Articles by Cheryl Winokur Munk

Does Your Merchant Cash Advance Company Pass The Scrutiny Test?

April 29, 2019

The merchant cash advance business has come under repeated fire of late from regulators, legislators and customers. “Every aspect of the industry is under scrutiny right now. Syndication agreements, underwriting, and collections are the subject of bills in Congress and across multiple states,” says Steven Zakharyayev, managing attorney for Empire Recovery Services in Manhattan, which offers debt recovery services to financial companies. So how should funders respond amid these obstacles? Here are a few pointers to help funders succeed despite ongoing challenges from a legal, regulatory, business and public relations perspective:

DIFFERENTIATE BETWEEN CASH ADVANCES AND LOANS AND MODEL BUSINESS DEALINGS ACCORDINGLY

In the eyes of the law, merchant cash advances and loans are very different. With a cash advance, a funder advances the merchant cash in exchange for a percentage of future sales, plus a fee. A loan, on the other hand, is a lump sum of cash in exchange for monthly payments over a set time period at an interest rate that can be fixed or variable. While the two types of funding options have certain similarities, funders have to be extremely careful to make appropriate distinctions in their business practices; otherwise legal trouble can easily ensue, experts say.

Most funders know that they are supposed to draw a bright line between merchant cash advance and lending, but it’s critical they put this knowledge into practice. Funders have to ensure the distinction is evident in their business lexicon, says Gregory J. Nowak, a partner in the Philadelphia office of law firm Pepper Hamilton LLP who focuses on securities law.

For example, it’s extraordinarily important that funders don’t refer to merchant cash advances as loans in their business dealings. Business records, emails and other documents can be requested in litigation for discovery purposes. If the funder’s internal documentation refers to cash advances as loans, it’s going to be hard for the company to argue that they aren’t, in reality, loans.

For example, it’s extraordinarily important that funders don’t refer to merchant cash advances as loans in their business dealings. Business records, emails and other documents can be requested in litigation for discovery purposes. If the funder’s internal documentation refers to cash advances as loans, it’s going to be hard for the company to argue that they aren’t, in reality, loans.

“Most judges want to see consistency of treatment and that includes your vocabulary,” Nowak says. “The word ‘loan’ should be banned from their email and Word files.”

There’s a fair amount of litigation surrounding what is and what isn’t a cash advance. This can be helpful guidance for funders in setting out the criteria they need to follow to be able to defend their activities as cash advances. Even so, the line is somewhat of a moving target and funders need to be stalwart in these efforts given heightened regulatory scrutiny, experts say.

“If it looks like a loan, the law will treat it as a loan—and all the consequences that follow such a determination,” says Christopher K. Odinet, an associate professor of law at the University of Oklahoma College of Law.

BE CAREFUL ABOUT YOUR COLLECTION POLICIES

Obviously companies want to collect their payments. But some funders are too quick to file lawsuits, which could lead to unwanted trouble, says Paul A. Rianda, who heads a law firm in Irvine, Calif.

“The business model of sue first, ask questions later can be a problem,” says Rianda, whose clients include merchant cash advance companies.

The concern is that when funders sue, merchants start talking to attorneys and that could open the MCA firm to other types of lawsuits. The more a funder sues, the more it increases media attention and invites examination by state regulators and others. “You invite class action lawsuits and regulatory scrutiny that you really don’t want. It’s a boomerang thing,” he says.

The issue is especially pertinent now as legislators grapple with how to handle the thorny issue of confessions of judgement, more popularly known as COJs. For instance, since the start of the year, New York courts and county clerks have become much more rigid in processing confessions of judgments.

Certainly, not all funders use COJs. Just recently, for instance, Greenbox Capital suspended the use of COJs indefinitely, in response to the heightened industrywide debate over their use. While there’s no all-encompassing directive to stop using COJs, experts say it is incumbent upon funders to ensure they are used in a responsible and proper manner, especially amid political and regulatory uncertainty.

For instance, it would be irresponsible and potentially actionable to execute on a COJ simply because the merchant doesn’t remit receivables the merchant cash advance company purchased because he didn’t generate receivables, says Catherine M. Brennan, a partner at the law firm Hudson Cook LLP in Hanover, Maryland.

To be lawful, the COJ has to be based on a breach of performance under the agreement. Fraud, for instance, is actionable. But simple failure to remit receivables because the business has failed is not, she says.

“Conflating those two things—breaches of repayment versus performance—leads to a world of hurt,” she says. “MCA transactions do not have repayment as a concept.”

In places like New York, where COJs are more controversial, funders have to be especially careful about using them properly, experts say. Even though COJs are still enforceable under New York law for the time being, funders should understand every county processes them a bit differently, says Zakharyayev of Empire Recovery Services. “If they have a preferred county for filing, they should ensure their COJs are not only compliant with state law, but also complies with local rules,” he says.

What’s more, funders should ensure their COJs are properly notarized under New York law, ensure party names and the amount confessed is accurate, and avoid blanket statements such as naming each and every county in New York as a possible venue for filing, he says.

While some funders have suggested changing their venue provisions to a COJ-friendly state if New York outlaws COJs, Zakharyayev says he recommend New York funders keep their venue in New York regardless since it would still be one of the most efficient states to enforce a judgment. “I’ve filed COJs outside of New York and, even without a COJ, New York is much more efficient in judgment enforcement as New York courts are less restrictive in allowing the judgment creditor to pursue the debtor’s assets,” he says.

BE CAREFUL WHEN RAISING THIRD-PARTY MONEY

Aside from their dealings with merchants, funders also have to be cautious when it comes to interactions with potential investors.

Some companies have ample balance sheets and don’t need money from third parties to fund their operations. But funders that decide for business purposes to solicit money from investors, have to be careful not to run afoul of SEC rules, says Nowak, the attorney with Pepper Hamilton.

He recommends funders treat these fundraising efforts as if they are issuing securities and follow the rules accordingly. Otherwise they risk being the subject of an enforcement action where the SEC alleges they are raising money using unregulated securities. “You need to be very careful here because these rules are unforgiving. You can’t ignore them,” Nowak says.

TACKLE ACCOUNTING CHALLENGES

Accounting is another business challenge many funders face. Some have fancy customer relationship management systems, but the systems aren’t always set up to provide the detailed information the accounting department’s needs to effectively reconcile the firm’s books, says Yoel Wagschal, a certified public accountant in Monroe, New York, who represents a number of funders and serves as chief financial officer at Last Chance Funding, a merchant cash advance provider.

Ideally, a funder’s CRM and accounting systems should be integrated so both sales and accounting receive the relevant data without the need for either department to input duplicate data. The two systems need a way to get information from each other, without someone manually entering the data in both systems, which is inefficient and prone to error, Wagschal says.

DON’T SKIMP ON LEGAL SERVICES

There’s no set standard for funders to follow when it comes to legal advice. Some funders have in-house counsel, some contract with external law firms and some don’t have attorneys at all, which, of course, can be a risky proposition.

Some funders use contracts they’ve poached from a reputable funder online or from a friend in the industry, says Kimberly M. Raphaeli, vice president of legal operations at Accord Business Funding in Houston, Texas. The trouble is what flies in one state may not be legal in another, she says.

Many contracts include things such as jury waivers and class-action waivers or COJs and depending on the state, the rules surrounding the enforcement of these types of clauses may be different. So it’s really important to know the nuances of the state you’re doing business in and even potentially the states where your merchants are located, she says.

Having dedicated legal staff is arguably better. But at the very least, funders should have an attorney on speed dial who can provide advice on contracts, compliance and other areas of their business. Even when a funder has in-house attorneys, Raphaeli says it’s a good idea to tap external counsel to review documents in situations where potential liability exists. Not only does this offer a second set of eyes, it can provide added peace of mind. “A funder should never shy away from paying a little bit of money for long-term business security,” Raphaeli says.

