published reports say. In 2016, the U.S. Supreme Court declined to hear the Madden case, which in effect upheld the appellate court ruling.

In response, both houses of Congress are considering bills that would ensure that the interest rate on a loan originated by a bank remains valid if the loan is sold, assigned or transferred to a non-bank third party, the Republican Policy Committee says.

On Feb. 14, 2018, the House passed its version of the proposal, H.R. 3299, the Protecting Consumers’ Access to Credit Act of 2017, or the “Madden fix,” as it’s known colloquially. The vote was 245 to 171, mostly along party lines with 16 Democrats joining 229 Republicans to vote in favor. The Senate version, S. 1642, had not reached a vote by press time.

“It’s not a revolutionary concept,” Brennan says of the proposed law. “It had been understood prior to Madden that you determine usury at the time the loan is originated, and that should be restored.”

As the alternative small-business funding industry continues to mature it could benefit from the legislation, Brennan predicts. In the future, alt funders may begin to buy or sell more debt, which would make it subject to the state caps if the legislation fails to pass, she says.

The proposed law would also benefit partnerships in which banks refer prospective borrowers to alternative funders because it would eliminate uncertainty and would thus improve the stability of the asset, Brennan continues. “I would think anyone in the commercial lending space would want to see the Madden bill pass,” she contends.

Stephen Denis, executive director of the Small Business Finance Association, a trade group for alt funders, agrees. While most of the SBFA’s members don’t work with bank partners, the trade group has supported the lobbying efforts of other associations and coalitions representing financial services companies directly affected, he says. “We are concerned on behalf of the broader industry because we all work closely together and everyone has the same goal of making sure that we’re providing capital to small businesses,” he maintains.

That goal of keeping funds available to entrepreneurs also motivates the sponsor of H.R. 3299, Rep. Patrick McHenry, R-N.C., who’s chief deputy whip of the House and vice chair of the House Financial Services Committee. His interest in crowdfunding, capital formation and disruptive finance is fueled by events he experienced in his childhood, when his father attempted to operate a small business but struggled to find financing, according to the Congressman’s website.

Although H.R. 3299 passed in the House with mostly Republican votes, it attracted bipartisan co-sponsors in that chamber. They are Rep. Gregory Meeks, D-N.Y.; Rep. Gwen Moore, D-Wis., and Rep. Trey Hollingsworth, R-Ind. The Senate version of the legislation is sponsored by Sen. Mark R. Warner, D- Va.

Although H.R. 3299 passed in the House with mostly Republican votes, it attracted bipartisan co-sponsors in that chamber. They are Rep. Gregory Meeks, D-N.Y.; Rep. Gwen Moore, D-Wis., and Rep. Trey Hollingsworth, R-Ind. The Senate version of the legislation is sponsored by Sen. Mark R. Warner, D- Va.

But opponents of the proposed law aren’t feeling particularly bipartisan and argue vehemently against it, Brennan contends. “There’s been a lot of misinformation put out there by consumer advocates saying this would somehow embolden payday lending in all 50 states,” she says. “It’s simply not true.”

Payday lenders aren’t banks, so the proposed legislation would not apply to them and thus would not enable them to avoid interest caps imposed by borrowers’ states, Brennan notes, adding that some states don’t even allow payday consumer lending.

Consumer advocates are spreading propaganda because they oppose interest rates they consider high, Brennan continues. Advocates are incorrectly conflating payday lending with marketplace lending, she maintains.

The latter is defined as partnerships where non-banks sometimes work with banks to operate nationwide platforms, mostly online and sometimes peer-to-peer, she says, noting that examples include LendingClub and Prosper.

There’s no evidence marketplace lenders would astronomically increase their interest rates if the president signs into law a bill that resembles those now before Congress, Brennan says. It wasn’t happening before Madden, she notes, and banks involved in those partnerships operate under strict guidance of the Federal Deposit Insurance Corp. (FDIC) or the Office of the Comptroller of the currency, depending upon their charters.

But consumer advocates haven taken to the warpath, Brennan reports. Opponents of the legislation call partnerships between banks and non-bank lenders by the derogatory term “rent-a-bank schemes.” But it’s lawful to create such relationships because the FDIC oversees them, she asserts.

Just the same, the House is considering H.R. 4439, a bill to ensure that in a bank partnership with a non-bank, the bank remains the “true lender” and can set the interest rate, Brennan notes. If the bill becomes law, it would clear up the conflict that has arisen in inconsistent case law, some of which has defined the non-bank as the true lender, she says.

Meanwhile, opponents of H.R. 3299 and S. 1642 have written a letter to members of Congress, urging them to vote against the bills. The letter, drafted by the Center for Responsible Lending (CRL) and the National Consumer Law Center (NCLC), was signed by 152 local, state, regional and national organizations. Most of the signers belong to a coalition called Stop the Debt Trap, says Cheye-Ann Corona, CRL senior policy associate.

The bills create a loophole that enables predatory lenders to sidestep state interest rate caps, Corona maintains. That’s because non-banks are actually originating the loans when they work in tandem with banks, she says. The non-banks are using banks as a shield against state laws because banks are regulated by the federal government. If the legislation passes, non-banks would not have to observe state caps and could charge triple-digit interest rates, she contends.

“This bill is trying to address the issue of fintech companies, but there is nothing innovative about usury,” Corona says. “They are just repackaging products that we’ve seen before. A loan is a loan. These lenders don’t need this bill if they are obeying state interest-rate caps.”

The lenders disagree. In fact, a trade group formed by OnDeck, Kabbage and Breakout Capital calls itself the Innovative Lending Platform Association, according to a report in the Los Angeles Times. The article cites the need for small-business capital but questions whether the loans are marketed fairly.

Innovative or not, lenders offering credit with higher interest rates could condemn consumers to a nightmare of debt, according to the letter from the CRL and NCLC to Capitol Hill. “Unaffordable loans have devastating consequences for borrowers – trapping them in a cycle of unaffordable payments and leading to harms such as greater delinquency on other bills,” the letter says.

However, alt funders say their savvy small-business customers understand finance and thus don’t need much government protection from high interest rates. But the CRL doesn’t adhere to that philosophy, Corona counters. “Small businesses are at risk with predatory lending practices,” she says, maintaining that some alt funders charge interest rates of 99 percent.

Small-business owners plunged themselves into hot water by borrowing too much in anecdotal examples provided by Matthew Kravitz, CRL communications manager. In one example, an entrepreneur found himself automatically paying back $331 every day. He overestimated his future income and now says he feels like hiding under the covers every morning.

Corona also dismisses the idea that high risk calls for high interest rates to compensate for high default rates. When interest rates rise to a level that borrowers can’t handle, no one wins, she maintains.

The right to charge higher interest rates could also encourage lenders to loosen their underwriting criteria, Corona warns. That could result in shortcuts reminiscent to the practices that gave rise to the foreclosure crisis and the Great Recession, she says, adding that, “we don’t want to see that happen again.”

Banks, Alt Funders Continue to Compete for Small Business

February 13, 2018

The alternative small-business finance industry owes its very existence to banks’ reluctance to lend money to mom-and-pop shopkeepers, tradespeople and restauranteurs, but bankers’ tight fists may be loosening. Small-business owners are reporting better results when they apply for bank loans.

In fact, small entrepreneurs succeeded in landing bank loans 37 percent of the time in the fourth quarter of 2017, up from 29 percent a year earlier, according to the 1,341 merchants surveyed for the most recent quarterly Private Capital Access Index report provided by Dun & Bradstreet and Pepperdine University’s Graziadio School of Business and Management.