FOLLOW BEST PRACTICES

The Small Business Finance Association, an advocacy group for the non-bank alternative financing industry, has developed a list of best practices for industry participants to follow. These encompass principles of transparency, responsibility, fairness and security.

The Small Business Finance Association, an advocacy group for the non-bank alternative financing industry, has developed a list of best practices for industry participants to follow. These encompass principles of transparency, responsibility, fairness and security.

“It’s a very competitive market and companies are trying to differentiate themselves. I think it’s important to make sure you’re following industry standards,” says Steve Denis, executive director of the association whose members include funders and lenders.

Funders also need to be mindful that best practices can change based on business and competitive realities, so it’s important for funders to review procedures periodically, says Raphaeli, of Accord Business Funding. Because the industry is fast-moving, a good rule of thumb might be for a funder to review the entire set of policies and procedures every 18 months. But more frequent review could be necessary if outside factors such as new case law or regulation demand it, she says.

“Periodically taking a look at your collections techniques, your default procedures, even your funding process down to your funding call – these are all critical components of having a successful MCA funder,” she says.

TAKE PAINS TO AVOID INDUCTION INTO THE PUBLIC HALL OF SHAME

While there is no shortage of unseemly news stories involving MCA, funders need to do their best to avoid negative press. This means being extra careful about the way they present themselves to businesses, at public speaking engagements, at conferences, industry trade shows, brokers and others, says Denis of the Small Business Finance Association.

Denis, a long-time Washington, D.C., resident, recommends funders invoke what he calls the “The Washington Post test,” though it applies broadly to any news outlet. Before sending an email, leaving a voicemail or saying anything publicly, funding company employees need to ask themselves: Am I comfortable with that information being on the front page of the paper? “I think our industry has a big problem with public relations right now,” he says. “The stigma is only as true as our industry allows it to be.”

Tips For Trade Show Success

February 14, 2019

Conference season will soon kick off, but many attendees are at a loss at how to score big at these events. Without a doubt, trade shows and conferences offer participants a prime opportunity to boost brand exposure, make professional connections and increase sales.

But there’s also a lot of behind-the-scenes work required to turn these events into successful business endeavors. While the playbook won’t be the same for every company, here are some tried-and-true tips to help attendees get the most out of conferences.

Start by determining which conferences to attend. With dozens to choose from, it’s not realistic from a budget, time or value perspective to hit every conference, says Jim Larkin, who manages events for OnDeck. Companies should select conferences based on which ones make the most sense for their goals and objectives. Not all conferences will offer the same benefits to every company or industry professional, frequent conference attendees say.

Ideally, management teams should meet early in the year to weigh the pros and cons of each conference, against the backdrop of the company’s budget. Some factors to consider include where and when the conference is being held, which of your competitors, prospects and customers are likely to attend and how many employees it makes sense to send, if any. “Budgets drive everything and you want to be smart with spending money,” says Janene Machado, Director of Events for deBanked, whose flagship conference, Broker Fair, is scheduled for May 6 in New York. “You need to be strategic about why you are attending a particular conference,” she says.

It’s essential to plan ahead for each conference to make the most out of the event. This includes carefully combing through the agenda, scheduling meetings ahead of time and getting acquainted with the physical layout of the event space. If more than one company representative is attending, it’s also important to coordinate their activities in advance to avoid duplicating efforts and to maximize productivity.

“You have to make your own luck at these conferences,” Larkin says.

Most events have an online or mobile agenda and networking portal that are open to participants at least a few weeks beforehand. Bookmark the sessions you would like to attend, build your wish-list of people you would like to meet and start requesting meetings as soon as possible, says Peter Renton, co- founder and co-chairman of LendIt Fintech, which has an upcoming conference scheduled for April 8 and 9 in San Francisco. “Last year we helped to enable nearly 2,100 meetings at our USA event, and most of those meetings were organized through our networking portal,” Renton says.

Don’t delay when it comes to setting up advance appointments because schedules can fill up quickly, says Monique Ruff-Bell, event director for Money20/20 USA, which will take place in Las Vegas from Oct. 27 through Oct. 30. “Identifying the right contacts beforehand, reaching out and establishing what you’d like to achieve in a short meeting will make your time much more productive,” she says.

It’s fine for attendees to leave some time in their schedule for impromptu meetings as well; just be sure to fill those slots, says Ken Peng, head of business development and marketing at Elevate Funding. “No one should ever be asking, ‘what are we doing next?’ You should know,” he says.

It’s also a good idea to plan ahead for a dedicated meeting space so you’ll have a convenient, comfortable and quiet space to conduct meetings, seasoned conference attendees say. This can be especially important at big conferences where thousands congregate. For those who don’t want, or can’t afford, to pay for a meeting room, it’s a good idea to find a quiet restaurant or coffee shop outside the busy convention center area where you can have quiet, uninterrupted, productive conversations in a relaxed environment, says Larkin of OnDeck. Don’t choose the heavily frequented coffee shop next to the hotel where meetings are sure to be disrupted by heavy foot traffic, he says. “Get away from the noise, the hustle, the chaos. Quiet is king.”

Conferences can be expensive, so it’s important to make the right decisions with the available budget. For instance, companies don’t have to miss out on promotional opportunities just because the highest level of sponsorship is out of reach for their budget. Instead, look for creative ways to make an impact without breaking the bank, says Stephanie Schlesinger, director of marketing for LEND360.

Schlesinger suggests that would-be sponsors have an open conversation with conference organizers about what they can afford to spend and what they hope to reap in return for their marketing dollars. She offers the examples of companies that have sponsored popcorn breaks, pens and pads of paper, badges, lanyards and other marketing materials. “There could be opportunities to do something very unique. By brainstorming together we can think of outside-the-box opportunities to really make an impact for your brand,” she says.

Another cost consideration is where to stay. Though it can be tempting to save a few bucks by bunking off-site, that’s not always the most prudent decision, frequent conference attendees say.

“Time is really valuable at these shows and events. If you’re staying off-site you have to battle everybody for the cab line, and the increased expense of commuting can offset any cost savings,” says Sheri Chin, chief marketing officer at BFS Capital. Also, staying on-site “gives you more flexibility when unscheduled things come up,” she says.

If staying on premises isn’t an option, conference attendees should make extra efforts to spend considerable time in the bar or lobby of the conference site, says Jeffrey Bumbales, marketing director at Credibly. People will come in and go and it’s an easy way to start conversations, he says.

Conferences typically consume a lot of energy, so Eden Amirav, chief executive and co-founder of Lending Express, recommends participants try to catch people well before they are running on empty. As the conference goes on, it becomes harder to engage people because they also get drained, he says. Typically conference doors open a few hours before the first sessions begin, and this can be an especially effective time to network, Amirav says.

Arriving early also allows participants to find their way around. Ruff-Bell of Money20/20 USA recommends participants walk through the entire event space upon arrival to get their bearings. “Many of these large conferences can be overwhelming, and knowing where to go will help with your time management,” she says.

Bumbales of Credibly also recommends conference attendees pack their schedule tightly—even though it might mean activities extend late into the evening. Instead of calling it quits at 6 p.m. he recommends conference attendees plow through and host evening meetings over dinner or drinks. Even though a participant may be tired, it’s best not to miss these important networking opportunities, he says.

The proper conference mindset includes knowing there’s a good chance sleep won’t be plentiful. To accommodate, Bumbales tries to ensure he’s well-rested before a conference. He also makes sure to pack protein bars and non-perishable snacks for replacement meals as needed throughout the conference in case he needs to eat on the go. The goal is to hit the ground running and be able to focus entirely on conference-related business, he says.

Although numerous social opportunities abound at conferences, not everyone takes advantage. Certainly not everyone is as comfortable approaching strangers. But it’s important for conference- goers to try to break out of their shell whenever possible, industry professionals say. When he first started going to conferences, Gary Lockwood, vice president of business development at 6th Avenue Capital, says he found it difficult to strike up conversations with strangers because it took him out of his “comfort zone.” But he forced himself to make the extra effort, and it has served him well. He says that some of the best connections he’s made have come from these chance meetings at breakfast, lunch or during random breaks.

Although attendees don’t always stay on-site for meals, Peng of Elevate Funding recommends people stick around during these times, if possible. He finds these meals a good opportunity to chat with others in a comfortable setting as opposed to the more strained conversations that can happen when someone approaches him at an exhibitor booth. These informal conversations offer a better chance to build a rapport with someone and learn—in a non- pressured environment—about what the other person does, he says.

Although attendees don’t always stay on-site for meals, Peng of Elevate Funding recommends people stick around during these times, if possible. He finds these meals a good opportunity to chat with others in a comfortable setting as opposed to the more strained conversations that can happen when someone approaches him at an exhibitor booth. These informal conversations offer a better chance to build a rapport with someone and learn—in a non- pressured environment—about what the other person does, he says.

Bumbales of Credibly says elevator time offers another opportunity for chance meetings that can turn into business opportunities. Most times, he prefers to take the stairs, but not at conferences. Elevators can be great for short, yet productive conversations. He likes to position himself next to the elevator buttons, which gives him an opening to break the ice. He says he’s had a few business opportunities arise as a result of elevator conversations.

It’s also important not to monopolize anyone’s time says Machado of deBanked. Everyone is there to meet as many people as possible, so she recommends keeping conversations quick, meaningful and relevant.

It’s also important not to monopolize anyone’s time says Machado of deBanked. Everyone is there to meet as many people as possible, so she recommends keeping conversations quick, meaningful and relevant.

When he’s talking to someone for the first time, Lockwood of 6th Avenue Capital tries to listen more than he speaks. “I want to listen a little more than I talk in the beginning so I can tailor the conversation to what they need.”

While not every exchange will be fruitful, it’s important to recognize that any conversation could lead to future business; even a commercial real estate broker who has no present connection to merchant cash advance can be a potential partner or resource at some point, Lockwood says.

It’s also a good idea to keep your business cards handy at all times. Bumbales says he’s been in several situations when people don’t have them available, which makes exchanging information more awkward. “It’s a lot less awkward to exchange business cards then it is to ask for someone’s cell phone number,” Bumbales says.

Because each day is so jammed- packed with information, it’s a good idea to take notes so you don’t lose track of important details, says Ruff-Bell of Money20/20 USA. Each person will have his own system, but effective note-taking becomes important for recapping the event back in the office and for sending post-event follow-ups to new contacts. “At the end of each day, go through your notes and clean them up, ensuring you’ll understand the key points and important details weeks later,” she says.

Some conference participants fall short when it comes to following up with new connections they’ve made, but this can be a grave mistake. Follow-up emails are most effective when they are personal, says Peng of Elevate Funding. He recommends attendees jot down a few notes on the business card of each person they meet to jog their memory later on about their conversation. Then, weave details of the conversation into the follow-up email, so the correspondence won’t seem cold, generic or canned, he says.

Remember, conference-goers will be meeting hundreds of other people at the conference, Ruff- Bell says. “Ensure your follow-up is prompt, effective, and most importantly, memorable,” she says

Even though the setting is social, conference attendees need to be mindful about maintaining proper decorum at all times. This is a seemingly obvious rule of thumb that people sometimes forget, conference participants say.

“You’re there for work first, play second,” Peng says.

Professionalism also dictates that attendees and exhibitors should be where they are supposed to be at appropriate times. Peng recalls a conference he attended last year where one of the exhibitors left its booth unmanned for most of the conference. There’s no way to know where an interaction at these booths can lead in terms of new business or face-time with existing clients.

“It’s not doing the company any favors” by passing up the opportunity, he says.

Open Banking — A U.S. Pipe Dream or Near-Term Reality?

December 18, 2018 Some alternative funders are anxious for “open banking” to become the gold standard in the U.S., but achieving widespread implementation is a weighty proposition.

Some alternative funders are anxious for “open banking” to become the gold standard in the U.S., but achieving widespread implementation is a weighty proposition.

Open banking refers to the use of open APIs (application program interfaces) that enable third-party developers to build applications and services around a financial institution. It’s a movement that’s been gaining ground globally in recent years. Regulations in the U.K., a forerunner in open banking, went into effect in January, while several other countries including Australia and Canada are at varying stages of implementation or exploration.

For the U.S., however, the time frame for comprehensive adoption of open banking is murkier. Industry participants say the prospects are good, but the sheer number of banks and the fragmented regulatory regime makes wholesale implementation immensely more complicated. Nonetheless, industry watchers see promise in the budding grass-roots initiative among banks and technology companies to develop data-sharing solutions. Regulators, too, have started to weigh in on the topic, showing a willingness to further explore how open banking could be applied in U.S. markets.

Open banking “is a global phenomenon that has great traction,” says Richard Prior, who leads open banking policy at Kabbage, an alternative lender that has been active in encouraging the industry to develop open banking standards in the U.S. “It’s incumbent upon the U.S. to be a driver of this trend,” he says.

The stakes are particularly high for alternative lenders since they rely so heavily on data to make informed underwriting decisions. Open banking has the potential to open up scores of customer data and significantly improve the underwriting process, according to industry participants.

“Open banking massively enables alternative lending,” says Mark Atherton, group vice president for Oracle’s financial services global business unit. What’s missing at the moment is the regulatory stick to ensure uniformity. Certainly, data sharing is gradually becoming more commonplace in the U.S. as banks and fintech companies increasingly explore ways to collaborate. But even so, banks in the U.S. are currently all over the map when it comes to their approach to open banking, posing a challenge for many alternative lenders. Many alternative lenders would like to see regulators step in with prescriptive requirements so that open banking becomes an obligation for all banks, as opposed to these decisions being made on a bank-by-bank basis. Especially since many consumers want to be able to more readily share their financial information, they say.

“It will create huge value to everyone if that data is more accessible,” says Eden Amirav, co-founder and chief executive of Lending Express, an AI-powered marketplace for business loans.

Some global-minded banks like Citibank have been on the forefront of open banking initiatives. Spanish banking giant BBVA is also taking a proactive approach. In October, the bank went live in the U.S. with its Banking-as-a-Service platform, after a multi-month beta period. Also in October, JPMorgan Chase announced a data sharing agreement with financial technology company Plaid that will allow customers to more easily push banking data to outside financial apps like Robinhood, Venmo and Acorns.

There are several other examples of open banking in action. Kabbage customers, for instance, authorize read-only access to their banking information to expedite the lending process through the company’s aggregator partners, says Sam Taussig, head of global policy at Kabbage.

Also, companies such as Xero and Mint routinely interface with banks to put customers in control of their financial planning. And companies like Plaid and Yodlee connect lenders and banks to help with processes such as asset and income verification.

Some banks, however, are more reticent than others when it comes to data sharing. And with no regulatory requirements in place, it’s up to individual banks how to proceed. This can be nettlesome for alternative lenders trying to get access to data, since there’s no guarantee they will be able to access the breadth of customer data that’s available. “As an underwriter, you want the whole financial picture, and if data points are missing, it’s hard to make appropriate lending decisions,” Taussig says.