“That’s a big change. It’s outside the margin of error and outside normal statistical variation,” Craig R. Everett, assistant professor of finance at Pepperdine and director of the Graziadio and Dun & Bradstreet Private Capital Markets Project, tells deBanked. He’s comparing the shift to patterns established in the nearly six years the quarterly index has pegged small-business trends.

But the effects of bankers’ increased willingness to lend to small businesses may prove a bit muted in the alternative funding industry. That’s partly because Pepperdine and Dun & Bradstreet define small businesses as having up to $5 million in annual revenue. Alt funders often deal with much smaller enterprises that could still fail to capture the attention of bank loan officers, says Noah Grayson, managing director of South End Capital in Encino, Calif. “If you’re making $5 million in gross revenue, that’s a pretty robust business,” he says of his clients.

But the effects of bankers’ increased willingness to lend to small businesses may prove a bit muted in the alternative funding industry. That’s partly because Pepperdine and Dun & Bradstreet define small businesses as having up to $5 million in annual revenue. Alt funders often deal with much smaller enterprises that could still fail to capture the attention of bank loan officers, says Noah Grayson, managing director of South End Capital in Encino, Calif. “If you’re making $5 million in gross revenue, that’s a pretty robust business,” he says of his clients.

Then there are the borrowers whose companies seem small in that they employ just a few people but might rake in $5 million on a single contract – like contractors who specialize in heavy construction equipment or have a presence in the aviation business – but aren’t profitable enough to qualify for bank loans, says Gene Ayzenberg, CEO of PledgeCap, a company with offices on Long Island and in Manhattan that specializes in business and personal loans secured by collateral.

Besides, lots of alternative lenders don’t regard gross revenue as the measure of a business. “I would look at what kind of resources and infrastructure the business has to define what is small and medium-sized,” says David Obstfeld, CEO of New York-based SOS Capital. Many alt lenders cite the importance of net over gross.

The size of prospective borrowers aside, banks are probably lending to small merchants more often these days because small businesses are becoming more profitable in today’s relatively healthy business climate and thus stand a better chance of qualifying for credit, Everett says. The recent reduction in corporate taxes will also improve profits and make small businesses more credit-worthy, he says.

The change in bank lending volume seems tied to those financial gains and doesn’t appear to be linked to any shift in policy among bankers, Everett notes. But new policies at the Small Business Administration could prompt the banking community to view small-business loans more favorably, according to Grayson. The SBA is increasing the percentage it guarantees for some loans and reducing the amount required for a down payment on some loans, he notes. That could make life more difficult for some alternative lenders because most of the small-business loans made by major banks, like Wells Fargo and Chase, are SBA loans, he says. The SBA did not provide details regarding the changes by press time.

Regardless of what’s making banks loosen their grip on the purse strings, merchants are feeling more optimistic – or at least less gloomy – about obtaining bank loans in the near term, the study by Pepperdine and Dunn & Bradstreet indicates. In the fourth quarter of last year, 55 percent of small-business owners predicted difficulty in raising financing in the next six months, down from 61 percent a year earlier, the survey shows.

Regardless of what’s making banks loosen their grip on the purse strings, merchants are feeling more optimistic – or at least less gloomy – about obtaining bank loans in the near term, the study by Pepperdine and Dunn & Bradstreet indicates. In the fourth quarter of last year, 55 percent of small-business owners predicted difficulty in raising financing in the next six months, down from 61 percent a year earlier, the survey shows.

“That’s an improvement, but I still think it’s an alarmingly high number,” Ayzenberg says of those findings. “Before they even start worrying about how their operations are going and how good their product is, one in two businesses is already worrying that their bank is not going to be able to fulfill their needs. They shouldn’t have to have those fears.”

So, banks are becoming a bit more likely to loan to small businesses but still aren’t throwing open the flood gates to create a flood of funding. That’s true of banks that qualify as large and those classified as small.

American banks tend to be either small community institutions or huge national concerns that are swallowing up the remaining mid-sized regional banks, observers agree. Between 80 and 90 banks control assets of $10 billion or more and thus qualify as large, while thousands of small banks have more limited resources, says David O’Connell, an Aite Group senior analyst.

Large and small banks exhibit about the same degree of ambivalence toward small-business loans. Banks can mitigate the downside of the loans because they have funds to hire staffs and buy technology to analyze risk, O’Connell says. Executives at small banks can avoid potential problems with small-business loans because they’re often dealing with prospective borrowers who were their high school or college classmates, he notes.

Whether banks are large or small, they have their reasons to deny loans to small businesses. Perhaps foremost among the rationales for denying loans to small businesses is the cost of underwriting, says O’Connell. Banks simply can’t make enough money on the loans to pay the cost of processing them, he says, adding that, “It’s a long-standing problem.” For example, a bank can make a profit by loaning $2 million at prime plus 2 percent, but can’t cover the underwriting costs of an $80,000 loan that also earns prime plus 2 percent. The underwriting costs would be the same in both cases, he notes.

Banks became even more ambivalent about loaning to small businesses after the Great Recession struck in 2008, O-Connell continues. They didn’t want to repeat the mistakes of the freewheeling period that preceded the economic catastrophe. About the same time, private equity and hedge funds began madding more capital available to alternative lenders, he says. Meanwhile, technology and alternative data sets helped the alternative industry understand risk and reduce underwriting costs, he maintains.

Banks also find it more expensive to loan to small businesses these days because the Dodd-Frank Act has increased compliance costs, Everett points out. “Red tape and reserve requirements for the banks have all increased under Dodd-Frank, so making loans to small businesses is less cost-effective than it was before.” Banks now need upwards of $1 billion in assets under management to remain viable, and they feel compelled to expand their staffs to follow all the new rules for lending, he says.

What’s more, bankers still exercise extreme caution when it comes to extending credit to small businesses because stores or restaurants often fail and then the business or the owner defaults on the loan, Everett says. That’s why banks often require business-loan applicants to demonstrate two years of profitability to qualify for credit, he notes. Higher interest that can mitigate that risk, but state usury laws often capping rates at 36 percent or less, Everett notes. New York, for example, limits banks to 16 percent, he says.

State usury laws don’t apply to factoring or merchant cash advances, and that enables alternative funders to charge more for the use of funds, Everett says. “If it’s not called a loan and what the customer is paying is not called interest, then it’s not subject to state usury laws,” he says.

Obstfeld puts it this way: “In would be great to be in a business where nobody defaults. The rates we charge at SOS Capital are necessary to cover our losses and be profitable at the same time.”

The high cost of obtaining funds in the alternative market could eventually prompt the federal government to intervene with regulation but that probably won’t happen anytime soon, Everett predicts. O’Connell agrees, noting that in the current political climate the government has little appetite for new restrictions on a major source of capital for thousands of small businesses.

Because alternative funders have greater flexibility than banks in how much they can charge for access to credit, banks have sometimes formed referral relationships with alt funders to hand off small-business borrowers. “That looks good on paper and makes great headlines, but it’s harder to do in real life,” O’Connell maintains, because the bank loses control of the customer experience. If the alt funder doesn’t manage customers’ expectations effectively, the bank might have to take the blame – at least in some consumers’ minds, he contends. He’s surveyed bankers and found them feeling “really mixed” about such partnerships.

The impact of such partnerships hasn’t been as great as some anticipated. “We were quite nervous when we heard that JPMorgan would be using OnDeck’s platform,” recalls Obstfeld. “However, it’s been quite some time that they’ve been doing that and it hasn’t seemed to make a dent – at all – in alternative lending.”