The problem can be particularly acute among smaller banks, industry participants say. While the quality of data you can get from one of the money-center banks is quite good, “as you go down the line, it becomes a little less consistent,” says James Mendelsohn, chief operating officer of Breakout Capital Finance. For these smaller banks, the issue is sometimes one of control. There’s a feeling among some community banks, that “if I make it easier for my small business customers to get loans elsewhere, I’m done,” says Atherton of Oracle.

Absent regulatory requirements, alternative lenders are hoping that this initial hesitation among some banks changes over time as they continue to gain a better understanding of the market opportunity and as more of their counterparts become open to data sharing through APIs.

Open banking could be a boon for banks in that it would enable them to service customers they probably couldn’t before, says Jeffrey Bumbales, marketing director at Credibly, which helps small and mid-size businesses obtain financing. Open banking makes for a “better customer experience,” he says.

One challenge for the U.S. market is the hodgepodge of federal and state regulators that makes reaching a consensus a more arduous task. It’s not as simple here as it may be in other markets that are less fragmented, observers say.

Major rule-making would be involved, and there are many issues that would need attention. One pressing area of regulatory uncertainty today is who bears the liability in the event of a breach—the bank or the fintech, says Steve Boms, executive director of the Northern American chapter of the Financial Data and Technology Association. Existing regulations simply don’t speak to data connectivity issues, he says.

To be sure, policymakers have started to give these matters more serious attention, with various regulators weighing in, though no regulator has issued definitive requirements. Still, some industry participants are encouraged to see regulators and policymakers taking more of an interest in open banking.

A recent Treasury Report, for example, notes that as open banking matures in the United Kingdom, “U.S. financial regulators should observe developments and learn from the British experience.” And, The Senate Banking Committee recently touched on the issue at a Sept. 18 hearing. Industry watchers say these developments are a step in the right direction, though there’s significant work needed, they say, in order to make open banking a pervasive reality.

“We’re seeing the pace and interest around these things picking up pretty significantly,” Boms says. Even so, it can take several years to implement a formal process. “The hope is obviously as soon as possible, but the financial services sector is a very fragmented market in terms of regulation. There’s going to have to be a lot of coordination,” Boms says.

Another challenge to overcome is customers’ willingness to use open banking. Many small business owners are more comfortable sending a PDF bank statement versus granting complete access to their online banking credentials, says Mendelsohn of Breakout Capital Finance. “There’s a lot more comfort on the consumer side than there is on the small business side. Some of that is just time,” he adds.

Certainly sharing financial data is a concern—even in the U.K. where open banking efforts are well underway. More than three quarters of U.K. respondents expressed concern about sharing financial data with organizations other than their bank, according to a recent poll by market research body, YouGov. This suggests that more needs to be done to ease consumers into an open banking ecosystem.

The topic of data security came up repeatedly at this year’s Money20/20 USA conference in Las Vegas. How to make people feel comfortable that their data is safe is a pressing concern, says Tim Donovan, a spokesman for Fundbox, which provides revolving lines of credit for small businesses. Clearly, it’s something the industry will have to address before open banking can really become a reality in the U.S., he says.

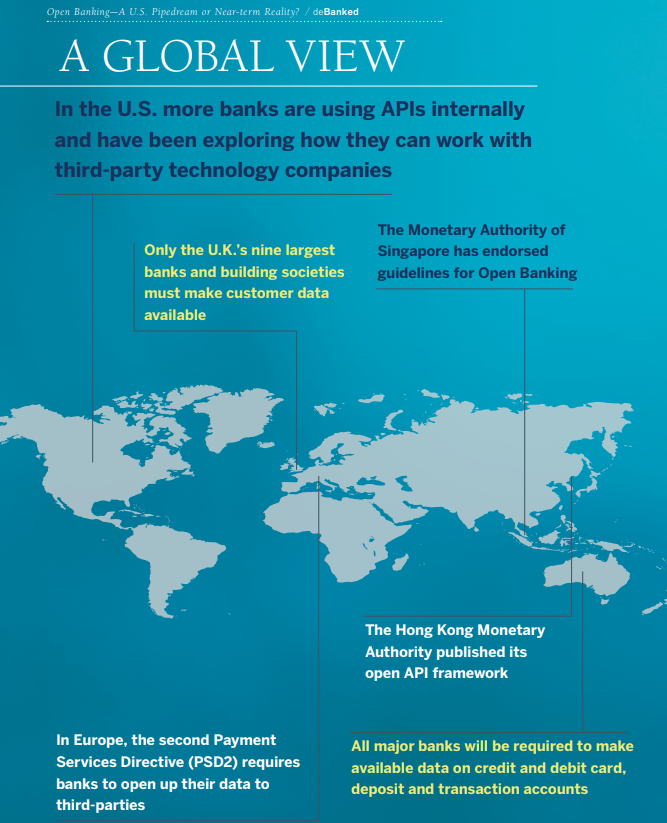

Despite these challenges, many market watchers feel open banking in the U.S. is inevitable, given the momentum that’s driving adoption worldwide. Several countries have taken on open banking initiatives and are at varying states of implementation—some driven by industry, others by regulation. Here is a sampling of what’s happening in other regions of the world:

In the U.K., for example, the implementation process is ongoing and is expected to continually enhance and add functionality through September 2019, according to The Open Banking Implementation Entity, the designated entity for creating standards and overseeing the U.K’s open banking initiative.

At the moment, only the U.K.’s nine largest banks and building societies must make customer data available through open banking though other institutions have and continue to opt in to take part in open banking. As of September, there were 77 regulated providers, consisting of third parties and account providers and six of those providers were live with customers, according to the U.K. open banking entity.

In Europe, the second Payment Services Directive (PSD2) requires banks to open up their data to third parties. But implementation is taking longer than expected—given the large number of banks involved. By some opinions, open banking won’t really be in force in Europe until September 2019, when the Regulatory Technical Standards for open and secure electronic payments under the PSD2 are supposed to be in place.

In Australia, meanwhile, the country has adopted a phase-in process to take place over a period of several years through 2021. Starting in July 2019, all major banks will be required to make available data on credit and debit card, deposit and transaction accounts. Data requirements for mortgage accounts at major banks will follow by February 1, 2020. Then, by July 1 of 2020, all major banks will need to make available data on all applicable products; the remaining banks will have another 12 months to make all the applicable data available.

For its part, Hong Kong is also pushing ahead with plans for open banking. In July, the Hong Kong Monetary Authority published its open API framework for the local banking sector. There’s a multi-prong implementation strategy with the final phase expected to be complete by mid-2019.

Singapore, by contrast, is taking a different approach than some other countries by not enforcing rules for banks to open access to data. The Monetary Authority of Singapore has endorsed guidelines for Open Banking, but has expressed its preference to pursue an industry-driven approach as opposed to regulatory mandates.

Other countries, meanwhile, are more in the exploratory phases. In Canada, the government announced in September a new advisory committee for Open Banking, a first step in a review of its potential merits. And in Mexico, the county’s new Fintech Law requires providers to provide fair access to data, and regulators there are reportedly gung-ho to get appropriate regulations into place. Still other countries are also exploring how to bring open banking to their markets.

The U.S. meanwhile, is on a slower course—at least for now. More banks are using APIs internally and have been exploring how they can work with third-party technology companies. Meanwhile, companies like IBM have been coming to market with solutions to help banks open up their legacy systems and tap into APIs. Other industry players are also actively pursuing ways to bring open banking to the market.

As for when and if open banking will become pervasive in the U.S., it’s anyone’s guess, but industry participants have high hopes that it’s an achievable target in the not-too-distant future.

Thus far, there has been little pressure for banks to adopt open banking policies, says Taussig of Kabbage. But this is changing, and things will continue to evolve as other countries adopt open banking and as pressure builds from small businesses and consumers in an effort to ensure the U.S. market stays competitive, he says. Open banking “is going to happen in the near future,” Taussig predicts.

Is Your Firm Ready for Machine Learning?

October 15, 2018Artificial intelligence such as machine learning has the potential to dramatically shift the alternative lending and funding landscape. But humans still have a lot to learn about this budding field.

Across the industry, firms are at different points in terms of machine learning adoption. Some firms have begun to implement machine learning within underwriting in an attempt to curb fraud, get more complex insights into risk, make sounder funding decisions and achieve lower loss rates. Others are still in the R&D and planning stage, quietly laying the groundwork for future implementation across multiple areas of their business, including fraud prevention, underwriting, lead generation and collections.

“It’s entirely critical to the success of our business,” says Paul Gu, co-founder and head of product at Upstart, a consumer lending platform that uses machine learning extensively in its operations. “Done right, it completely changes the possibilities in terms of how accurate underwriting and verification are,” he says.

While there’s no absolute right way to implement machine learning within a lender’s or funder’s business, there are many data-related, regulatory and business-specific factors to consider. Because things can go very wrong from a business or regulatory perspective—or both—if machine learning is not implemented properly, firms need to be especially careful. Here are a few pointers that can help lead to a successful machine learning implementation:

Using machine learning, funders can predict better the likelihood of default versus a rule-based model that looks at factors such as the size of the business, the size of the loan and how old the business is, for example, says Eden Amirav, co-founder and chief executive of Lending Express, a firm that relies heavily on AI to match borrowers and funders.

Machine learning takes hundreds and hundreds of parameters into account which you would never look at with a rule-based model and searches for connections. “You can find much more complex insights using these multiple data points. It’s not something a person can do,” Amirav says.

He contends that machine learning will optimize the number of small businesses that will have access to funding because it allows funders to be more precise in their risk analyses. This will open doors for some merchants who were previously turned down based on less precise models, he predicts. To help in this effort, Lending Express recently launched a new dashboard that uses AI-driven technology to help convert business loan candidates that have been previously turned down into viable applicants. The new LendingScore™ algorithm gives businesses detailed information about how they can improve different funding factors to help them unlock new funding opportunities, Amirav says.

Lenders and funders always have to be thinking about what’s next when it comes to artificial intelligence, even if they aren’t quite ready to implement it. While using machine learning for underwriting is currently the primary focus for many firms, there are many other possible use cases for the alternative lenders and funders, according to industry participants.

Lead generation and renewals are two areas that are ripe for machine learning technology, according to Paul Sitruk, chief risk officer and chief technology officer at 6th Avenue Capital, a small business funder. He predicts that it is only a matter of time before firms are using machine learning in these areas and others. “It can be applied to several areas within our existing processes,” he says.

Collection is another area where machine learning could make the process more efficient for firms. Machines can work out, based on real-life patterns, which types of customers might benefit from call reminders and which will be a waste of time for lenders, says Sandeep Bhandari, chief strategy and chief risk officer at Affirm, which uses advanced analytics to make credit decisions.

“There are different business problems that can be solved through machine learning. Lenders sometimes get too fixated on just the approve/decline problem,” he says.

“Most underwriters don’t have enough data to effectively incorporate AI, deep learning, or machine learning tools,” says Taariq Lewis, chief executive of Aquila, a small business funder. He notes that effective research comes from the use of very large datasets that won’t fit in an excel spreadsheet for testing various hypotheses.

Problems, however, can occur when there’s too much complexity in the models and the results become too hard to understand in actionable business terms. For example, firms may use models that analyze seasonal lender performance without understanding the input assumptions, like weather impact, on certain geographies. This may lead to final results that do not make sense or are unexpected, he says.

“There’s a lot of noise in the data. There are spurious correlations. They make meaningful conclusions hard to get and hard to use,” he says.

The more precise firms can be with the data, the more predictive a machine learning model can be, says Bhandari of Affirm. So, for example, instead of looking at credit utilization ratios generally, the model might be more predictive if it includes the utilization rate over recent months in conjunction with debt balance. It’s critical to include as targeted and complete data as possible. “That’s where some of our competitive advantages come in,” Bhandari says.

Underwriters also have to pay particularly close attention that overfitting doesn’t occur. This happens when machines can perfectly predict data in your data set, but they don’t necessarily reflect real world patterns, says Gu of Upstart.

Keeping close tabs on the computer-driven models over time is also important. The model isn’t going to perform the same all along because the competitive environment changes, as do consumer preferences and behaviors. “You have to monitor what’s going well and what’s not going well all the time,” Bhandari says.

Certainly, as AI is integrated into financial services, state and federal regulators that oversee financial services are taking more of an interest. As such, firms dabbling with new technology have to be very careful that any models they are using don’t run afoul of federal Fair Lending Laws or state regulations.

“If you don’t address it early and you have a model that’s treating customers unfairly or differently, it could result in serious consequences,” says Tim Wieher, chief compliance officer and general counsel of CAN Capital, which is in the early stages of determining how to use AI within its business.

“AI will be transformative for the financial services industry,” he predicts, but says that doing it right takes significant advance planning. For instance, Wieher says it’s very important for firms to involve legal and compliance teams early in the process to review potential models, understand how the technology will impact the lending or funding process and identify the challenges and mitigate the risk.

“AI will be transformative for the financial services industry,” he predicts, but says that doing it right takes significant advance planning. For instance, Wieher says it’s very important for firms to involve legal and compliance teams early in the process to review potential models, understand how the technology will impact the lending or funding process and identify the challenges and mitigate the risk.

To be sure, regulation around AI is still a very gray area since the technology is so new and it’s constantly evolving. Banking regulators in particular have been looking closely at the issues pertaining to AI such as its possible applications, short-comings, challenges and supervision. Because the waters are so untested, there can be validity in asking for regulatory and compliance advice before moving ahead full steam, some industry watchers say.

Upstart, for example, which uses AI extensively to price credit and automate the borrowing process, wanted buy-in from the Consumer Financial Protection Bureau to help ease the concern of its backers as well as to satisfy its own concerns about the legality of its efforts. So the firm submitted a no-action request to CFPB. The CFPB responded by issuing a no-action letter to Upstart in September 2017, allowing the company to use its model. In return, Upstart shares certain information with the CFPB regarding the loan applications it receives, how it decides which loans to approve, and how it will mitigate risk to consumers, as well as information on how its model expands access to credit for traditionally underserved populations.

The No-Action Letter is in force for three years and Upstart can seek to renew it if it chooses.

Theoretically firms could have a computer underwriting model constantly updating itself without having a human oversee what the model is doing—but it’s a bad idea, industry participants say. “I believe there are companies doing that, and it’s a risky thing to do,” says Scott M. Pearson, a partner with the law firm Ballard Spahr LLP in Los Angeles.

During review of the models—and before implementing them—people should carefully review the models and the output to make sure there’s nothing that causes intrinsic bias, says Kathryn Petralia, co-founder and president of Kabbage, which is one of the front-runners in using machine learning models to understand and predict business performance.

“If you’re not watching the machine, you don’t know how the machine is complying with regulatory requirements,” she says.

Kabbage has teams of data scientists regularly developing models that the company then reviews internally before deploying. The company is also in frequent contact with regulators about its processes. Petralia says it’s very important that firms be able to explain to regulators how their models work. “Machines aren’t very good at explaining things,” she quips.

As a best practice, Pearson of Ballard Spahr says lenders and funders shouldn’t use any machine learning model until it’s been signed off on by compliance. “That strikes a pretty good balance between getting the benefits of AI and making sure it doesn’t create a compliance problem for you,” he says.

While AI has many benefits, industry participants say alternative lenders and funders need to be mindful of how it can be applied practically and effectively within their particular business model.