The impact of such partnerships hasn’t been as great as some anticipated. “We were quite nervous when we heard that JPMorgan would be using OnDeck’s platform,” recalls Obstfeld. “However, it’s been quite some time that they’ve been doing that and it hasn’t seemed to make a dent – at all – in alternative lending.”

But alternative funders can provide borrowers with advantages that banks can’t match. Some alternative lenders can approve a client’s application in a few hours and wire funds to the recipient the same day, Grayson says. Steve Hauptman, chief operating officer at SOS Capital, notes that banks can require weeks or even months to respond to an application.

That’s why SOS Capital customers sometimes obtains funding from the company as a bridge to keep operating while they’re waiting for an SBA bank loan or to take advantage of an opportunity that requires a quick response, Obstfeld says.

That’s why SOS Capital customers sometimes obtains funding from the company as a bridge to keep operating while they’re waiting for an SBA bank loan or to take advantage of an opportunity that requires a quick response, Obstfeld says.

The advantages of the alternative funding industry don’t end there. SBA bank loans require more paperwork than is needed for a merchant cash advance, which can slow the process even further as the client assembles the documentation, Obstfeld notes.

In addition, banks can simply seem slow to respond to the needs of the market. “Banks are banks – they’re never going to be able to do the things we can do,” says Obstfeld. “If one product becomes an issue, we can pivot and create new product tomorrow. It takes banks years to get approval for something new.”

Then there are cards. Besides an increase in banks’ willingness to lend to small businesses, merchants are finding it easier to obtain business credit cards, the index provided by Pepperdine and Dun & Bradstreet finds. In the fourth quarter of last year, 65 percent of survey respondents applied successfully for cards, compared with 51 percent in the corresponding period a year earlier.

Easier access to credit cards might not make merchants less likely to apply for loans, Everett says. “Usually, credit cards are a backup plan,” he notes. “They’re the poor man’s line of credit. It’s a very high interest rate.” Most businesses would prefer to open a line of credit from a bank with a lower interest rate. Many cardholders use cards only for travel expenses or to ease short-term cash-flow issues, he says.

Easier access to credit cards might not make merchants less likely to apply for loans, Everett says. “Usually, credit cards are a backup plan,” he notes. “They’re the poor man’s line of credit. It’s a very high interest rate.” Most businesses would prefer to open a line of credit from a bank with a lower interest rate. Many cardholders use cards only for travel expenses or to ease short-term cash-flow issues, he says.

Finding the right credit card poses a challenge, even for those who are adept at online searches, says Grayson of South End Capital. In addition, many business credit cards carry a low spending limit. A business might qualify for a $5,000 credit limit on the card but could receive a $50,000 loan, he adds. “A card generally doesn’t fill their needs,” he declares.

Others have a slightly different view of business cards. “Once you get approved, it’s easy money,” Obstfeld says of business credit cards. However, cards can’t finance some of the actions that cash from merchant cash advances can cover, such as buying out a partner or opening a second location, he notes.

Moreover, the fact that competitors exist – whether they’re banks, card issuers or other alternative lenders – doesn’t necessarily threaten existing alt funders, according to Hauptman. Remember that banks and alternative lenders aren’t offering the same products, he says. Those products, such as bank loans, factoring and merchant cash advances, each have advantages and disadvantages, which prompt merchants to pursue the vehicles that are right for them, he says.

Having banks and nonbanks in the mix can even prove complementary, too. Pumping more funds into the small-business economy from any source can result in a healthier environment that offers more opportunities for all, Ayzenberg says.

The real danger resides not so much from direct competition but rather from failing to keep pace with the alternative lending industry’s introduction of new products, falling behind in the quest to speed up the decision-making process granting funding or neglecting to obtain technology that eases the application process, Grayson says.

In one recent development, some alternative lenders aren’t reviewing credit histories, he notes. Instead they look just at deposits and can extend credit based just on that, Grayson notes. That’s somewhat like a merchant cash advance, but it’s offered at single-digit rates and on favorable terms, he says. “A lot of lenders are making it very simple for borrowers to get money now,” he continues, concluding that alt funding firms that can’t afford to make such improvements probably can’t remain in business.

Though some players will inevitably disappear, the alternative small-business funding industry in general seems likely to survive so long as banks remain reticent about lending to small businesses – the situation that gave rise to the alternative industry in the first place.

Goodbye Liens and Judgments

October 28, 2017 Justice can require sacrifice. Take the example of a decision by the three major credit bureaus – Equifax, Experian and TransUnion – to stop including some liens and most judgments in their credit reports.

Justice can require sacrifice. Take the example of a decision by the three major credit bureaus – Equifax, Experian and TransUnion – to stop including some liens and most judgments in their credit reports.

The change makes life a little less unfair for consumers who fell victim to reporting errors. Many invested precious time and large amounts of money trying unsuccessfully to correct their credit histories and restore their reputations.

But for the alternative small-business finance industry, omitting data on liens and judgments increases costs, creates extra work and can even give rise to an unsettled feeling in the pit of the stomach. “You’re not looking at a full credit report anymore, which is kind of scary,” one alt funder admits.

Yellowstone Capital CEO Isaac Stern provides an example to illustrate what’s at issue. “Imagine I’m the Ford Motor Co. and I want to do a lease with you,” he says. “But I don’t have the information that you happen to have judgments from Chrysler, Chevy and BMW, so I approve your lease. Imagine that! Without full information, how do you make accurate decisions?”

Operating without the data could prove dangerous, agrees David Goldin, who sold his U.S. Capify operations to Strategic Funding Source in January but still runs Capify UK and Capify Australia and remains open to U.S. opportunities. “The IRS could come in and seize credit card processing accounts and prevent the lender from getting paid,” he says. “Once you have a judgment a creditor could come in and freeze bank accounts.”

Fears aside, the change in reporting probably won’t dry up alternative small-business credit – even in the short run, Goldin predicts. Alt funders will adjust quickly, he says, noting that they can compare the old and new credit scores of long-time customers to spot patterns and apply those patterns to their calculations. The industry can also tap alternative sources of information.

Even with those reassurances, the transition would have been easier if the industry had more advance notice, alt funders say. “We found out July 31 when a Reuters rep emailed us and said this is going into effect tomorrow,” recalls Stern. “That was really weird – I’ve got to tell you.” Experian didn’t provide a heads-up even though Yellowstone is one of its largest New Jersey customers, he notes. “We were a little bit annoyed, but what are going to do?” Meanwhile, Goldin says he didn’t begin researching the situation until deBanked asked him about it. “I don’t think anyone really knew about it” much in advance, he says.

But the industry is finding out and taking action. Yellowstone, for example, is performing a performing a workaround by integrating the judgments and liens section of the Clear investigative platform into the information underwriters see when they open a file, Stern says. The integration required a couple of weeks of hard work by the Yellowstone tech team, he notes.

Clear, which is provided by Thomson Reuters, amasses public records that can date back 20 years and can fill more than a hundred pages, he says, adding that you have to know where to look for the relevant information. “You have to dig through it,” he says.

Clear, which is provided by Thomson Reuters, amasses public records that can date back 20 years and can fill more than a hundred pages, he says, adding that you have to know where to look for the relevant information. “You have to dig through it,” he says.

In the past, Yellowstone performed a Clear report on most files just before funding them, Stern explains. Now, the Clear report is scrutinized more extensively and earlier in the process – before the file is approved. As a result, Yellowstone underwriters will have all the information they need, but it will take them a little longer to get it, he says.

Yellowstone incurred the expense of obtaining additional user licenses from Clear, which cost it $800 to $900 monthly Stern says. Experian now charges the same price for less information, he notes.

Accommodating the changes didn’t require more underwriters but it became necessary to hire four additional data entry clerks to input information until the integration with Clear was completed, Stern says. Now that Clear and the Yellowstone systems are working together, the four extra clerical workers will shift their attention to inputting data from the increasing number of applications coming into the company, he says.

Most Alt funders won’t need to employ more people in their underwriting departments because changes to their models will be automated, Goldin says. “I don’t think this is as much of a game changer as people think it is,” he says of the credit bureaus’ new approach to reporting.” It’s just one extra step. It’s more of a nuisance issue than a manpower issue.”

However, a challenge arises for underwriters because leaving out the liens and judgments will result in higher credit scores for some loan or advance applicants, Goldin says. That means some alt lenders may need to go to the trouble and expense of tweaking their risk models to compensate for the change in the scores reported by the credit bureaus, he maintains.

The impact may be greatest among alt funders who rely on quick online decision-making, Goldin says. Adding extra steps to the process increases the difficulty of maintaining the speed that provides a selling point and a source of pride for those companies.

While Clear is helping to fill the gap at Yellowstone, it’s not the only company providing much-needed data. LexisNexis Risk Solutions isn’t a credit bureau and will thus continue to disseminate information it gathers from courtrooms on lien and judgments, Goldin notes. Alt lenders who weren’t already using the vendor’s service or were using it only when an application reached a predetermined threshold will face added expense because of the credit bureaus’ decision, he says.

While Clear is helping to fill the gap at Yellowstone, it’s not the only company providing much-needed data. LexisNexis Risk Solutions isn’t a credit bureau and will thus continue to disseminate information it gathers from courtrooms on lien and judgments, Goldin notes. Alt lenders who weren’t already using the vendor’s service or were using it only when an application reached a predetermined threshold will face added expense because of the credit bureaus’ decision, he says.

Indeed, LexisNexis Risk Solutions views the credit bureaus’ hiatus on some liens and judgments reporting as a business opportunity to increase its sales by supplying the missing data, according to Ankush Tewari, senior director of marketing planning in the company’s business services section. The company was already selling data on liens and judgments and anticipates selling much more of it, he observes.

For 15 years LexisNexis Risk Solutions has been selling RiskView Solutions, a product that contains liens, judgments and other information not generally found on credit reports, such as the assessed value of a consumer’s home or a list of a consumer’s professional licenses. It offers no data on loan repayment but its other information helps define a consumer’s creditworthiness and character, Tewari says. Lenders can combine that peripheral information with credit scores for a more complete customer profile that outperforms the credit score alone, he suggests.

For 15 years LexisNexis Risk Solutions has been selling RiskView Solutions, a product that contains liens, judgments and other information not generally found on credit reports, such as the assessed value of a consumer’s home or a list of a consumer’s professional licenses. It offers no data on loan repayment but its other information helps define a consumer’s creditworthiness and character, Tewari says. Lenders can combine that peripheral information with credit scores for a more complete customer profile that outperforms the credit score alone, he suggests.

And there’s more. LexisNexis Risk Solutions has reacted to the credit bureaus’ decision by creating RiskView Liens & Judgments Report, which lists only those two types of records. “The credit bureaus announced these changes a year ago, and we knew there would continue to have a need for that data,” Tewari says. The company prices the RiskView information based upon the transaction volume, he notes, so a lender pays less per transaction as volume increases.

With this emphasis on liens and judgments, one might well wonder who tracks down the information. Companies like LexisNexis Risk Solutions gather and disseminate public records on liens and judgments from courthouses throughout the United States, says Tewari. Over the years the company acquired some of its competitors and eventually was spun off from its sister company, LexisNexis, which built its name partly as an aid for lawyers researching cases, he notes.

For decades, LexisNexis Risk Solutions has been providing the credit bureaus with raw data not only on liens and judgments but also on bankruptcies, Tewari says. The bureaus have then parsed those files electronically and appended the data to credit reports, he continues.

Problems arose because the credit bureaus’ tech systems could not always link the court documents to the right person when the courts provided only a name and address, Tewari maintains. Courts often limit information in their records to those two identifiers because they’re reluctant to divulge additional identification that criminals could intercept and use to commit fraud, he says.

Tewari traces the bureaus’ inaccuracies in matching court records to the right people to what he calls the bureaus’ “DNA.” The bureaus are accustomed to receiving “clean” information from lenders on a regularly scheduled basis. Conversely, some of the LexisNexis Risk Solutions data, gathered from obscure places like county deed offices, may arrive in a form that’s far from clean, he notes.

However, that lack of court information or inconsistencies in the presentation of that information doesn’t pose problems for LexisNexis Risk Solutions because the company cleans the data before analyzing it. Tests indicate its linking methodology works accurately with just a name and address more than 99.9 percent of the time, Tewari contends. Thus, the company can establish that John Smith at 1234 Maple Street is the same person as John A. Smith at 1234 Maple Street, he says. He considers that linking technology the core of the company’s operations.

However, that lack of court information or inconsistencies in the presentation of that information doesn’t pose problems for LexisNexis Risk Solutions because the company cleans the data before analyzing it. Tests indicate its linking methodology works accurately with just a name and address more than 99.9 percent of the time, Tewari contends. Thus, the company can establish that John Smith at 1234 Maple Street is the same person as John A. Smith at 1234 Maple Street, he says. He considers that linking technology the core of the company’s operations.

The information LexisNexis Risk Solutions can supply becomes vital to lenders because studies indicate that people who have a lien or judgment on file are twice as likely as people without them to default on a consumer loan and five times as likely to default on a mortgage, Tewari says. “The data didn’t become less important because the credit bureaus decided not to include it anymore,” he maintains. “It’s still just as predictive as it was.”

Meanwhile, other types of information can also help lenders make decisions, notes Eric Lindeen, vice president of marketing for ID Analytics, a credit risk and fraud risk management company that offers a credit score called Credit Optics, which it bases on a combination of traditional and alternative credit data.

Alternative credit data is defined as anything the credit bureaus don’t include in their reports, Lindeen says. Examples include the bills consumers pay for cell phones, utilities and cable television, he notes, adding that rent is also sometimes considered alternative credit data. The category also encompasses records from marketplace lenders.

A consumer’s tendency to pay those bills on time, late or not at all can reflect on creditworthiness, Lindeen maintains. That history becomes relevant for alt funders because the small businesses they serve constitute a hybrid of consumer and commercial credit, he says.

Using that data, ID Analytics can spot people who are good credit risks when the credit bureaus still consign them to “thin file” status — the limbo where applicants don’t have enough credit history to evaluate their creditworthiness, Lindeen maintains. About 60 percent of near-prime applicants qualify for credit when lenders factor in alternative data, according to an ID Analytics study he says. At the same time, alternative data can also expose weaknesses among individuals with excellent traditional credit scores, he observes.

Combining alternative data with traditional data has become more important with the bureaus’ decision to stop supplying data on liens and judgments, Lindeen says. Leaving out that data will raise some credit scores, and the effect will be strongest among near-prime individuals with good but not great traditional scores, he notes. With those consumers, a 10-point shift could make a big difference in qualifying for credit, he says.

“Even though it’s a small population, it’s a critical population,” Lindeen says of those newly minted prime applicants. They may number only one in a hundred of a particular funder’s portfolio, but they may advance to another risk pool and consequently invalidate a risk model, he suggests. Over time, risk managers will adapt to the change and oversee a “risk migration,” he predicts.

Overall, between 6 percent and 9 percent of consumers will see their credit scores rise because of the bureaus’ new policy, Lindeen estimates. The change usually won’t exceed 20 points, he says. Still, about 700,000 will see an improvement of 40 points or more, he continues. “That’s a significant increase for a nontrivial population,” he says. “It’s likely their performance will stay the same as their score goes up.”