Craig Focardi, senior analyst with consulting firm Celent in San Francisco, contends that the classic FICO score continues to be the gold standard for credit decisions in the U.S. He warns firms not to get overly distracted trying to find the next best thing.

“Many fintech lenders have immature risk management and operations functions. They’re better off improving those than dabbling in alternative scoring,” he says, noting that data modeling is an entirely separate core competency.

Indeed, Lewis of Aquila cautions underwriters not to view AI as a silver bullet. “AI is just one tool out of many in the lenders’ toolbox, and our industry should use it and respect its limitations,” he says.

Underwriting 101—Veteran Funders Share Tools of the Trade

August 12, 2018For brokers, funding partnerships are critical to success. But making the most of these connections can be elusive.

“Transparency, efficiency and a thorough scrubbing on the front end can help the whole process,” says William Gallagher, president of CFG Merchant Solutions, an alternative funder with offices in Rutherford, N.J. and Manhattan.

Gallagher recently moderated an “Underwriting 101” panel at Broker Fair 2018, which deBanked hosted in May. The panel featured a handful of representatives from different funding companies discussing various hot-button items including striking the proper balance between technology and human underwriting, trade secrets of the submission process and stacking. Here are some major takeaways from that discussion and from follow-up conversations deBanked had with panel participants.

Each funder has slightly different processes and requirements. Brokers need to understand the different nuances of each firm so they know how to properly prepare merchants and send relevant information, funders say.

Many brokers sign up with funders without delving deeper into what the different funders are really looking for, says Jordan Fein, chief executive of Greenbox Capital in Miami Gardens, Fla., that provides funding to small businesses.

For example, there are a growing number of companies that rely more heavily on advanced technology for their underwriting, while others have more human intervention. Brokers need to know from the start what the funder’s underwriting process is like—the nitty gritty of what each funder is looking for—so they can more effectively send files to the appropriate funder.

“They will look poor in front of the merchant if they don’t really know the process,” Fein says.

Certainly, it’s a different ballgame for brokers when dealing with funders that are more human based versus more automated, says Taariq Lewis, chief executive and co-founder of Aquila Services Inc., a San Francisco-based company that offers merchants bank account cash flow analysis as well as funding that ranges from 70 days to 100 business days.

At Aquila, the process is meant to be totally automated so that brokers spend more time winning deals faster, with better data to do so. This means, however, that some of the underwriting requirements differ from some other industry players. Aquila’s most important requirement is that a merchant’s business is generally healthy and shows a positive history of sales deposits. Other funders require documents and background explanations, whereas Aquila strives to be completely data-driven, Lewis says. These types of distinctions can be important when submitting deals, funders say.

Stacking is another example of a key difference among funders that brokers need to understand. It’s a controversial practice; some funders are open to stacking, while others will only take up to a second or third position; a number of funders shy away from the practice completely. Brokers shouldn’t waste their time sending deals if there’s no chance a funder will take it; they have to do their research upfront, funders say.

Most times, brokers “don’t invest enough time to understand the process,” Fein says.

Some brokers may feel competitive pressure to sign up with as many funders as possible, but it can easily become unwieldy if the list is too long, funders say. Better, they say, to deal with only a handful of funders and truly understand what each of them is looking for.

“There are brokers that deal with 20 [funders], but I don’t think it’s a good, efficient practice,” says Rory Marks, co-founder and managing partner of Central Diligence Group, a New York funder that provides working capital for small businesses.

He suggests brokers select funders that are easy to work with and responsive to their phone calls and emails. Not all funders will pick up the phone to speak with brokers who have questions, but he believes his type of service is paramount, he says. “It’s something we do all the time,” he says.

He also recommends brokers consider a funder’s speed and efficiency of funding as well as document requirements and their individual specialties. There are plenty of funders to choose from, so brokers shouldn’t feel they have to work with those that are more difficult, he says.

To prevent a broker’s list from becoming too unwieldy, Gallagher of CFG Merchant Solutions suggests brokers have two to three go-to funders in each category of paper from the highest quality down to the lowest. Having a few options in each bucket allows greater flexibility in case one funder changes its parameters for deals, he says.

Brokers “sometimes just shotgun things and throw things against the wall and hope they stick,” Gallagher says. Instead, he and other funders advocate a more precise approach –proactively deciding where to send files based on what they know about the merchant and research they’ve done on prospective funders.

It used to be that when sending files to funders, brokers would provide some background on the company in the body of the email. This was helpful because even a few sentences can help funders gain some perspective about the company and better understand their funding needs, says Fein of Greenbox Capital.

These days, however, Fein says he’s getting more emails from brokers that simply request the maximum funding offer, without providing important details about the business. The financials on ABC importing company aren’t necessarily going to tell the whole story because funders won’t know what products they import and why the business is so successful and needs money to grow. Providing these types of details could help sway the underwriting process in a merchant’s favor. Brokers don’t have to say a lot, but funders appreciate having some meaty details. “A few sentences go a long way,” Fein says.

Many brokers make the mistake of overpromising what they can get for merchants and how long the process could take, funders say. Both can cause significant angst between merchants and brokers and between brokers and funders.

If a company is doing $15k in sales volume and asking for $50k in funding, the broker should know off the bat, the merchant is not going to get what he wants, says Marks of Central Diligence Group. By managing merchant’s expectations, brokers are doing their clients—and themselves—a favor. Why waste time on deals that won’t fund because they are fighting an uphill battle? Brokers shouldn’t knowingly put themselves in the position of having to backtrack later, Marks says.

Instead, explain to the merchant ahead of time he’s likely to receive a smaller amount than he’d hoped for. To show him why, walk the merchant through a general cash flow analysis using data from the past three to four months, says Gallagher of CFG Merchant Solutions. This will help merchants understand the process better, and it can help raise a broker’s conversion rate, he says.

“It’s about setting realistic expectations,” Marks says.

Sometimes brokers take only a cursory look at a merchant’s financials, and because of this, they overlook important details that can delay, significantly alter, or sink the underwriting process, funders say.

Heather Francis, founder and chief executive of Elevate Funding in Gainesville, Fla., offers the hypothetical example of a merchant who has total deposits of $80k in his bank account. On its face, it may look like a solid deal and the broker may make certain assurances to the merchant. But if it comes out during underwriting that most of the deposits are transfers from a personal savings account as opposed to sales, there can be trouble. Based on the situation, the merchant may only be eligible for $30k, but yet the owner is expecting to receive $80k based on his discussions with the broker. Now you have an unhappy merchant, a frustrated broker and a funder who may be blamed by the merchant, even though it’s really the broker who should have dug deeper in the first place and then managed the merchant’s expectations accordingly. “We see that a lot,” says Francis.

To get the most favorable deals for merchants, some brokers only present the rosiest of information in the hopes that the funder won’t discover anything’s amiss. Several panelists expressed frustration with brokers who purposely withhold information, saying it puts deals at risk and makes the process much less efficient for everyone.

Marks of Central Diligence Group offers the hypothetical example of a merchant whose sales volume dipped in two of the past six months. To push the deal through, a broker might submit only four months of data, hoping the funder doesn’t ask about the other two months. Some funders might accept only four statements, but other shops will want to see six. If a funder then asks for six, the broker’s omission creates unnecessary friction, he says.

Funders say it’s better to be upfront and disclose relevant information such as sales dips or some other type of temporary setback that weighs a merchant’s financials. Kept hidden, even small details could easily become game-changers—or deal-breakers—a losing proposition for merchants, brokers and funders alike.

“If we have the full story upfront and we’re going in eyes wide open, we can look at the file in a little bit of a different way,” says Gallagher of CFG Merchant Solutions.