Overall, between 6 percent and 9 percent of consumers will see their credit scores rise because of the bureaus’ new policy, Lindeen estimates. The change usually won’t exceed 20 points, he says. Still, about 700,000 will see an improvement of 40 points or more, he continues. “That’s a significant increase for a nontrivial population,” he says. “It’s likely their performance will stay the same as their score goes up.”

A study by VantageScore Solutions, the company that provides the VantageScore credit scoring model to the credit reporting bureaus, projected scores would increase an average of 10 points for slightly more than 8 percent of the scorable U.S. population.

Those changes are characterized as “minimal” by Francis Creighton, President & CEO of the Consumer Data Industry Association, a trade group that represents the three major credit bureaus as well as about a hundred other companies – mostly smaller credit bureaus around the country, resellers of credit bureau information and background screening companies.

The credit bureaus decided to curtail reporting of judgments and liens as part of the National Consumer Assistance Plan, or NCAP, Creighton says. NCAP is an agreement reached in March 2015 among the three major credit bureaus and the attorneys general of 31 states, who were pressing for fairness in credit reports. Many observers call NCAP a “settlement” but the agreement did not result from a lawsuit, he notes.

Under NCAP, the bureaus will continue to include bankruptcies in their reports because the records meet the standard of providing a name, address, Social Security number and date of birth and because visits to the courthouse to update records occur at least every 90 days. About half of liens don’t meet those standards and will be removed from credit reports, and nearly all judgments fail to adhere to the standard and will no longer appear on the reports.

Although Creighton declines to say how many consumers were victims of credit reporting errors, he emphasizes the severity of the problem for each victim. “If you were one of the people who had a name similar to somebody else or a similar Social Security number, it would impact you a lot,” he maintains. “I don’t know how widespread it was, but it was disruptive enough for individual people that it’s better just not to have it.”

A Federal Trade Commission study released in 2013 reported that a sample of 1,000 credit reports indicated that 25 percent had at least one error that could reduce scores, according to published reports. Such findings prompted state attorneys general to seek remedies that resulted in NCAP.

The bureaus planned to implement another major portion of NCAP in September when they were to begin waiting 180 days before reporting medical debts, Creighton notes. At the same time, debts for medical expenses covered by insurance policies were to be omitted from credit reports, he says.

Changes brought by NCAP represent part of ongoing efforts to improve the system, according to Creighton. “We want accurate information in the reports,” he says. “That’s good for everybody.”

LendingPoint: CAN Capital’s Close Neighbor in Kennesaw

August 14, 2017 LendingPoint, a consumer lender staffed largely by former CAN Capital employees, may have something to teach the alternative small-business finance industry about creditworthiness. Three-year-old LendingPoint claims to go beyond FICO scores to bring each applicant’s sense of fiscal responsibility into sharper focus.

LendingPoint, a consumer lender staffed largely by former CAN Capital employees, may have something to teach the alternative small-business finance industry about creditworthiness. Three-year-old LendingPoint claims to go beyond FICO scores to bring each applicant’s sense of fiscal responsibility into sharper focus.

But first, let’s examine the CAN Capital connection. Four or five members of LendingPoint’s top management team came to the company after lengthy tenures at CAN Capital, a LendingPoint official says. That includes Tom Burnside, LendingPoint’s CEO and founder, and Franck Fatras, the company’s president and chief operating officer. Both worked 13 years for CAN Capital, with Burnside leaving as chief operating officer and Fatras departing as chief technology officer, according to biographies posted online.

All told, about 30 of LendingPoint’s 100 or so employees – a total that includes outsourced positions – formerly labored at CAN Capital, according to Fatras. Many put in considerable time at CAN Capital, holding jobs there in management, corporate governance, legal affairs, risk, sales, operations, IT, marketing, analytics, design, customer service, partner success and success delivery, online reports say.

Geography no doubt encourages CAN Capital employees to consider LendingPoint when it’s time to move on to another job. Both companies maintain headquarters in office parks in the Atlanta suburb of Kennesaw. In fact, the two companies operate half a mile apart, both of them just off of Cobb Place Boulevard Northwest, according to Google Maps and Directions.

Great news! Our new logo has OFFICIALLY made it's mark on our new building. What do you think?#Finance #LendingPoint #Logo pic.twitter.com/cpUIQvLy2w

— LPLoans (@LPLoans) March 13, 2017

The way Fatras tells it, LendingPoint hasn’t raided CAN Capital’s workforce. “We post the job, and they end up responding,” he says. “When they’re known quantities and people we have a lot of respect for, we just end up making it work.”

Moreover, LendingPoint’s connections with other companies don’t begin or end with CAN Capital. Some of the people in top management met when they worked at First Data Corp. and Western Union, Fatras recalls. Juan E. Tavares, co-founder and chief strategy officer, and Victor J. Pacheco, chief product officer, came from those relationships, he says.

Regardless of where they became acquainted, Lendingpoint’s leadership team has come together to form a direct balance-sheet consumer lender specializing in what they call a “near prime” clientele. The company defines the phrase “near prime” to include personal-loan applicants with FICO scores from 600 to 700, Fatras says, adding that the segment’s not sub-prime and not prime. The company has even trademarked “NEARPRIME” as a single word in capital letters, and it appears that way on the company website. It regards those consumers as “deserving yet underserved,” Fatras notes.

To qualify those applicants for credit, LendingPoint considers “behavior,” such as work history, education, and timeliness with paying rent, utility bills and cell phone bills, Fatras says. “A lot of what we do is identify patterns,” he says. “It’s all about asking the right questions.” The process requires tapping into multiple sources to collect the data, he observes.

In a blog published online soon after LendingPoint was launched, executives Burnside and Tavares claim that most credit models search for ways to say no to applicants, while their company uses big data to find ways of saying yes. LendingPoint algorithms predict risk with great precision, they say.

In a blog published online soon after LendingPoint was launched, executives Burnside and Tavares claim that most credit models search for ways to say no to applicants, while their company uses big data to find ways of saying yes. LendingPoint algorithms predict risk with great precision, they say.

In a newspaper opinion piece that ran about the same time, Burnside and Tavares maintain that their model examines cycles in an applicant’s life to pinpoint upward and downward trends. A consumer on the way up deserves a loan, according to the theory.

The company’s willingness to study information that resides outside credit scores did not originate with the CAN Capital connection, Fatras says. “The model is unique and the data structure we are using is unique,” he says. “It’s all about understanding the credit story of the person.”

Latin American lending practices had some influence on LendingPoint, Burnside and Tavares write in one of their editorial pieces. Lenders there review factors other than credit scores because the scores aren’t readily available in some countries, they write.

To analyze that type of non-FICO information, LendingPoint has developed its own internal scoring model and then automated the process, spending a lot of time to develop the technology, Fatras continues. Once again, asking the right questions determines the meaning that the company can extract from the data, he emphasizes. Otherwise, the information’s just not that beneficial, he says.

When consumers come to the LendingPoint website and answer five or six questions, they can receive a firm offer of credit in an average of seven seconds and sometimes as quickly as four seconds, Fatras maintains. The offers are contingent upon the company underwriting department’s validation of income and other figures, ne notes, adding that “we’re pretty happy with the infrastructure we’ve built.”

LendingPoint collects on the loans with automatic payments from customers’ savings or checking accounts twice a month, according to the company website. Deducting the payments twice a month helps customers with budgeting, the site says. Consumers can borrow up to $20,000 and pay it back in 24 to 48 months.