It’s Back to Business For Alternative Funding in Puerto Rico

June 15, 2018

Last year, alternative funding in Puerto Rico ground to a halt after the island was ravaged by two devastating hurricanes in close proximity. Now, however, the alternative funding business in Puerto Rico is getting its second wind, after a several-month hiatus.

Puerto Rico got lashed by high winds and rain from Hurricane Irma in early September 2017, causing large-scale power outages and damage. Then, about two weeks later, Hurricane Maria hit the island square on, causing even more catastrophic destruction. Millions were without power for months (thousands still are), homes were destroyed, multiple lives were lost, businesses were decimated and the island’s already shaky economy teetered on the brink of disaster.

More than half a year later, residents are still trying to pick up the pieces of the epic humanitarian crisis. Hurricane Maria caused an estimated $90 billion in damage, according to the National Hurricane Center, making it the costliest hurricane on record to strike Puerto Rico and the U.S. Virgin Islands. The hurricane knocked out 80 percent of Puerto Rico’s power lines and destroyed its generators. Even months later, the lives of many residents are still in disarray as they wait desperately for insurance payments to materialize and get back to a semblance of their former lives. The island faces additional challenge—and uncertainty— with another hurricane season just around the corner.

In the midst of this turmoil, however, there’s a glimmer of hope for the budding alternative funding sector. Some businesses are once again seeking funds to rebuild or expand, and alternative funders are once again dipping their toes into the Puerto Rican market—albeit somewhat slowly. While some funders have exited the Puerto Rican alternative lending market, other new entrants are starting to stake a claim, citing an expected uptick in economic development that tends to follow natural disasters. Some funders also see Puerto Rico as a sweet spot because the market isn’t as mature as the U.S. and competition from other alternative funders is scant. Banks on the island aren’t always willing to provide businesses there with much- needed funds, so opportunities for non-bank funders are considered plentiful.

Businesses struggling to rebuild from the storms need more help than ever before, says Sonia Alvelo, president of Latin Financial LLC, an ISO that has been arranging funding for business owners in Puerto Rico for three years. “There is no doubt that Puerto Rico has a long, hard road ahead,” she says. But “I can assure you the entrepreneurial spirit is alive and well,” she says.

Latin Financial and other ISOs and funders are back to business—courting merchants and trying to help them get back on their feet. In December, Latin Financial processed its first renewal since Maria; in January it funded its first new client since September. Latin Financial continues to arrange funding of between $500k and $1 million per month on average in Puerto Rico, after some hurricane-related downtime.

“The storm destroyed a lot, but it didn’t set the small business drive back. They’re still pushing hard and really trying to maintain and grow business,” says Brendan P. Lynch, business partner and fiancé to Latin Financial’s Alvelo.

Greenbox Capital in Miami Gardens, Fla., an early entrant to the Puerto Rican alternative funding market, has also returned to funding small businesses on the island after a few-month hiatus. The company put off new deals right before Maria hit, and as a goodwill measure suspended the payments of existing customers for 90 days. Given the extension, almost all customers were able to stay on track and the firm suffered very few losses, says Jordan Fein, the company’s chief executive. Greenbox began funding again in January, he says.

Greenbox Capital in Miami Gardens, Fla., an early entrant to the Puerto Rican alternative funding market, has also returned to funding small businesses on the island after a few-month hiatus. The company put off new deals right before Maria hit, and as a goodwill measure suspended the payments of existing customers for 90 days. Given the extension, almost all customers were able to stay on track and the firm suffered very few losses, says Jordan Fein, the company’s chief executive. Greenbox began funding again in January, he says.

To be sure, it’s not exactly business as usual, since many businesses in Puerto Rico are still struggling, Fein says. While the situation should continue to improve, it will take time for the economy and businesses to fully recover, he says.

“They’ve come a long way since September, but they still aren’t fully back. We’re not seeing the same type of submissions that we saw before,” Fein says. Nonetheless, Fein remains positive about the market’s long-term prospects. “I think they are going to come back stronger, I really do,” he says.

To be sure, not all funders are interested the Puerto Rican market. Ripe with political uncertainty and economic instability, Puerto Rico already posed challenges that made many funders hesitant to do business there. The devastation wrought by Irma and Maria complicated matters further, and some funders pulled out of the market completely.

For others, however, the market’s still an opportune one, albeit not as stable as the U.S. market. Certainly, there are reasons for alternative funders to be optimistic. Despite its recent troubles, Puerto Rico is still considered a growth market. What’s more, with new businesses popping up in the wake of the storms, new infrastructure being instituted and businesses anxious to bounce back even bigger and better than before, some funders are striking while the iron is hot.

“This is the right time, as the island is growing,” says Paul Boxer, chief marketing officer and vice president of business development at Quicksilver Capital, a New York-based small business funder. Quicksilver funded its first deal in Puerto Rico in late April.

The company had been mulling over the possibility of doing business in Puerto Rico when an actual funding prospect arose. The company decided to give it a shot, sensing a potentially viable business opportunity. Existing businesses are rebuilding after the hurricane, there’s plenty of new business development and there’s a pressing need for new infrastructure as Puerto Rico continues to recover from the devastation, Boxer says.

Accordingly, Boxer says his company is in the process of vetting additional funding opportunities in Puerto Rico and hopes to continue growing this business in what he says is a largely untapped market. “I see it as a positive addition to what we offer, and I see a lot more opportunity in the future,” Boxer predicts.

Tips For More Successful Marketing

April 30, 2018 In marketing, there’s a basic tenet that it takes seven “touches” within 18 months to prod someone into action.

In marketing, there’s a basic tenet that it takes seven “touches” within 18 months to prod someone into action.

Nowadays, with customers exposed to thousands of ads a day and across so many channels, it takes several times that in interactions to generate viable sales leads, according to Samantha Berg, a marketing and strategic partnerships executive with 6th Avenue Capital in New York.

That’s why it’s so important for funders, ISOs, brokers and other alternative funding professionals to have a solid marketing and lead-generation strategy that incorporates multiple channels such as search engine optimization, digital ads, direct mail, email and social media. The challenge, of course, is to find the right balance between being invasive and being top of mind, industry professionals say. Here are a few ways tried and true ways to generate warm leads and potential new business:

DON’T DIS DIRECT MAIL

Many marketers have a negative view about the importance of direct mail to consumers. But consumers may be more interested in this medium than you think. Consider a survey of more than a thousand consumers by Yes Lifecycle Marketing, a provider of email and digital marketing services. According to this study, 56 percent of all consumers say they find direct mail influential when researching a purchase. By contrast, a separate survey by Yes Lifecycle Marketing paints a very different picture of how marketers view direct mail; 78 percent of those polled say they believe direct mail is not influential for any age group.

One good thing about direct mail is that it can be opened at the merchant’s convenience, unlike a phone call which some merchants find annoying, especially since they often get multiple calls a day from numerous funders. With direct mail, even if a business does not need funding immediately, there’s a decent chance the merchant will keep your information on file for future reference, says Glen Faulhaber, vice president of sales at G-Plex Direct Mail Services in Holtsville, N.Y. Sending a follow-up mailing within a week of the first helps you gain additional brand recognition, he says.

One good thing about direct mail is that it can be opened at the merchant’s convenience, unlike a phone call which some merchants find annoying, especially since they often get multiple calls a day from numerous funders. With direct mail, even if a business does not need funding immediately, there’s a decent chance the merchant will keep your information on file for future reference, says Glen Faulhaber, vice president of sales at G-Plex Direct Mail Services in Holtsville, N.Y. Sending a follow-up mailing within a week of the first helps you gain additional brand recognition, he says.

Of course, for direct mail to be successful, certain parameters should be followed. For starters, mailings have to be based off good data; meaning the people or businesses you are sending to have a high likelihood of needing funds. Without worthwhile data, you’re basically throwing money out the window, Faulhaber says.