The system was devised by top management with combined experience of more than a century in credit and risk, Fatras says. When those executives with so much commercial lending experience gather around the conference table to talk about the business, the possibility of lending to small businesses occasionally comes up in the conversation.

But Fatras doubts the company will make that move to the commercial side anytime soon because companies in the alternative small-business finance industry are competing for 5 million to 6 million potential customers while the country has 50 million near-prime consumers. “The space is so big where we are,” he says. “The demand could be over a billion dollars a month. We have a lot of room in front of us for growth.”

With that seemingly infinite market, LendingPoint has been growing at a healthy pace, Fatras says. The company, which was self-funded for the first year, made its initial loan in January 2015. In 2016, it did $150 million in business, he notes. By the middle of this year, the company had made a total of $250 million in loans to 25,000 consumers, he says.

It’s a business model that members of the alternative small-business finance community might do well to emulate, Fatras suggests. “There could be a lot of cross-pollination,” between consumer and commercial loans when it comes to going beyond FICO, he says.

LendingPoint executives that were formerly at CAN Capital

Tom Burnside, CEO

formerly a COO and president at CAN

Franck Fatras, President and COO

formerly a CTO at CAN

Mark Lorimer, Chief Marketing Officer

formerly a CMO at CAN

Dave Switzer, Chief Analytics Officer

formerly a VP at CAN

Joe Valeo, EVP of Strategic Development

formerly an EVP at CAN

Humans vs. Bank Statements – An Underwriting Journey

June 8, 2017 Automation hasn’t replaced humans yet when it comes to reading bank statements in the alternative small-business finance industry. ISOs, brokers, funders and underwriters still fend off drowsiness and ignore the risk of eye strain as they pore over months of paper or electronic documents.

Automation hasn’t replaced humans yet when it comes to reading bank statements in the alternative small-business finance industry. ISOs, brokers, funders and underwriters still fend off drowsiness and ignore the risk of eye strain as they pore over months of paper or electronic documents.

Many consider the drudgery a necessary part of the business. A merchant’s bank statements can reveal negative balances and commitments to previous loans or previous cash advances – any of which can indicate a bad risk, observers say. Moreover, detecting altered statements can expose fraudulent attempts to obtain credit, they add.

So why not dispense with the tedium and possible tampering of reading paper statements and pdfs? Instead, interested parties could simply obtain the login credentials for a credit or advance applicant’s bank accounts and explore their banking records firsthand. But a mixture of fear, fraud and expense often prevents that direct and relatively simple approach, multiple sources contend.

“Merchants simply don’t want to give up their username and password to enable someone to log into their bank account,” says Sam Bobley, CEO of Ocrolus, a company that specializes in automating the reading of paper statements and statements that have been converted to PDFs. Fear of somehow falling victim to an electronic robbery may be at the root of that reluctance, many in the industry agree.

Whatever the source of the hesitancy to share login information, the wariness usually seems more pronounced at the beginning of the underwriting process than toward the end, notes Arun Narayan, senior vice president of risk and analytics at Strategic Funding Source Inc., a New York City-based direct funder. “I don’t think that’s a problem after the commitment to fund,” he says, “but it is a problem before the commitment to fund.” Funders can try to leverage their market power to urge brokers to obtain a username and password from a merchant, Narayan suggests. But he admits that approach works only some of the time.

Whatever the source of the hesitancy to share login information, the wariness usually seems more pronounced at the beginning of the underwriting process than toward the end, notes Arun Narayan, senior vice president of risk and analytics at Strategic Funding Source Inc., a New York City-based direct funder. “I don’t think that’s a problem after the commitment to fund,” he says, “but it is a problem before the commitment to fund.” Funders can try to leverage their market power to urge brokers to obtain a username and password from a merchant, Narayan suggests. But he admits that approach works only some of the time.

Merchants who have had a bad experience applying for loans or advances or are submitting their first application exhibit the most fear of surrendering login credentials, according to John Tucker, managing member at 1st Capital Loans, a broker with headquarters in Troy, Mich. “If they’ve been through the process before, they pretty much know what’s expected of them,” he says.

All too often, applicants balk at presenting their login information because they have something to hide, notes Cheryl Tibbs, owner of One Stop Commercial Capital, an Atlanta-based brokerage that handles deals for multiple ISOs. She says her detective work with bank statements uncovers an average of two fraudulent applications per week.

Attempts at fraud average more than five a day at Elevate Funding, a Gainesville, Fla.-based director funder, says CEO Heather Francis. Her company’s underwriters learn what to look for in bank statements that can indicate a merchant is trying to defraud a funder, she says.

First, an underwriter who’s manually checking bank statements knows that documents bearing the names of certain banks have a higher likelihood of being bogus, Francis says. Apparently, fraudsters find the statements from those banks easier to alter, or perhaps they have the templates for those banks and can plug in false information, sources speculate.

WHETHER PAPER OR PDF BANK STATEMENTS PROVIDE TO BE ON-THE-LEVEL OR NOT, READING THEM MANUALLY TAKES TIME

Besides, anyone hoping to bilk a funder can buy a customized “vanity statement” for $25 or $30 on craigslist, complete with whatever deposits, opening balances and closing balances they choose, Francis notes. That can tempt troubled merchants as well as outright criminals, observers agree.

And some of the more bizarre errors that appear in falsified statements can seem almost comical. Tibbs cites the example of a statement she saw that was supposedly for January but was populated with transactions dated in February. On altered statements the ending balance for one month might not match the beginning balance for the next month, several sources note.

Sometimes the fake numbers that wayward applicants choose to include in their fraudulent statements can send up red flags, Tibbs maintains. If a merchant is seeking $40,000 and presents account documents indicating $80,000 or $90,000 balances at the end of each month, something’s amiss “10 times out of 10,” she says.

Tibbs tells the story or a referral partner from a one-or two-person ISO calling her in a state of near-euphoria in the middle of the night, breathlessly describing a potential customer with monthly sales of $800,000 and a need for $500,000 in capital. Experience told her immediately that something wasn’t right. In the morning, she saw the statement’s ending balances of $300,000 to $400,000, which confirmed her suspicions.

Yet grafting such unlikely numbers to a forged bank statement isn’t as unsophisticated as some of the telltale signs that the industry sees when viewing bank statements manually, notes Francis. Some aspiring crooks doctor genuine statements with white-out correction fluid and then type in new numbers in a mismatched font, she says.

Anyone reading bank statements should also beware of applicants who “shotgun” applications to multiple ISOs, often on the same day, Tibbs warns. She often comes across that scam because numerous partners refer deals to her, she says.

Whether paper or pdf bank statements prove to be on-the-level or not, reading them manually takes time. An experienced underwriter who knows where to look for what he or she needs to find to verify a statement requires 15 to 20 minutes to approve one from a familiar financial institution, Francis says.

It seems that nearly every bank or credit union has its own way of designing statements, so the manual reading process slows down when an underwriter manually reads a document with an unfamiliar layout, Francis notes. Unfamiliar types of statements sometimes come from small, obscure credit unions or remote community banks, observers say.

Familiar or unfamiliar, statements represent a key part of the underwriting process, and some funders accept the time and expense of reading them manually as simply a cost of doing business, according to Francis. But that expense can become a significant portion of the cost of a credit evaluation, according to Narayan.

That’s why Narayan and his colleagues at Strategic Funding Source have been working with Ocrolus, a startup company that automates the reading of paper statements and pdf’s of statements. Ocrolus uses optical character recognition, or OCR, to automate the reading of those statements.

Simply stated, OCR enables a machine to make sense of the characters it perceives in an image, says Bobley, the Ocrolus executive quoted earlier. When the platform can’t make out certain data points, they’re snipped and verified by humans in crowdsourced mini CAPTCHA tests, which stands for Completely Automated Public Turing.

Simply stated, OCR enables a machine to make sense of the characters it perceives in an image, says Bobley, the Ocrolus executive quoted earlier. When the platform can’t make out certain data points, they’re snipped and verified by humans in crowdsourced mini CAPTCHA tests, which stands for Completely Automated Public Turing.

They’re those tests that ask computer users to type what they see to prove they’re not robots, Bobley notes. When two of three crowd workers agree on what an image says in the CAPTCHA test, the Ocrolus platform accepts their verdict as correct, he says.

Ocrolus envisions a large market for its new platform among the many funders still reading bank statements manually in the early stages of underwriting, Bobley says. However, in the later stages of underwriting many of those funders already use bank sync companies to verify statements.

Bank sync companies include DecisionLogic, MicroBilt, Yodlee, Plaid and Finicity. They connect directly with some financial institutions to verify statements. Funders often mention the expense when they talk about bank sync companies, and they also note that bank sync companies have not yet established connections with some lesser-known financial institutions.

But late in the funding process, Elevate Funding requires merchants to cooperate with the bank sync company it uses unless extenuating circumstance dictate otherwise, says Francis. The bank sync company can gain direct access to statements using encrypted login information that does not reveal the true username or password to Elevate Funding or the bank sync company, she maintains.

Some of Elevate Funding’s brokers maintain portals that merchants can use to provide their login credentials to get the bank sync process underway, Francis notes. The portal takes merchants to a page with Elevate Funding branding through a white-label program the bank sync company provides.

“IT HAS SAVED US FROM MERCHANTS THAT WOULD HAVE DEFAULTED…IT IS A NECESSARY TOOL – ONE THAT WE HAVE TO USE”

In about 85 percent of Elevate deals, the bank sync company is connected with the merchant’s financial institution and therefore theoretically capable of gaining access to the accounts in question, Francis notes.

Over the past 30 days the Elevate Funding bank sync results included 3 percent bank error and 17 percent merchant error, while 73 percent of the statements were verified, Francis says. Bank error occurs when the bank sync company is connected to the bank but still can’t obtain the account information. Merchant error sometimes happens when the potential client provides an incorrect user name or password, probably after forgetting the right one. Merchant error can also mean that the applicant was plotting fraud and abandoned the bank sync process upon realizing he or she was about to get caught.

The upshot? Some 73 percent of the bank statements submitted are verified, meaning that the information the merchants submitted matches the numbers at the bank, Francis reports. That also means that for whatever reason 7 percent don’t even start the process they’ve requested, she says.

Meanwhile, the bank sync connection also provides real time data that would indicate to the funder whether the merchant has had a decline in sales, an increase in negative activity or the recent addition of a credit provider, Francis says.

The service can pay off. In an average month, the bank sync service detects about 10 or 15 bad deals that Elevate Funding underwriters had accepted, Francis says. “It has saved us from merchants that would have defaulted,” she says. “It is a necessary tool – one that we have to use.”

But what about those cases where the bank sync company can’t connect with the financial institution and the merchant still won’t give up the login for the account? At 1st Capital Loans, Tucker can sometimes handle the situation by getting a bank activity sheet that lists transactions. If that type of sheet’s not available, he arranges a phone call to with a representative of the bank to verify that nothing’s amiss with the applicant’s bank account.

It’s another example of how – even with today’s rampant automation – the human touch sometimes remains indispensable in assuring that merchants deserve the loans or advances they seek.

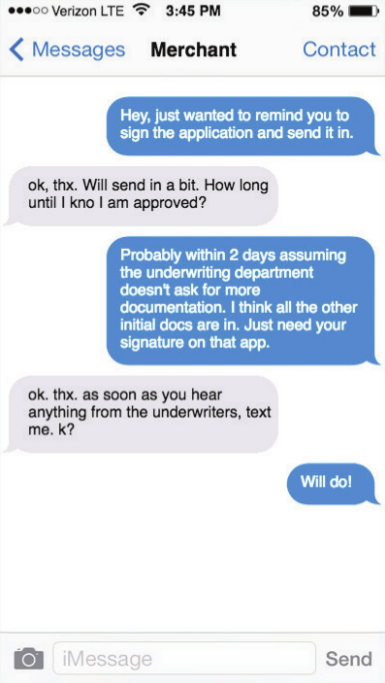

Text The Merchant, Close The Deal

April 15, 2017

About a year ago, Cheryl Tibbs, general manager of Douglasville, Ga.-based One Stop Funding, was having trouble getting in touch with one of her clients. The merchant in question runs a lawn care service and is usually out on the job, so he isn’t quick to return phone calls or respond to email messages.

“I just got the idea to send a text,” Tibbs recalls. She typed a message expressing her regret for intruding but letting her client know that he needed to take certain steps to advance the funding process for his loan application. He texted right back.

After that initial success, the texting continued between Tibbs and the lawn care provider. He’s been a customer for us for a while, and that’s just how we communicate,” she says. “It’s easy for him to stop and shoot me a text as opposed to having a full conversation with me.”

Tibbs isn’t alone in her appreciation for text messaging as a part of the sales process. Quick responses to texts are making the medium increasingly important in the alternative small-business funding business, maintains Gil Zapata, CEO of Miami-based Lendinero. “Text messaging is more powerful than emailing nowadays,” he declares.

One reason for that shift is that texts are easy to use, according to Tibbs. “It’s a matter of convenience for the merchant,” she contends. “In this business, any way you can make it easier for the merchant to facilitate the transaction with you is the method you have to use.”

Besides the convenience, there’s the sense of urgency people feel when they receive a text, asserts Jeb Blount, a sales trainer who’s written eight sales-oriented books, including the bestselling Fanatical Prospecting. “When you send a text message you move to the top of a person’s priority list,” he says. In fact, people who are talking face-to-face often disengage from the conversation to respond to a text message, he notes. “It’s treated as something that’s urgent.”

As texting becomes more commonplace in the alternative-finance business, some industry salespeople are beginning to view the medium in the same way they regard email, telephones and fax machines. “I use them as another tool for follow-up communications,” John Tucker, managing member of 1st Capital Loans in Troy, Mich., says of text messages. “In addition to sending them an email, I’ll shoot them a text.”

As texting becomes more commonplace in the alternative-finance business, some industry salespeople are beginning to view the medium in the same way they regard email, telephones and fax machines. “I use them as another tool for follow-up communications,” John Tucker, managing member of 1st Capital Loans in Troy, Mich., says of text messages. “In addition to sending them an email, I’ll shoot them a text.”

Texting has become almost standard procedure at Florida-based Financial Advantage Group LLC, according to Scott Williams, the firm’s managing member. He prefers that sales associates make the initial contact by phone to get a sense of what the merchant is looking for in a funding deal. After gathering information and getting approval, it’s best to send the offer by email so the merchant has “all the numbers in black and white” and more details than a text message can hold, he notes. After that, text messages can deliver requests for additional documentation and provide updates on the progress of the funding process. “We can tell them, ‘Hey, everything got cleared this morning – we should be able to do the funding this afternoon,’” he says.

Texting expedites communication regarding renewals, too, Williams observes. “If a merchant is 50 percent paid back, you can check in and see if they need some additional capital right now,” he says. “It’s really good for that.”

Clients can use messaging to convey images of documents needed in the funding process, Tibbs says. “I had a merchant yesterday who sent me over her IRS tax agreement through picture message,” Tibbs says by way of example. Often, funders request color images of both sides of an applicant’s driver’s license, she notes. To fulfill such requirements, it’s generally easier to snap a photo with a phone and send it as a picture message than to scan pages of paper into a computer to create an electronic document and then send the resulting file by email. “We do a lot with picture messaging,” she observes.