Timing is also important, he says. With direct mail, Faulhaber says you have about five seconds to get someone’s attention, so your message has to be catchy.

MAKE YOUR WEBSITE SHINE

Trey Markel, a software specialist at CentrexSoftware, a customer relationship management software company in Costa Mesa, Calif., says it’s shocking how many funders don’t use their websites to generate leads. Markel, who consults with B2B lenders and MCA providers on marketing strategies using enterprise software, recommends funders spend time working on their website so that it appeals to all types of visitors: those who want to read relevant articles, those who want to watch webcasts and those who want to listen to podcasts.

The idea is for funders to use their website to provide helpful information to merchants that will, in turn, encourage them to seek funding from you. For instance, you might consider hosting monthly webinars on topics such as how businesses can use loaned money to increase their marketing budget. Another topic merchants may find appealing is how to use credit cards to increase customers. “You give them a solution to a problem, and then you give them the money to go afford that solution,” Markel says.

Many funders know how to close a deal, but they fail to understand that the consultative approach over time will gain them even more business, Markel says. “Becoming a trusted information source in the industry is so much more valuable to customers than just being a funder,” he says. The industry needs “professionals who are going to tell you how to solve a problem.”

GET PERSONAL

Jennie Villano, vice president of business development at Kalamata Advisors LLC, says ISOs looking to build their business should attend networking events where small businesses are present. Sounds simple, but many ISOs don’t take advantage of this, meaning a missed opportunity to connect with “people from every facet” including accountants and other business professionals who can be a good source of referrals.

She also recommends ISOs hire at least one professional who is warm, trusting and engaging to visit merchants at their place of business. She recommends they pick places such as local strip malls which have a sizeable number of merchants. If you saw 20 merchants a day and only two funded with you that amounts to 40 extra deals a month, she points out. “Many ISOs would benefit from an extra 40 deals a month,” she says. On top of that, you have additional touchpoints because each of the merchants you visit may tell other businesses about your services, she says.

USE SOCIAL MEDIA

ISOs should also use social media more often than they do now—and not just to find sales help, Villano recommends. She uses it to target ISOs, but in the course of that, she gets inquiries from small businesses. ISOs should be using social media to find small businesses in need of funds. “I just don’t know why they aren’t using it more. It has tremendous reach,” she says.

To be sure, you don’t have to bombard your connections with posts. Once every other week is a good target. Make sure to include your business name and phone number, but posts shouldn’t be a hard sell. “There are ways to stand out and get your message across without appearing pushy or too sales oriented. The two-minute video ‘Cooking with Kalamata Capital’ that went viral in the industry is an example,” she says.

Also remember there are many social media venues. Sometimes funders focus their efforts on LinkedIn, Facebook and, to a lesser extent, Twitter. But Instagram and Pinterest can also be used to target potential customers. Posting aspirational videos or photos in these venues can help encourage businesses to think about ways to fund the things they might need, says Berg of 6th Avenue Capital.

USE EMAIL MARKETING TO YOUR ADVANTAGE

Some funding professionals say text messaging works well for them, though others prefer email for a host of reasons.

For one thing, it’s a “little less intrusive” than a telephone call or a text, Berg says. Also, with email, there’s ample ability to personalize, and you can run analytics to determine helpful metrics such as open rates and click-through rates, for example. You can compare how these metrics change when you tinker slightly with email subject lines or messages.

“We see email as a very viable channel,” she says.

Another advantage of email is that it helps funders and brokers get around the restrictions imposed by the Telephone Consumer Protection Act (TCPA) that has hampered lead generators’ ability to solicit business owners, says Michael O’Hare, president of Blindbid, a B2B lead generation site.

With email, you can direct the prospect to click on a link, which then triggers a phone call from a sales rep. In an environment when cold-calling can result in a lawsuit, email is a viable alternative, says O’Hare, an outspoken opponent of TCPA restrictions for business-related matters.

A growing number of funders are also using or exploring the use of artificial intelligence to help with lead generation, says Matthew Martin, managing director of Silver Bullet Marketing, a provider of trigger lead data.

One company that’s working in this area is AI Assist. Using Conversica, an AI-powered virtual sales assistant, funders can send automated emails to prospects. The automated sales assistant determines whether the prospect is interested, and if so, it alerts a human sales representative. The automated sales assistant can also gather additional information from a lead, such as the best phone number and best time to call. The entire “dialogue” is available for the human sales rep to review.

“AI is not going to make the sale for you, but it’s going to give you enough information to move forward,” Martin says.

REFINE YOUR LEADS

REFINE YOUR LEADS

To generate leads, funders, ISOs and brokers tend to buy banner ads on Google or send an email blast with a link for interested businesses to click on. The link usually directs businesses to an online form that typically asks for their name, telephone number, email and how much money is being requested.

But it doesn’t generate meaningful information about the business or what type of funding product the business is looking for, says O’Hare of Blindbid. These forms don’t typically include critical information such as whether the person has been in business for less than a year, whether he or she has mounds of debt or what kind of funding the business is seeking.

One way to get better, more tailored leads is with “lead quizzes” similar to those used by the online insurance industry, he says. Instead of a basic form, potential leads would be directed to fill out a form that has much more pointed questions about the person, the business and the type of funding sought, he explains. Some questions might be, for instance: Is your credit score over 500? Have you been in business for more than a year? And, what type of funding are you seeking? Based on the merchant’s responses, he or she could be directed to a certain funding product or a specific funder, if you’re an ISO working with multiple providers. The funder could also decide to pass on an opportunity based on a merchant’s answers to the lead quiz.

O’Hare says he doesn’t know of MCA providers currently using this type of form, but it’s one of the things he’s working on as a way to generate better leads for his clients. With the basic forms many funders use today, you get a “lot of garbage,” O’Hare says.

Certainly, there are many ways to market and get leads, but industry professionals say one thing is clear: you can’t rely on one avenue alone. According to Markel of CentrexSoftware, too many in the industry put too much faith in raw data that gets plugged into a phone system dialer. The quality of this data isn’t always the best, which means funding professionals are wasting a lot of time, he says. “There are only so many small businesses in the country and an even smaller amount that are fundable,” he says.

A Dialogue with Peter Renton: Cryptocurrency and Beyond

March 2, 2018

deBanked Magazine recently caught up with Peter Renton, founder of Lend Academy, a leading educational resource for the marketplace industry. Through his writing, podcasts and video courses, he’s been helping multitudes of people better understand the industry since 2010. Renton is also the co-founder of LendIt, one of the world’s largest fintech conventions, which recently branched out beyond its marketplace lending focus to include other types of fintech. The flagship U.S. conference will take place April 9 through April 11 in San Francisco. The following is an edited transcript of our discussions.

deBanked: Why did you decide to rebrand LendIt as LendItFintech?

Renton: The main reason is that we have moved beyond the online lending space. While it’s still the core of what we do, it’s not all of what we do anymore. Many of the large online lenders have also moved beyond online lending. Lending is part of financial services, but our attendees want to know what else is important. Our attendees also want to look at other opportunities for expansion. They want to know how other areas of fintech are going to affect their business—topics such as blockchain and digital banking. LendItFintech tells people that lending is what we focus on, but it also makes clear that we’re about more than lending.

deBanked: In addition to your marketplace lending investments, you entered into the cryptocurrency space back in early 2015. Tell us what you’re doing now with respect to cryptocurrency?

Renton: This was not something that I spent much time thinking about back then. At the time, I expected bitcoin to never amount to anything. But I’m interested in financial innovation and I decided to give it a go. I never thought in my wildest dreams that it would get to $10,000. (Editor’s note: In 2017, bitcoin climbed to nearly $20,000; in early February it fell below $8,000 for the first time since Nov. 2017)