But as useful as text messaging can become for contacting phone-shy clients or helping clients share an image to document a key cancelled check, companies should exercise care when using the medium for prospecting, warns Zapata. He and just about everyone else deBanked consulted emphasizes that sending unsolicited text messages can violate Federal Trade Commission regulations. “Just because our industry isn’t regulated doesn’t mean there aren’t regulations out there on the side,” he says.

Most say they learned of the regulations from third-party vendors who specialize in sending batches of text messages simultaneously. The key to sending those groups of messages legally is to get permission from the recipients in advance, notes Ted Guggenheim, CEO of TextUs, a Boulder, Colo., company specializing in multiple-texting services. “If you’re (randomly) contacting people you got off a list somewhere, that’s a pretty bad idea,” he maintains.

Most say they learned of the regulations from third-party vendors who specialize in sending batches of text messages simultaneously. The key to sending those groups of messages legally is to get permission from the recipients in advance, notes Ted Guggenheim, CEO of TextUs, a Boulder, Colo., company specializing in multiple-texting services. “If you’re (randomly) contacting people you got off a list somewhere, that’s a pretty bad idea,” he maintains.

The feds heavily regulate five-digit short-code texts but tread lightly with long-code texts – the ones sent from 10-digit phone numbers, Guggenheim says. The latter would apply in alternative finance, and if a text recipient calls back on the phone number associated with a long-code text, someone will answer, he notes.

Citing guidelines from the Cellular Telecommunications Industry Association (CTIA), Guggenheim stipulates that consumers should have the ability to opt out of additional messages after receiving the first one. Members of the industry who want to send groups of text messages can post conditions on their websites that compel users to grant permission to contact them by text if they submit their contact information, he suggests.

After ensuring everything’s legal, Tucker reports 1st Capital Loans nets a good response when he uses a vendor to blast multiple identical text messages to lists of prospective clients who have already granted permission for his company to contact them by text message. The strategy has helped bring in a reasonable number of deals because the prospects were “already in the pipeline,” he notes.

Remember, though, that cell phone numbers change more often than land line numbers, Tucker cautions. That means a call to a number that’s been reassigned could inadvertently fall into the unsolicited text message category that violates federal rules, he says. “You could be texting a 14-year-old,” instead of a small business, he warns.

When mounting a mass text campaign, marketers are wise to avoid lengthy missives, according to Tibbs. “Keep it simple,” she says. A typical message from her might read: “Looking for funding? Looking for capital? Give us a call,” she notes.

In business texts, avoid acronyms like “LOL” and write in complete sentences with proper punctuation and capitalization, Blount suggests. “Begin by typing out the message somewhere other than in the text box, read it, make sure it makes sense and then send it,” he says. Put your name with the word “from” at the top of the message so the recipient knows who sent it, he emphasizes.

Keep messages conceptual rather than marketing-oriented, Guggenheim advises. Messages should directly address the customer’s situation to avoid seeming they were sent by a robot, he says. As with any response a salesperson receives, getting back to customers quickly pays off in better results, he adds. When sending a batch of texts, vendors of the bulk service can ensure every text bears the same phone number that the sales rep uses to call the client, thus avoiding the possible confusion of using more than one number, says Guggenheim. The system he offers can trigger a pop-up on the computer screen of a specified salesperson when a text recipient responds, he says. It also keeps management informed of the volume of texts and the response rate, he says. That helps managers determine which types of text messages are working, he maintains.

Keep messages conceptual rather than marketing-oriented, Guggenheim advises. Messages should directly address the customer’s situation to avoid seeming they were sent by a robot, he says. As with any response a salesperson receives, getting back to customers quickly pays off in better results, he adds. When sending a batch of texts, vendors of the bulk service can ensure every text bears the same phone number that the sales rep uses to call the client, thus avoiding the possible confusion of using more than one number, says Guggenheim. The system he offers can trigger a pop-up on the computer screen of a specified salesperson when a text recipient responds, he says. It also keeps management informed of the volume of texts and the response rate, he says. That helps managers determine which types of text messages are working, he maintains.

Users can also rely on Guggenheim’s TextUs system to schedule messages for delivery in the future to remind clients of meetings. The system detects land-line numbers and informs the user that the phone will not receive text messages, and it integrates with customer-relationship management systems to exchange information, he says.

So used properly, texting can offer benefits for everyone involved. But some unscrupulous players still insist upon using the medium to mislead prospective clients, says Zapata. His customers have shown him texts from competitors who make initial contact or early contact by sending text messages that might look like offers but are really just marketing letters, says Zapata. That approach, which might tout the availability of $50,000, can cause problems when it turns out that the merchant qualifies for only $25,000, he explains. “Trust me, you’re not going to look like the good guy,” he says of the firms that send what he considers objectionable text messages.

Sensitivity comes into play with text messaging, according to Blount. He and other sources say a great number of people regard email as business-oriented and texts as personal. That leads them to nonchalantly delete unwanted email messages but to become angry when they receive a text they didn’t want, he says. “You can’t send text messages to customers if they don’t know you,” he counsels.

Once a relationship is established, however, text messages can nurture it, Blount maintains. Suppose two businesspeople meet at a networking event and exchange business cards, he says. He advises noting the cell number on the card and sending a LinkedIn invitation immediately after meeting the potential client. Twelve hours later he would send a text message mentioning the encounter. If the salesperson can get the potential client to respond to a text message, that prospect is granting permission to receive texts, he says.

Once a relationship is established, however, text messages can nurture it, Blount maintains. Suppose two businesspeople meet at a networking event and exchange business cards, he says. He advises noting the cell number on the card and sending a LinkedIn invitation immediately after meeting the potential client. Twelve hours later he would send a text message mentioning the encounter. If the salesperson can get the potential client to respond to a text message, that prospect is granting permission to receive texts, he says.

Blount’s example seems to suggest the line between business and personal may be blurring when it comes to texting. People often check their email messages on phones these days – instead of on a laptop or desktop computer – which also minimizes the difference between texting and emailing, says Tibbs. “Everybody does everything with their phone these days,” she notes.

Communicating through a more personal channel such as texting has advantages, too, Williams contends. That’s because some merchants consider their financing to be personal and don’t want to broadcast the details to employees, he says. To protect their privacy, merchants often provide financial institutions with their cell phone number instead of their office number or toll-free line, he notes.

Meanwhile, the world continues to become more comfortable with texting. When Williams and his sales associates began messaging clients about four years ago, they found younger customers receptive and older ones reluctant, he remembers. In the intervening years, however, the 50 plus crowd has warmed to the medium, he observes.

An advantage that accrues with text messaging – compared with email – arises from the fact that spam filters and spam folders don’t seem to have a place in the world of texting. Several sources cite that as a big advantage with using texts. “If you send someone a text message, they’re going to see it,” notes Zapata.

Asked about a downside to the proper use of text messaging in business, most sources could not name one. However, Williams has discovered one area where the mode of communication comes up short. “I would not deliver bad news over text-messaging,” he advises. “If the merchant is upset or frustrated by the news, it would be better-handled in a phone call so you could explain the reason for the negative news. A text message leaves too many things unsaid.”

The Road To Training The Best Sales Reps

February 26, 2017

Alternative-finance industry executives tend to agree on at least two basic rules for building a successful sales team: Hire people who know how to sell and never stop training them. Following the second rule requires knowledge and perseverance. The first one takes a leap of faith.